Using Notice of Assessment for Mortgage, Loans, and Divorce

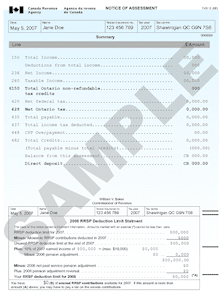

Remember, your NOA is an important document that serves as an official record of your income and tax payment history for a specific year. It’s recommended to review it carefully and keep it for your records.

Distinguishing Between a Tax Return and a Notice of Assessment

A tax return also referred to as a T1 General, is a compilation of all your earnings and claims for a specific tax year. It includes either the amount you’re due to receive as a return or the amount you owe.

On the other hand, a Notice of Assessment (NOA) is an official government document containing this information. Generally, your T1 General will match your NOA unless the Canada Revenue Agency (CRA) identifies errors or necessary changes before finalizing your return.

In essence, while your T1 General and NOA contain similar information, the T1 General is a document that has yet to be an official document. The NOA, which the CRA must verify, is the officially recognized and used document.

NOA Required Dates

Understanding how these important dates in separation and divorce will make a material difference: The When, Then and Now of Divorce

How to find my notice of assessment?

Where to Find Your Notice of Assessment

How can I get a copy of my notice of assessment?

How to get Notice of Assessment online – CRA access how-to video

My Account, the Canada Revenue Agency’s secure portal

Why the Notice of Assessment is important in Separation and Divorce?

When separated in Canada, you must indicate your marital status on your tax return. This can affect credits and deductions you’re eligible for.

Delays in receiving your Notice of Assessment could be due to high volume, errors in your tax return, or additional review by the CRA.

The Notice of Assessment is issued after the CRA has processed your tax return

The CRA would send you a Statement of Account if there are any discrepancies or balances owing on your account.

Line 150 / 15000 your Notice of Assessment indicates your total income for the tax year.

You can download your Notice of Assessment from the CRA’s My Account portal under the “Tax Returns” section.

You can get a Notice of Assessment through the CRA’s My Account portal or by mail

It typically takes about 8-14 days for electronic returns and 4-6 weeks for paper returns to receive your Notice of Assessment.

No, a T1 is not the same as a Notice of Assessment. A T1 is the tax return form you fill out and submit to the CRA, while the Notice of Assessment is the document you receive from the CRA after your T1 has been processed.

Related Documents:

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call

Financial disclosure is the process by which both sides (you and your spouse) exchange reports about income, property, and debts of the other person.

Financial disclosure is the process by which both sides (you and your spouse) exchange reports about income, property, and debts of the other person.