Reveal the Secrets of Ontario’s Child Support Calculation

Equivalence Scale-Based Support Analysis

| Primary Parent | Payor Parent | |

| Year | 2023 | 2023 |

| Taxable Income | $45,000 | $85,000 |

| Percent of Family Income | 35% | 65% |

| Taxes and Deductions | -$5,218 | -$21,686 |

| After-tax Income | $39,782 | $63,314 |

| Government Benefits Not Included in Tax Return | $15,163 | $488 |

| Subtotal: Funds- After Tax Credits & After-Benefits Income | $54,945 | $63,802 |

| Guideline Child Support | $15,408 | -$15,408 |

| Income After-Credits & Benefits and Child Support | $70,353 | $48,394 |

| Equivalence Scale Child Expenditures | -$28,985 | |

| Personal Disposable Income | $41,368 | $48,394 |

| Reconciliation of Child Cost vs. Support Funds | ||

| Guideline Child Support Paid by Non-Custodial Parent (Year) | $15,408 | -$15,408 |

| Children’s Expenditures | -$28,985 | $0 |

| Subtotal: Net out-of-pocket child cost (see note 1) | -$13,577 | -$15,408 |

| Other Child-Related Funding | ||

| Government Tax Credits | $5,218 | |

| Government Benefits (CCB GST Rebate) | $15,163 | $488 |

| After-Tax Credits & Benefits Net out-of-pocket child cost (see note 2) | $6,804 | -$14,920 |

Notes:

- Note 1: The equivalence scale expenses each parent incurs for child-related costs appear to align well with the existing Guidelines, which have been in place since 1997

- Note 2: After accounting for tax credits and benefits, the primary parent ends up with a surplus of $6,804 after covering their portion of equivalence scale child-related expenses. On the other hand, the parent responsible for making payments finds themselves $14,920 in the red due to child-related costs.It’s worth noting that the Federal Child Support Guidelines from 1997 did not originally factor in government child subsidies.

How Much is Child Support Example

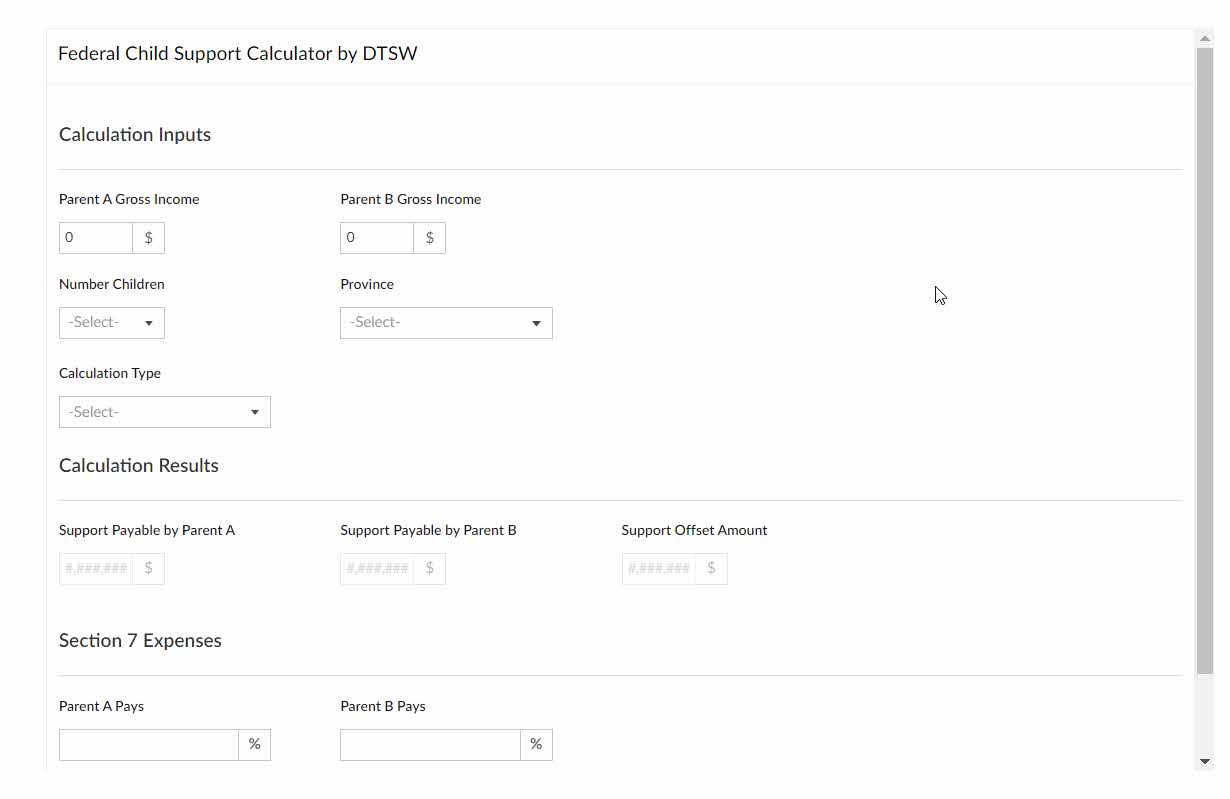

Based on the Child Support Tables, if your gross annual income is $20,000 and you have 2 children, your table amount will be $311. Another easy way to calculate the table amount is to the child support calculator available at the Child Support Lookup. This Lookup is based on the Federal Child Support Guidelines and is simple to use.

| 1 Child | 2 Children | 3 Children | |

|---|---|---|---|

| Income Per Year | Support Payment Per Month | Support Payment Per Month | Support Payment Per Month |

| $20,000 | $161 | $311 | $360 |

| $30,000 | $256 | $459 | $621 |

Child Support Online Lookup

Child Support – Frequent Questions and Answers

Courts rarely issue orders for no child support. The responsibility to provide child support is almost inescapable unless there’s undeniable proof that the children’s needs are fully met, which is uncommon. Thus, when children are involved, it’s prudent to prepare for child support obligations.

In Ontario, Canada, child support is regulated by two distinct Acts. If child support claims are part of a divorce process, they fall under the Federal Divorce Act. On the other hand, for couples who were either never married or were married but opt for separation instead of divorce, the Ontario’s Family Law Act is the guiding legislation for child support applications.

The Ontario child support calculator 2022 and 2023 are the same as the 2017 version, there have been no updates since 2017.

The child support calculator Ontario 2023 has not changed since its last revision in 2017.

Do I have to pay child support even if we were never married or haven’t lived together long enough to be considered common-law partners?

Will I still owe child support if my ex remarries?

What happens if I fail to pay child support?

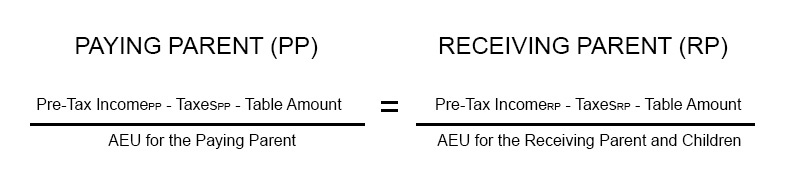

What is the formula for calculating child support?

Do I declare child support on taxes?

Can I be compelled to pay child support for a child that is not mine?

Can child support be avoided with a prenup?

Can I pay my child directly?

How should child support be spent?

Are sports included in child support?

How is self-employed income calculated?

How do I register with the Family Responsibility Office (FRO) for Child Support?

How does the Family Responsibility Office function?

What are the consequences of not paying child support in Ontario?

Can child support be modified?

How does bankruptcy impact child support?

Why am I obligated to pay child support even if I can’t see my child?

This May Interest You:

- Book a Get Acquainted Call: Schedule a call with Ken Maynard for professional advice on child support calculation or other divorce-related matters.

- Early Neutral Consultation: Kick Starter: Learn about the benefits of early neutral consultation if you’re in the early stages of separation.

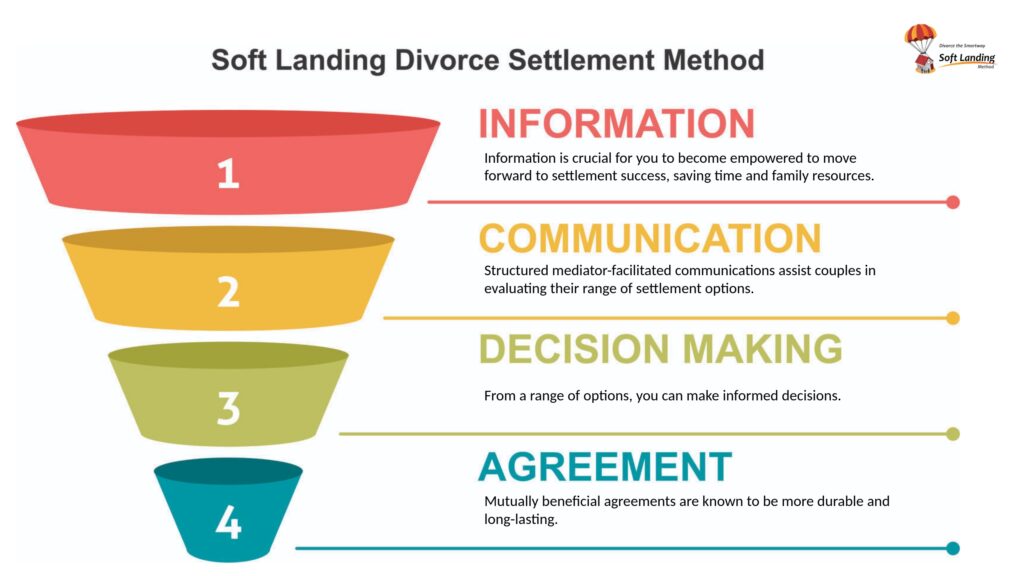

- Mediation: Soft Landing Method: Discover a peaceful and less stressful way to navigate your separation with the Soft Landing Method.

- Creating Effective Separation Agreements Without a Lawyer: Learn how to create effective separation agreements without a lawyer.

- Free Legal Advice in Ontario: Access resources for free legal advice in Ontario.

- Conscious Uncoupling – Divorce Soft Landing: Learn about conscious uncoupling, a method of separating that focuses on personal growth and co-parenting.

- Craft your Separation Agreement for a Soft Landing!: Get guidance on crafting a separation agreement.

- Why Divorce Mediation Works in Ontario (A Step-by-Step Guide): Understand why and how divorce mediation works in Ontario with this step-by-step guide.

- Mediator vs Lawyer in divorce [Resolved]: Compare the benefits of using a mediator versus a lawyer in a divorce.

- Cryptocurrency and Divorce: Learn how cryptocurrency is handled in divorce financial settlements.

External Related Links

- Federal Child Support Guidelines: This is a comprehensive guide on child support provided by the Canadian Department of Justice. It was chosen because it provides authoritative and detailed information on child support guidelines in Canada.

- MySupportCalculator.ca: This is a free service that provides an estimate of child support payments based on the Federal Child Support Guidelines. It was chosen because it provides a practical tool for calculating child support payments.

- Child Support in Ontario: This is an official resource from the Ontario Ministry of the Attorney General. It was chosen because it provides authoritative information on child support in Ontario.

- Child support information: This resource provides a wide range of information on child support. It was chosen because it offers comprehensive information on child support, including legal aspects.

- Child support services in Canada: This is an official resource from the Government of Canada. It was chosen because it provides a broad overview of child support services available in Canada.

- Legal aid for child support in Ontario: This resource provides information on legal aid services available for child support cases in Ontario. It was chosen because it provides valuable information for individuals who may need legal assistance.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call