Streamline Asset Division with Our Equalization Payment Guide

Divorce Equalization Payment - Fair Asset Division

Easily calculate equalization payments for a fair and accurate division of marital assets and debts with our Divorce Equalization Payment Tool. Ensure financial fairness post-divorce

Understanding Divorce Equalization Payments in Ontario

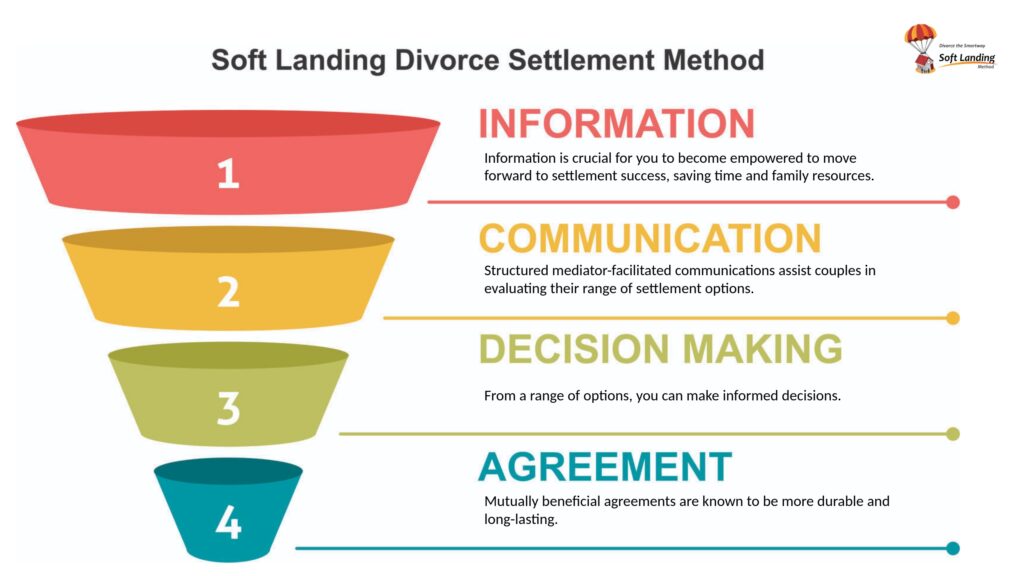

The process of divorce can be emotionally and financially challenging. In Ontario, one important aspect of divorce settlements is the equalization payment. This article provides an in-depth understanding of equalization payments and how they are calculated.

We will explore the purpose of these payments, the legal framework, the factors considered in their calculation, and the role of assets, debts, and spousal support. Additionally, we will discuss challenges and disputes during the determination of equalization payments and provide strategies for negotiating fair settlements.

Lastly, we will touch on the tax implications associated with divorce equalization payments.

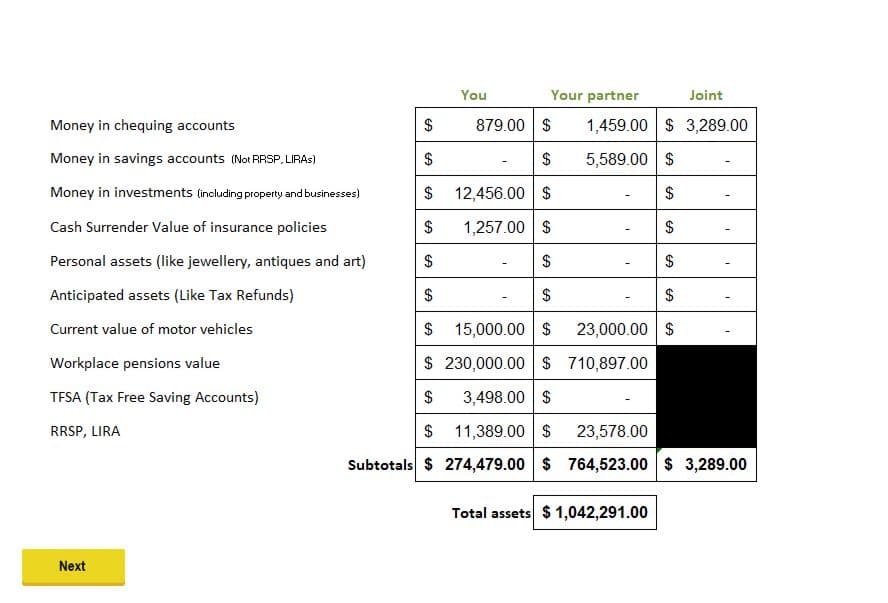

In Ontario, the equalization payment is calculated by determining the net family property of each spouse at the date of separation. The spouse with the higher NFP must pay the other spouse half of the difference between their NFP values

Case Study: Bruce and Mary

| Bruce Smith (Husband) | Amount |

|---|---|

| Assets | |

| Value of Real Estate (matrimonial home value at $1,800,000) | $900,000 |

| Household (Cars, Boat Furniture, etc.) | $55,000 |

| Financial Accounts (RESP, Savings, RRSP etc.) | $350,000 |

| Business | $135,000 |

| Subtotal of Assets | $1,440,000 |

| Liabilities | |

| Mortgage | $275,000 |

| Ford Motor Credit Car Loan | $9,000 |

| RBC Visa Credit Card (50% of Joint card with a $22,600 balance) | $11,300 |

| Tax Allowance on RRSP | $45,000 |

| Business Tax Adjustments | $34,000 |

| Real Estate Disposition Cost | $52,545 |

| Subtotal of Liabilities | $426,845 |

| Date of Marriage Deduction | |

| RRSP | $12,000 |

| Line of Credit | ($4,000) |

| Subtotal of Date of Marriage Deduction | $8,000 |

| Excluded Property | |

| Kids RESP | $123,400 |

| Inheritance | $50,000 |

| Subtotal of Excluded Property | $173,400 |

| Net Family Property Summary | |

| Total Assets | $1,440,000 |

| Less Total Liabilities | $426,845 |

| Less Total Marriage Deduction | $8,000 |

| Less Total Excluded Property | $173,400 |

| Net Family Property | $831,755 |

| Mary Smith | Amount |

|---|---|

| Assets | |

| Value of Real Estate (50% of matrimonial home value at $1,800,000) | $900,000 |

| Household (Cars, Furniture, etc.) | $35,000 |

| Financial Accounts (Teachers’ Pension, Savings, etc.) | $650,000 |

| Time Share | $5,000 |

| Subtotal of Assets | $1,590,000 |

| Liabilities | |

| Mortgage | $275,000 |

| Honda Finance Canada Car Loan | $15,000 |

| RBC Visa Credit Card (50% of Joint card with a $22,600 balance) | $11,200 |

| Tax Allowance on and Pension | $114,000 |

| Real Estate Disposition Cost | $52,545 |

| Subtotal of Liabilities | $467,845 |

| Date of Marriage Deduction | |

| RRSP | $18,000 |

| MasterCARD Credit Card | ($4,000) |

| Subtotal of Date of Marriage Deduction | $14,000 |

| Excluded Property | |

| Inheritance | $23,400 |

| Gift | $30,000 |

| Subtotal of Excluded Property | $53,400 |

| Net Family Property Summary | |

| Total Assets | $1,590,000 |

| Less Total Liabilities | $467,845 |

| Less Total Marriage Deduction | $14,000 |

| Less Total Excluded Property | $53,400 |

| Net Family Property | $1,054,755 |

| Equalization Calculation | NET FAMILY PROPERTY | ||

|---|---|---|---|

| Bruce | Mary | ||

| $831,755 | $1,054,755 | ||

| Mary | $223,000 | ||

| Financial Imbalance | has a greater NFP then | ||

| Bruce | |||

| Mary | $111,500 | ||

| Equalization Amount | To equalize she needs

Pay / Transfer to |

||

| Bruce | |||

| Soft Landing Settlement Example | |||

|---|---|---|---|

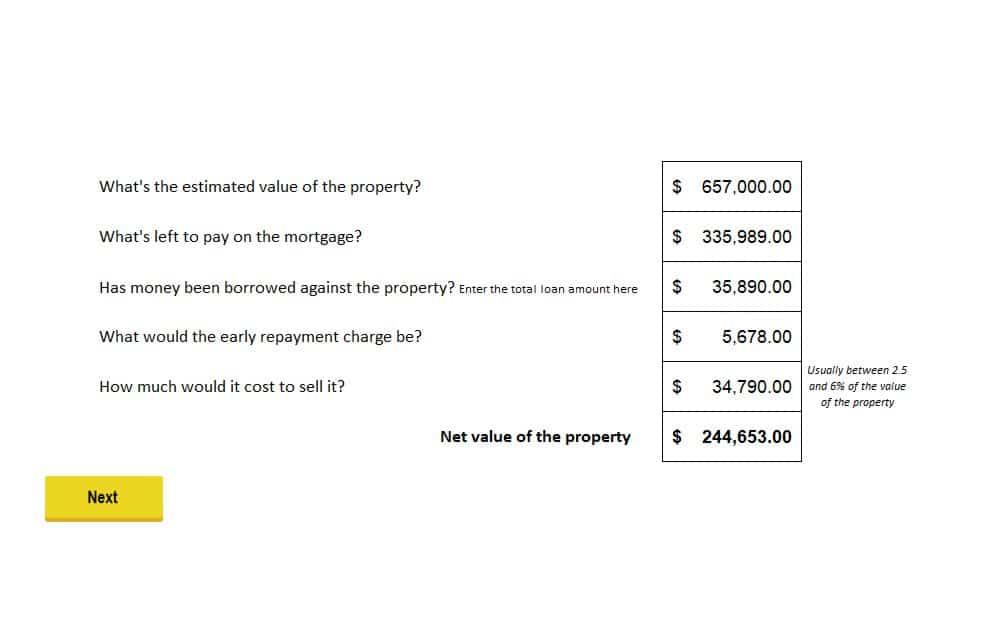

| Matrimonial Home Value (appraised market value) | $1,800,000 | ||

| Obligations: | |||

| Disposition Cost (RE Commission + Legal + HST) | $105,090 | ||

| Mortgage (Bruce will assume) | $550,000 | ||

| Subtotal of Obligations: | deductions from home equity | – | $655,090 |

| Subtotal: Equity | = | $1,144,910 | |

| Share of Net Equity: | Value due to Mary (50%) | 1/2 | $572,455 |

| Offsetting Values: | |||

| Equalization due from Mary to Bruce (see above) | $111,500 | ||

|

Bruce Transfer RRSP to Mary (Tax-Free Rollover) |

$190,000 | ||

| Bruce pays Mary cash | $270,955 | ||

| Subtotal of Payments | Value of payments to Mary | $572,455 | |

| Total Balance due to Mary | $0 | ||

More about Property Equalization

External links that may interest you

- Property and Equalization: Discover how equalization payments are paid and their limitations for common-law spouses.

- Dividing property when a marriage or common law relationship ends: Information on court decisions for equalization payment timelines.

- Calculating family property and equalization payments: Detailed guide on calculating equalization payments between spouses.

- Calculate the equalization payment:

- Wife Misses Deadline for Claiming Equalization: Case study on the importance of meeting deadlines for equalization claims in Ontario.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call