Family Mediator for Divorce Mediation in Aurora, Ontario

DTSW offers Family Mediation in Aurora, Ontario, utilizing our Soft Landing Separation and Divorce Settlement Method. This unique approach supports families in Aurora and nearby communities such as Newmarket, Richmond Hill, King City and Whitchurch–Stouffville.

We provide personalized and highly adaptable mediation services, ensuring each family's unique needs are met. This reassures you that we understand and are ready to support you through your unique situation, because we truly listen and acknowledge your needs.

Family Mediation vs Divorce Mediation

The difference between a Family Mediator and a Divorce Mediator lies primarily in the scope of their services:

- Family Mediator:

- Scope: Family Mediators handle various family-related conflicts, not limited to divorce. This can include disputes between parents and children, issues related to elder care, sibling disputes, and other family dynamics.

- Focus: Their primary goal is facilitating communication and understanding among family members to resolve conflicts and reach agreements that benefit the entire family unit.

- Divorce Mediator:

- Scope: Divorce Mediators specialize in issues specifically related to the divorce process. This includes negotiating terms for separation agreements, division of assets and debts, child custody arrangements, and spousal support.

- Focus: Their main objective is to help divorcing couples reach amicable and legally binding agreements without going to court, focusing on the divorce’s specific legal and financial aspects.

While both roles aim to resolve conflicts and promote harmony, Family Mediators address a more comprehensive range of family issues, whereas Divorce Mediators concentrate on facilitating the divorce process.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

As Family Mediators Our Focus Is Divorce Mediation

DTSW focuses on resolving family law matters and achieving a legally binding separation agreement without contentious court battles. This method brings relief and peace of mind, ensuring your unique circumstances are carefully considered.

Our accredited family mediators provide experienced, compassionate guidance through the mediation process, helping you and your spouse find common ground. Unlike traditional family law firms, our boutique family law mediation offers customized packages tailored to your needs. We understand your emotional challenges and are here to support you every step of the way.

By choosing Divorce Mediation by DTSW, you can access expert financial analysis and support from seasoned professionals dedicated to achieving positive outcomes. Discover how our mediation services can transform your separation into a smoother, more amicable experience. We believe in the potential for a positive future and are committed to helping you confidently move forward.

Our team includes Divorce Mediators and Certified Divorce Financial Analysts (CDFA), ensuring comprehensive support throughout the mediation process. With DTSW, you can trust that your family’s best interests are at the heart of our services

As a family mediator and Certified Divorce Financial Analyst (CDFA), I had the privilege of working with Mary and Bruce, a couple who demonstrated remarkable resilience and unwavering dedication to their children’s well-being throughout their separation. Their journey is a testament to the power of family mediation in navigating the emotional and financial complexities of separation and divorce and crafting amicable solutions.

Background and Personal Information

Mary, a 44-year-old school teacher, and Bruce, a 46-year-old plumber, were married on July 24, 2001. Their unique situation, with Mary’s Master’s in Education and Bruce’s successful plumbing business, made their separation a complex process. They have two wonderful children, Madison (14) and Mackenzie (17), who attend Aurora High School. Their decision to separate on July 30, 2020, after nearly two decades together, was a testament to their commitment to finding the best solution for their family. They had built a life together in Aurora, Ontario, which added another layer of complexity to their separation.

Family History

Mary and Bruce, inspired by Mary’s sister’s painful and drawn-out divorce, took a proactive approach to their separation. They were determined to avoid a similar fate and to prioritize their emotional well-being and financial stability. Despite attending 12 sessions of marriage counselling, they ultimately decided that separation was the best path forward.

Current Living Arrangements

Bruce moved in with his parents across town six months before mediation. They agreed to delay the sale of their three-bedroom matrimonial home until Madison graduated from high school, using their savings to maintain the property. This decision was pivotal in providing stability for their children during the transition.

Financial Details

Mary earns $119,000 annually, while Bruce earns $140,000 annually. We focused on managing their financial affairs, debts, and pensions. Bruce agreed to pay child support per the Federal Child Support Guideline, amounting to $456 monthly. Both parents shared the children’s extra expenses equally.

Parenting Plan

The primary focus was Madison and Mackenzie’s welfare. Mary and Bruce crafted a shared parenting schedule, translating to a 60/40 time split. They agreed to remain flexible to accommodate the children’s needs. Each parent could take the children on an out-of-country vacation for up to two weeks annually, ensuring that both parents remained integral parts of their lives. Joint decision-making responsibilities were established to ensure both parents had a say in critical aspects of the children’s upbringing.

Mediation Process

Separation Agreement Details

The final agreement was a testament to the couple’s commitment to their children’s well-being. It delayed the sale of their marital home until Madison’s graduation, providing stability for the children. Spousal support was deemed unnecessary, a decision that was reached through careful consideration of both parties’ financial situations. A particular condition allowed either party to give a 90-day notice to sell the home if there was a material change in circumstances, ensuring the flexibility needed in their evolving situation.

Outcome and Reflections

The mediation process concluded with a comprehensive Separation Agreement and Parenting Plan that prioritized the children’s happiness and ensured quality time with both parents. Mary and Bruce were relieved and satisfied with the mediation’s speed and effectiveness, contrasting with the prolonged legal battles they wanted to avoid. Their children adapted well to the changes, reaffirming that they made the right decision for their family’s future.

Lessons Learned

This case highlighted the importance of effective communication and compromise. Family Mediation was a valuable alternative to traditional litigation, preserving emotional well-being and financial stability. Mary and Bruce’s story serves as a testament to the power of mediation in resolving complex issues amicably and efficiently.

Confidentiality and Consent

Mary and Bruce consented to share their story with anonymized details to protect their identities, hoping it would help others navigate similar challenges.

Mary and Bruce’s journey through divorce mediation illustrates that with the proper support and willingness to work together, it’s possible to reach an amicable resolution that benefits everyone involved, especially the children. If you or someone you know is facing a similar situation, remember that mediation can offer a path to a smoother, more constructive separation.

- Soft Landing Method: Provides a peaceful and effective alternative to traditional divorce litigation.

- Cost-Effective: Mediation is typically less expensive than going through the courts.

- Time-Saving: The process is quicker compared to litigation.

- Child-Focused: Prioritizes the well-being of children with customized parenting plans.

- Reduced Conflict: Encourages cooperation and minimizes adversarial interactions.

- Confidentiality: Ensures privacy of discussions and agreements.

- Tailored Solutions: Personalized agreements to fit the unique needs of both parties.

- Emotional Support: Creates a less stressful environment.

- Financial Planning: Includes detailed financial analysis for fair asset division.

- Expert Guidance: Led by experienced mediators like Ken S. Maynard for effective communication.

- Community Access: Servicing Aurora, Ontario and surrounding areas.

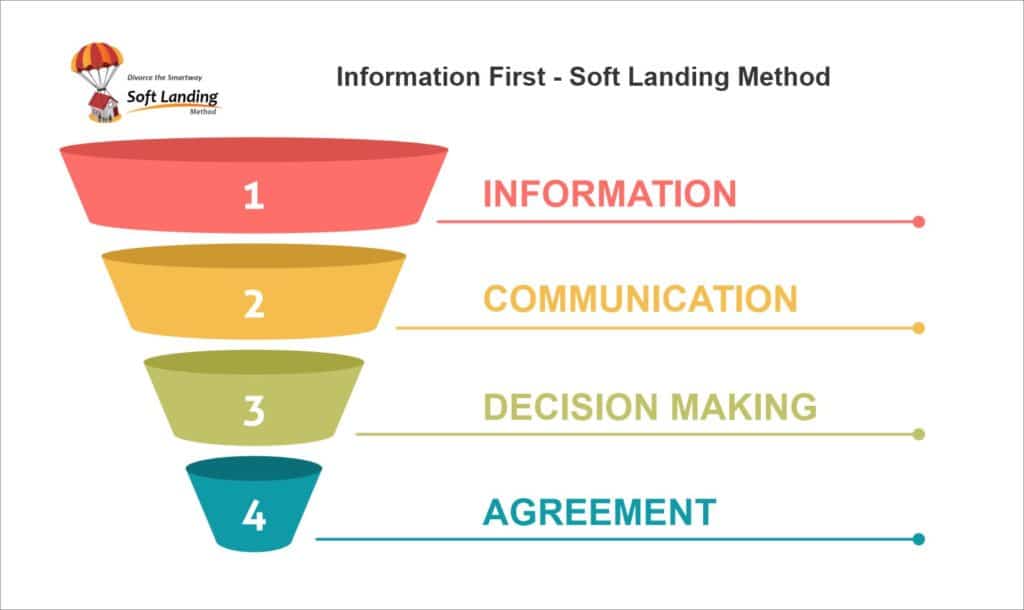

Navigating the complexities of separation can be an overwhelming and emotional experience. As both a Mediator and a Certified Divorce Financial Analyst (CDFA), I have the expertise to guide you through this challenging time and help you reach a fair and equitable settlement. My unique Soft Landing Settlement Method combines the benefits of mediation with the financial acumen of a CDFA, ensuring that you and your spouse can move forward with peace of mind.

By utilizing the Soft Landing Settlement Method, we can work together to achieve an amicable resolution that considers the emotional, financial, and interpersonal aspects of your situation. This comprehensive approach is designed to minimize conflict and promote a smoother transition for both parties involved.

Take the first step towards a more secure and harmonious future by scheduling a Get Acquainted Call with me today. During our call, we can discuss your specific circumstances and explore how my services can support you during this critical time. Ready to take control of your future?

Click this link to Schedule your Complementary Get Acquainted Call now.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

Roadmap to a Soft Landing Settlement

Discover the Soft Landing Divorce Settlement Method – a comprehensive approach to separation and divorce that ensures a fair and equitable division of assets and liabilities.

This method involves a detailed financial walkthrough, including identification and valuation of assets, income assessment, expense analysis, financial projections, and settlement scenarios.

With the Soft Landing Method, you gain a clear understanding of your financial situation, empowering you to negotiate a settlement that meets your needs. Don’t navigate this complex process alone – work with a Certified Divorce Financial Analyst (CDFA) who specializes in separation and divorce cases.

Ready to create a Soft Landing?

Ken S, Maynard CDFA Acc.FM

Profile

Becoming a Certified Divorce Financial Analyst and Mediator was more than a professional choice for me; it was a deeply personal journey. In 2007, I navigated the family court system myself, an experience that was both challenging and enlightening. This journey inspired me to use my financial expertise to assist others facing similar situations. Growing up with practical money management skills from my family’s agribusiness, I further honed my abilities in Real Estate restructuring and as an analyst at two of Canada’s largest mutual fund managers.

I am dedicated to empowering parties to make informed decisions, recognizing that multiple solutions exist for every dilemma during the settlement process. My approach is rooted in patience and thoroughness, ensuring that every voice is heard.

I offer a comprehensive suite of services, leaving no stone unturned in addressing your divorce financial analysis and mediation needs. From information gathering to analysis, settlement negotiations, and document drafting, I guide you through every step of the way. Using an interest-based negotiation approach, I tailor my services to meet each couple’s unique needs.

What truly sets my services apart is our proprietary Soft Landing Divorce Settlement Method. This method is not just a tool but a testament to our commitment to your well-being. It is designed to facilitate smoother and more amicable settlements, ensuring that both parties feel heard and their needs are met.

The process begins with a “Get Acquainted” call, often conducted jointly but available individually. During this call, I will explain my hybrid fee schedule, which combines a flat fee for certain services and an hourly rate for others, and address any questions about the Soft Landing Separation and Divorce Settlement Method. Upon agreement, we proceed with the mediation process.

Many clients initially dismiss mediation due to preconceived notions or external influences. However, mediation invariably adds value to the separation process by narrowing issues and testing settlement perceptions against reality.

I am available most weekdays and work with couples across Ontario via Zoom video conference. Clients can also choose to meet with one of my highly trained associate mediators at various locations throughout the province.

Away from the Office

I have three young adult children who have grown into fine, productive members of society. My oldest is a Private Equity Banker, my middle child is a Nurse, and my youngest is a Digital Marketer. They were raised with strong values that give them the resiliency to navigate their parents’ separation at a young age and build quality personal relationships.

Away from the office, I love to chill out by taking my beach chair to our local beach. With neighbors and friends, we set our chairs at the water’s edge and let the waves roll in, enjoying conversations about nothing overly important. My hobby is digital marketing, and I take great enjoyment in growth hacking my business and sharing what I learn with my Digital Marketer daughter.

I actively attend and contribute to the Institute of Divorce Financial Analysts and the Ontario Association of Family Mediation