Expert Guide to Spousal Support Calculator Formulas

Calculating Spousal Support in Ontario

More About Spousal Support in Ontario

Canada’s Divorce Act sets the standards for spousal support orders for married couples. This federal law applies to all residents across the country. However, local provinces or territories may have laws defining how unmarried couples in common-law relationships should handle spousal support.

Need more certainty about your timeline? That’s perfectly fine! The Limitations Act ensures you don’t need to feel pressured by a looming deadline. You can apply for spousal support at any time without worrying about a strict deadline. The only reason to start as soon as possible is that a judge will consider your genuine need when granting support.

Spousal support may be denied in Ontario if:

- The couple has a cohabitation agreement that outlines spousal support.

- The recipient spouse remarries or starts living with a new partner.

- The recipient spouse is financially independent and does not require support.

Indexing spousal support refers to adjusting the amount of support payments based on changes in the cost of living. This is typically done using a specific formula or index, such as the Consumer Price Index (CPI), to ensure that the support amount keeps pace with inflation over time.

The duration of spousal support payments in Ontario varies based on factors such as the length of the marriage, the age of the spouses, and the roles during the marriage. As an Accredited Family Mediator, I help couples understand these factors and determine an appropriate timeline for support payments.

In Ontario, spousal support entitlement is determined by various factors including the length of the relationship, each party’s income, and the need of the spouse seeking support. As a Certified Divorce Financial Analyst, I provide detailed analysis and advice regarding spousal support entitlement.

Spousal support in Ontario is usually paid monthly but can be in the form of a lump sum. The amount and duration of payments depend on factors such as the length of the marriage, the income of each party, and the need of the recipient. As an Accredited Family Mediator, I assist couples in navigating these complexities.

Avoiding spousal support in Canada is a complex issue. Courts consider several factors to determine spousal support, and it’s designed to maintain financial fairness after a separation. However, there might be circumstances where spousal support may not apply. As a Certified Divorce Financial Analyst, I can guide you through this process.

The Spousal Support Advisory Guidelines in Ontario provide a framework for determining the amount and duration of spousal support. They consider factors such as the length of the marriage, the incomes of both parties, and whether children are involved. As an Accredited Family Mediator, I help couples understand and apply these guidelines.

In Ontario, spousal support is calculated based on factors like each party’s income, the length of the relationship, the roles during the relationship, and the need of the recipient. As a Certified Divorce Financial Analyst, I use these factors to assist in calculating a fair and appropriate spousal support amount.

Ken Maynard CDFA, Acc.FM

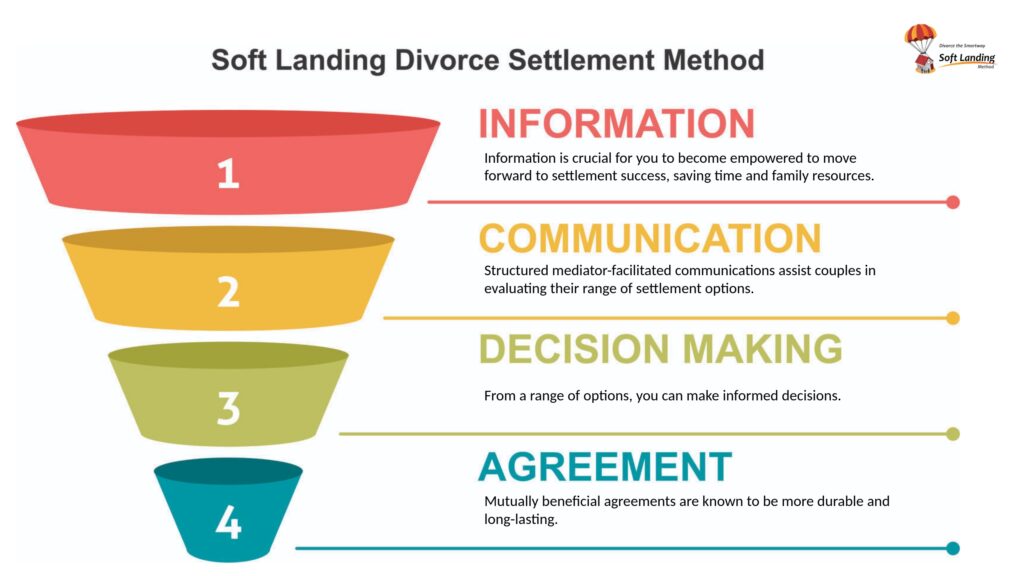

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call