Using a Separation Agreement Template

In more complex separations where children, pensions, RRSPs and other investments are involved templates fall short of being adequate.

The Courts have made Separation Agreements created from templates and kits invalid.

Full financial disclosure is a vital pillar of your separation agreement.

For an agreement to be legally durable, it’s vital that all decisions are informed decisions formulated from a complete set of facts.

Before signing your separation agreement, the independent legal advice requirement is misunderstood.

You may have decided on a self-drafted separation agreement without using lawyers for various reasons.

Among the most popular explanations are:

- Cost: You cannot or are unwilling to pay the high cost of hiring Lawyers.

- Time: You want to get your separation and divorce over with as soon as possible and avoid drawn-out legal procedures.

- Keep it Amicable: You want to remain amicable, and you fear that your amicable split will die in the hands of adversarial lawyers.

- Trust: You may believe you can rely on one another to come to a fair arrangement and may not want to use lawyers in what you expect would be a straightforward process.

- Control: You may feel that working together without lawyers can meet your desire to have more control over the course and outcome of your separation.

Not using lawyers to draft a separation agreement carries potential hazards. Although, in this article, I will not write about the problems self-drafters face with preparing their separation agreement; that is a different article and not why you came here.

My goal with this post is:

- educate you about separation agreements

- inform you of resources available to assist you

- provide access to a robust template separation agreement.

Creating an agreement from a template

Having a legally sound, durable and properly executed separation agreement is a primary step in your progression to a divorce. A separation agreement contains details about the understanding you and your spouse have come to regarding the vital issues that affect your separation and will shape your futures living apart from each other.

For a separation agreement to be legally durable, it’s vital that all decisions in the document have been reached with both parties being in possession of all the facts. Here are the main steps you need to take if you are planning to create your own separation agreement from a template:

Before you fill out your Canadian separation agreement template, you and your spouse will need to agree on the issues that will be covered in the agreement. These should include:

financial disclosure

Co-Parenting Arrangements

Child Support

Spousal Support

Actuarial Valuation of Pensions

Division of Property

Division of Debts

Matrimonial Home

Dispute Resolution

Independent Legal Advice

Use plain English, Don’t think you have to use fancy language just because these are official and legal separation papers. You need to write clearly and concisely.

Most Do-it-Your separation agreements are drafted at a point when the two of you are stressed, unhappy and in an overwhelmed headspace, and it is precisely the time when many important considerations can get overlooked, avoided, or brushed aside as “too difficult.” For these reasons, it is of particular importance to have the assistance of a neutral professional such a mediator, divorce financial specialist or parenting specialist apply a trained eye to your settlement arrangements. A Neutral knows who the good ILA lawyers are, and will prepare each of you for moving through independent legal advice smoothly.

Where to find a Free Templates:

The Family Law Information Centre is located in your local courthouse and should have an example separation agreement template aka divorce agreement form you can take away. (Sorry Not in Ontario)

Their websites will have forms for the most commonly filed family law documents, including separation agreements, but not Ontario. Finding the website for your province is easy enough. Simply search for your province name, plus court forms. Also, check out the Law Society Of Ontario and their separation agreement precedent document.

This professional software package includes 3 separation agreement precedents – Standard, Collaborative and Interim. There are versions that are specifically tailored for Ontario and British Columbia. These forms give you hundreds of clauses to choose from and cover everything from very simple cases to the most complicated. Clauses are regularly updated to keep pace with case law and legislative changes. Many professionals use DivorceMate, as I do. But expect a very steep learning curve if you choose this route and a hefty price tag of about $500 for a pay per use licence.

Link to DivorceMate.com

This is one of the top free legal resources on the internet, a place where you can find useful information about the law, lawyers and free legal forms, including Find Law’s sample separation agreement, which you can download or copy and paste.

Link to FindLaw.ca

Link to a basic separation agreement Find Law Sample Separation Agreement

This platform offers free and paid temporary and standard separation agreement that is customized for you and your province. All you need to do is fill in a few short forms and print your agreement. It’s ready in minutes. But check out their disclaimer as to who should use this template before laying down your money.

Link to Lawdepot.ca

What makes Amazon the most trusted online retailer is product reviews. It would be worth checking out the Self Counsel Press Ontario Separation Agreement kit Review on Amazon.

Link to Amazon.ca

You can purchase Self Counsel Press Ontario Separation Agreement kits from here.

Link to Staples Business Depot

This is one the newer player on the online separation agreement space on the internet. They claim you can Create and print your free Separation Agreement in under 5 minutes.

Link to LegalContracts.com

Link to mediate.com The Master Agreement

This site will create a free custom separation agreement for you within minutes. It will be tailored to your province and just requires you to answer a few simple questions before letting you download and print your customized form.

Link to Rocket Lawyer

This will inevitably reveal other online sources of separation agreement samples and separation agreement templates that will allow you to complete your agreement online.

Online separation agreements are designed for spouses who have come to an agreement about the terms of their separation and are both willing to accept such a settlement. However, if your circumstances involve complexity relating to property distribution, assets or issues related to your children, it’s usually best to seek expert advice when preparing your separation agreement.

Not all Separation Agreement Templates are created equal. Online providers seem to have very simple and brief templates when you compared with what a professional would use. For example, compare Sample Separation Agreements between Find Law Sample and the Law Society Example.

Exploring Online Separation Agreement Templates

These days, the internet offers a plethora of resources, including separation agreement templates. While I am not a lawyer, many clients express a desire to minimize legal and mediation fees by downloading or drafting their separation agreements. Agreeing on the division of property and shared parenting time might seem straightforward for couples intending to remain amicable. Although I frequently provide information on this website to assist those navigating contentious divorces, I am a strong proponent of amicable solutions.

Legal Considerations for DIY Separation Agreements

It’s important to note that even if both parties verbally or in writing agree on terms, such agreements must comply with legal standards to be enforceable in court. The Family Law Act and the Divorce Act provide comprehensive frameworks that any separation agreement must meet. If your agreement fails to meet these legal requirements, a court could challenge, alter, or even nullify it.

Additionally, when writing a separation agreement, it is crucial to consider family law, contract law, and relevant case law. An agreement that aligns with the Family Law Act but contradicts other legal precedents might need to be more enforceable.

The Role of Mediation and Legal Advice

Consider mediation instead of litigation if you and your partner can maintain an amicable relationship and reach mutual agreements. However, before signing any written agreement, investing in independent legal advice is advisable to ensure the terms are legally binding and will hold up in court should future disputes arise.

Factors that drive your costs

Where and how you start the agreement drafting process has a huge impact on your financial and emotional outcomes.

The two factors that drive costs in separation and divorce are complexity and conflict. If you and your spouse have separated, unlike a fine wine, your separation will not ‘improve’ with age. However, like a winemaker must work with ripe grapes, a mediator should only start mediation with couples who are ready.

From experience, we know that starting too soon when conflict levels are still high can result in costs increasing. Starting too late often means the complexity has increased.

Keep in mind that with a legal separation agreement comes peace of mind, often followed by a new ‘normal.’

What makes an agreement legal?

I want you to be clear about the 3 Pillars to create a Legal Separation Agreement, they are vital, so stay with me as I explain each one in turn:

The 1st Pillar: Full financial disclosure

The 2nd Pillar: Informed consent

For an agreement to be legally durable, it’s vital that all decisions are informed decisions formulated from a complete set of facts.

Informed consent can be achieved through mediation, because it’s a process that gives both parties a voice in formulating options that address their interests and concerns. The objective is always to avoid going to court while negotiating your parenting plan, division of assets, support and other settlement issues. Informed consent helps to achieve this.

The 3rd Pillar: Independent Legal Advice

Ontario family court judges often set aside (nullify) separation agreements when a spouse claims they did not fully understand the implications of what they were signing. This is why independent legal advice is so important to obtain.

In the future, should your ex-spouse could make a request to the courts that a particular section of the agreement, or indeed the entire separation agreement be overturned, a Certificate of Independent Legal Advice (ILA) is your assurance that your separation agreement will be upheld.

An ILA can only be obtained from a lawyer – not a notary, paralegal or commissioner of oath. Divorce the Smartway maintains an extensive referral roster of lawyers prepared to provide you with an ILA. Remember, it is in your mutual best interests to receive independent legal advice.

When you each receive your ILA, a separation agreement is presumed to be binding for both of you.

Why you need a separation agreement?

So let’s first understand divorce in Ontario. In simple terms, a divorce application is a ‘dissolution of marriage.’ It is the documentation that legally ends a marriage. The central purpose of an agreement, on the other hand, is to create clarity and certainty around your financial and parenting issues. Your separation does not end your marriage legally.

There are two ways to be legally separated and only one way to end a marriage. You can be separated either by court order or by a separation agreement. However, neither legally ends your marriage.

To dissolve a marriage in Ontario, you must make a divorce application to the courts to legally end your marriage. Conversely, a divorce order offers no protection to your assets, nor does it shield you from your spouse’s debts or establish terms around spousal and child support.

Is it necessary to get a separation agreement in Ontario? No. In Ontario, you do not need a separation agreement to separate and divorce. If you can show that you have been living apart for at least a year, the marriage has broken down and you are eligible for divorce.

You may be asking why I may need a separation agreement? Separation agreements are agreements between spouses who are legally separating but not yet or intending to divorce. To get a divorce, you will need to apply to the courts, but you can agree on when and how to get a divorce in your separation agreement.

There are plenty of good reasons why separating couples choose to formalize their parting in the form of a documented agreement:

- It’s usually faster, cheaper and less stressful than going to court

- It puts both spouses in control of deciding what works best for their family, instead of letting the court decide

- It will enable others who are involved in your children’s care know what’s been decided upon

- With a written separation agreement, it’s easier to prove what you and your partner have agreed on, compared to a verbal agreement

- You can call on the Family Responsibility Office if there’s a problem getting child or spousal support.

For both personal and financial reasons, couples may seek a legal separation. If you’re not sure if you want to dissolve your marriage, a formal separation might offer you time to think things through while also protecting your finances.

Separation Agreements are created any time after you decide to separate, but there are time limits placed on when you can ask your partner for certain things. For example, when it comes to dividing property, you have 5 years to sort it from your separation, but only 2 years after you get divorced.

What should be included in your agreement?

You will need two homes going forward. If you complete your separation agreement before entering the real estate market or buying your spouse out of the matrimonial home, you will avoid many costly and stressful pitfalls. Sadly, I see too many separated spouses, feeling the pressure of our tumultuous real estate market, walk right into some very expensive traps.

A signed separation agreement will smooth out the path to buying or selling the matrimonial home or a new home.

Couples that rush past a separation agreement can remain financially entangled far past their separation. You may be separated but to the bank, you jointly signed the mortgage so you are both responsible for this debt. This can extend to your lines of credit, credit cards, and car loans. These responsibilities and other joint debts will affect your individual creditworthiness. The financial terms of the separation agreement will clear up your connecting credits and explain to the bank your obligations for equalization, child and spousal support.

Upon closing the sale of your matrimonial home, a formal separation agreement is required to instruct your real estate lawyer on how to disperse your proceeds from the sale, otherwise, your equity will stay in your real estate lawyer’s trust account until a separation agreement is provided.

The Federal Child Support Guidelines are published to assist separating couples in arriving at a determination on the appropriate amount of child support. Parents jointly maintain the responsibility of financially supporting their children.

Each of your incomes and the number of children are factors that influence the child support amount. The guidelines also assist in determining when child support will end. Commonly, it is when the child turns 18 years old or until they have completed their post-secondary education, however other factors must be considered and that age may differ depending on each case.

Soft Landing Settlement Method separation agreement will help you apply Child Support Guidelines to arrive at an appropriate child support amount. It also addresses the other components of child support, such as the special (extraordinary) and extra-curricular child expenses.

For more about Child Support and options in mediation click here

A parenting plan is the written legal document that outlines how you and your spouse, as co-parents, will raise your children after your separation or divorce.

The term parenting plan may sound like a less hostile phrase for a custody agreement, but parenting plans offer much more information and much more flexibility than traditional custody agreements.

These plans, which are mediated between the parents, address various aspects of child custody. You and your ex-spouse can incorporate as much or as little information into a parenting plan as you deem necessary, and you can change your plan if you find it’s no longer working for your family’s needs. The nice thing about a parenting plan is that you have complete control. You’re not stuck signing a document you don’t agree with or waiting for a judge to render a custody decision. Some families only address custody and visitation in their parenting plans, while others get into much more detail.

When you’re working on a parenting plan, and for the many years ahead you will spend dealing with your ex, keep the following in mind:

- Each of you has something valuable to offer your child.

- Each of you needs and deserves time with the child.

- Disagreements do not mean either of you is a bad parent.

- Work to constructively resolve disagreements with practical solutions rather than escalating a dispute.

- Ask your ex-spouse what he or she needs, and express your needs clearly in a language that is neither confrontational nor blaming.

When you make financial, custody, and other divorce decisions, the well-being of your children should be the first thing on your mind. More than half of those children whose parents get embroiled in custody battles develop depression, but a parenting plan can help save them from such troubles down the road. Your child can rest easy, with complete security that she’ll have substantive time with both parents.

The benefits of a parenting plan:

Less stress

More than anything, children crave security and consistency. A parenting plan gives them both.

Your child will always know with which parent she will be, and can plan birthdays, outings, visits with friends, and projects accordingly. She also won’t be stuck wondering when she’ll see her other parent next or if her parents will ever resolve their conflicts.

Improved well-being

The shared parenting involved in a parenting plan is much better than fighting endlessly or trying to take all custody away from your ex.

Stronger relationships

Perhaps the most important benefit of a parenting plan is that it improves your child’s relationship with both parents. She’ll have guaranteed time with each of the people she loves most, and the open communication fostered by a parenting plan helps your child know that she’s not betraying you by loving her other parent.

Additionally, relationships don’t begin and end with parents. Your child may have grandparents, half siblings, aunts, uncles, cousins, godparents, and friends he only sees when he is with one parent.

Your parenting plan keeps these relationships – which are often vital for helping kids get through the stress of divorce – strong and intact.

Your parenting plan will minimize conflict by clearly setting out parenting guidelines and expectations; providing for your children’s needs and child support. Here are a few things that can be established in a parenting plan.

- Decision making

- Sharing information between parents

- Where the children live and scheduling on duty and off duty parenting

- Access to grandparents and other relatives

- Scheduling holidays and special occasions

- How and when new partners will be introduced to the children

- How other parenting issues may be addressed.

For more about Parenting Plans and options in mediation click here

In the applicable legislation, marriage is viewed as a financial partnership. When that partnership comes to an end neither spouse should be negatively affected more so than the other. Spousal support is one mechanism to equalize the financial circumstances resulting from the break-up of that partnership.

Spousal support terms such as how much, when, and for how long are detailed in the separation agreement.

The Spousal Support Advisory Guidelines are now a required tool for lawyers, mediators and judges across Canada. The ‘final version’ of the guidelines was released in July 2008. The guidelines require the inputting of several variables when calculating the range of spousal support and the support duration to be considered, in effect balancing how much support the receiving spouse requires to meet their needs, and how much the payer spouse can afford to pay.

The guidelines look at the length of the marriage as an indicator of the duration of the spousal support, however, there are other factors considered. As a general rule, with shorter-term marriages, spousal support is more about helping the receiver spouse to become financially self-sufficient. With longer-term marriages, it could be more about compensating the receiver spousal for the financial inequities created by the separation.

Here are three important provisions that every separation agreement should have with regard to spousal support:

- A clear spousal support review provision clarifying how the support is adjusted, terminated or changed.

- A spousal support release provision is required either way. Whether a spousal support claim is waived or not, a release provision must be included in the separation agreement. A release provision may be conditional on spousal support obligations being met in full prior to the activation of the release.

- Double dip avoidance provision. A double dip is when a spouse must pay support on income from an asset already shared with their former spouse.

For more about Spousal Support and options in mediation click here

A separation agreement arrived at by mutual consent and settled out of court is statistically known to be long lasting with a minimum of future conflict.

To create a durable settlement, your separation agreement will include dispute resolution provisions, illustrating the settlement procedure to be followed to self-resolve any future disagreements.

Having mutually agreed upon dispute resolution options and pathways ensure resolution of future unexpected issues without engaging lawyers or going to court.

Your workplace pension could also be family property. This means that it is an asset that must be addressed in your settlement negotiations. It is an asset subject to division or equalization. How this asset ultimately gets settled it must be included in your separation agreement.

A common misunderstanding around pensions is their values. Most of us take our bank, investments or RRSP statements at face value. With this thinking, the numbers on the regular annual pension statement must be the value of the pension, right? No, the pension statement value is never the correct value. The reasons the statement values are not correct has filled many books about pension valuation, so I will not go into the reasons here. My advice, however, is this: never make financial decisions directly from pension statements – you will be not just a little ‘out’ but very far off of being fair and equitable.

There are also far-reaching tax impacts connected to your pension. The good news is that, in 2012, Ontario introduced some new rules that made pension valuation a whole lot less complicated and much less expensive. Let us help you with this.

Can your agreements be overturned?

What makes a separation agreement void?

When and why our Courts have made Separation Agreements created from templates and kits invalid. In Ontario, the Family Law Act specifically permits a Court to set aside a separation agreement in certain situations.

Here are few examples of where a spouse asked the Family Courts to set aside a separation agreement made from an online template or do-it-yourself kit. Click the links below to read the case files:

Read the case files and you will find it’s not that Separation Agreements templates are flawed. It is the improper preparation, lack of financial disclosure, informed consent and Independent Legal Advice being the main reasons these Separation Agreements are made invalid.

The main problem with most templates is they are just to too simple. In more complex separations where children, pensions, RRSPs and other investments are involved templates fall short of being adequate.

In Rick v. Brandsema, 2009 the Supreme Court of Canada decision.

After a 29-year marriage, Ms. Rick and Mr. Brandsema reached an agreement to divorce. Ms. Rick was suffering from mental illness at the time. She also stated that she was a survivor of domestic violence.

Ms. Rick discovered a few years later that Mr. Brandsema had withheld crucial financial information during the discussions. She petitioned the court to overturn the separation agreement she had signed, claiming that it was unjust.

The Judges of the Supreme Court of Canada (SCC) agreed that the agreement should be overturned. While judges will not interfere with agreements that parties (parties in a court action, contract, or other legal matter) willingly enter into (create), the court stated that in some cases, judges will intervene (step in) to ensure fairness.

The SCC outlined three key considerations that judges should consider when deciding whether or not to set aside a separation agreement:

- Was there any non-financial disclosure? During your talks, did your spouse hide, lie about, undervalue, or transfer assets?

- Did your spouse take advantage of your mental illness or other vulnerable state, or did your spouse have complete access to the family’s financial information while you had little to none?

- Did the agreement fit the objectives of family law? Is the agreement fair and equitable to both you and your spouse, and does it ensure that you can both support yourself financially?

Will your separation agreement be legally binding?

Separation agreements must be signed by both spouses, and both of your signatures need to be witnessed in order for it to be valid.

Separation agreements must be made under your own free will, without any pressure from anyone.

The “law” says you should obtain Independent Legal Advice (ILA) before signing your agreement. This is to ensure you understand the agreement and the consequences of signing it. After all, a separation agreement is likely to be the largest financial transaction you’ll make in your life.

Separation agreements aren’t just for married couples. You can make one if you are in a common-law relationship too.

You can make separation agreements that last for a specified period of time. For example, if you agree on where your children should live for the summer, you can say the agreement ends in September

You can change a separation agreement at any time by replacing it with a new one, as long as you and your partner agree to the changes.

Separation agreements are only suitable for couples who can agree on the terms of the agreement. Any complicated issues may require you to seek legal advice.

A DIY couple creating their separation agreement may find a mediator a helpful tool.

Here are a few ways a mediator might be helpful:

Helping with communication:

As a mediator, I can help with the conversation between the parties in emotionally charged situations. I can contribute to ensuring both sides are heard, and their interests are incorporated into the agreement.

Finding common ground:

As a mediator, I can help the parties reach a compromise that benefits all parties. In addition, I can aid in locating points of agreement and offer solutions for resolving differences.

Provide legal Information:

As a mediator, I can guide the legal facets of the separation agreement. I can aid in making sure the contract is valid and enforceable under the law.

Stay on track:

Keeping the dialogue on track and helping the participants manage their emotions is the role of the mediator. I can help in calming tense circumstances and maintaining the focus on finding answers.

Saving time and money:

Compared to engaging lawyers to negotiate the separation agreement, I can save the parties time and money as a mediator. Traditional litigation is typically slower and more expensive than mediation.

Overall, I can help a DIY couple in creating a separation agreement that is reasonable, fair, and compliant with the law. Finding common ground, helping with communication, and managing emotions can all contribute to a less difficult separation process.

If you’re writing your separation agreement, a CDFA, or Certified Divorce Financial Analyst, might be a great help. Here are ways, as CDFA, I can be of help:

Financial analysis:

As a CDFA, I can offer financial estimates and analysis to help both parties comprehend the separation agreement’s short- and long-term financial effects. In addition, I can shed light on how different settlement options would affect taxes and the impact of paying child support, spousal support, and dividing up property.

As a CDFA, I can offer advice on distributing assets and obligations fairly and equitably. I can aid in the identification of all marital assets and liabilities as well as the provision of division possibilities.

Budgeting:

Based on your income and expenses, As a CDFA, I can help both parties develop a reasonable budget. I can help ensure each party knows their financial obligations and needs following the divorce.

Financial negotiations:

As a CDFA, I can help negotiate a reasonable settlement that satisfies both parties’ financial demands. I can help with dialogue between the parties and offer solutions for various settlement possibilities.

Planning for life after divorce:

As a CDFA, I can help both parties develop a financial strategy. I can offer advice on handling debt, repairing credit, and making retirement plans.

I can be a helpful tool for anyone writing their separation agreement, mainly if they are unfamiliar with financial planning and analysis. I offer fair financial guidance and ensure both parties make well-informed choices regarding their future financial well-being.

Conclusion

Most separation talks are started at a point when the two of you are stressed, unhappy and in an overwhelmed headspace, and it is precisely the time when many important considerations can get overlooked, avoided, or brushed aside as “too difficult.” For these reasons, it is of particular importance to have the early assistance of a neutral professional such as a mediator, divorce financial specialist or parenting specialist to amicably guide your settlement arrangements.

Are you having trouble with your separation agreement? Do you want to avoid going to a lawyer and asking for help? Consider working with a family mediator who can help your separation agreement in a way that is peaceful, cost-effective, and child-focused.

Would you like to learn more about how I can help you with your separation agreement? Get in touch for a Get Acquainted Call to learn more about finding a separation agreement with a soft landing.

Articles that may interest You!

What happens if a spouse refuses to sign?

What if Your Direct Negotiations Doesn't Work?

But, even if all efforts at direct-negotiations between you and your spouse (or cohabiting partner) have been exhausted and they are unsuccessful, or such negotiations are not feasible, all is still not lost.

Far from it! Quite to the contrary, fortunately, a new potent device has increasingly gained approval with the courts and popularity among divorcing and separating couples across the country. Such a device can come to your rescue. It’s called: MEDIATION.

Mediation basically involves using the assistance and services of a professional negotiator, called a “mediator”, to help couples negotiate their agreement or settlement. Often, the mediator is a social worker, or even a lawyer, but well trained specifically in the art of family conflict negotiations and resolution.

In recent times private mediation services and centers have sprung up across the country, their specialty being mediating divorce and separation cases — including property settlement, and child custody and support arrangements, alimony, etc.

Perhaps not surprising, at the beginning divorce lawyers have been among the major detractors of mediation as the lawyers claim that, because mediators are often not lawyers, their services often fail (they claim) to protect the right of either party in that mediators, the lawyers contend, are sometimes unaware of the legal ramifications of their decisions. But meditation has gained increasing popularity with the public aware of and educated about it.

The chief attraction of mediation which has accounted for its growing popularity especially among upper-middle-class and wealthier persons (but not necessarily among divorce lawyers!), are two-fold:

- first, mediators are involved in the process only to facilitate agreement by offering objective, professional, third-party alternatives acceptable to both sides;

- and second, use of mediation has been noted to save the parties both substantial time and money relative to the traditional method of using the lawyer-dominated settlement arrangements and often includes in one flat fee package the cost of preparing and filing the written agreements and court papers to finalize the separation or divorce judicially.

If you start to see some blood in the water then get the assistance of a peacemaking mediator.

The FBI hostage negotiators secret weapon!

If there is a contentious issue that your spouse is trying to pin you down on or bully you into agreeing to or you sense you are losing your settlement over a concerns of theirs, I suggest you use the FBI hostage negotiators secret weapon! I learned this conflict neutralizing phrase from former FBI hostage negotiator Chris Vos:

It Goes like this: Let’s say you are not agreeing about the house valuation and maybe the whole settlement is riding on this one issue. Then what you say is “I hear that you have concerns over the house value, as I do. Maybe we should get someone to help use with this important issue”. One of two things will happen – they we back down from their position or they will agree to have someone like me help out.

I am often asked how can a couple have a Good Divorce. So spent about 5 hours and wrote down the secrets to a Good Divorce and a Soft Landing for your family. I held nothing back, it is all I have learn in nearly 10 years helping separating couples.

Link to The Secrets of a Good Divorce – Guide

Does a Separation Agreement need to be notarized to be binding?

What do you do if a lawyer point blank refuses to witness (notarize) the signing of that separation agreement you and your spouse have spent time preparing yourselves? You’re eager to move on with your lives, and you’re convinced that once you get your notarized separation agreement sorted, you can close one chapter of your life and start and new one. Surely you need a notarized separation agreement for it to be legally binding?

So the question remains Who can notarize a separation agreement in Ontario? Or maybe the better question is who will notarize a separation agreement.

Does a separation agreement in Ontario need to be notarized?

Well, here’s the news flash: you don’t need a lawyer to notarize an Ontario separation agreement aka domestic agreement. In fact, in Ontario, the only formal requirements for a legal separation agreement to meet are:

- It needs to be written down

- It needs to be signed

- It needs to be witnessed

What’s far more important is getting a Certificate Of Independent Legal Advice, to prove that a lawyer has read, assessed and green-lighted that you understand the terms and impacts of your separation agreement.

Who Can Witness A Separation Agreement In Ontario?

While the advice is to always get your separation agreement witnessed by someone, that someone doesn’t have to be a lawyer, because there is no legal requirement in the Family Law Act for this. In fact, anyone over the age of 18 can be your witness, because their role is just to confirm that the two parties whom the separation agreement is between have signed it.

Getting independent legal advice (ILA) entails hiring a lawyer to closely analyze your separation agreement and any additional documentation, so they can advise you (just you, not your spouse) about the financial and other impact the separation agreement will have on you if you sign it. And that’s where the problems start and where I, Ken S. Maynard, a Divorce Mediator and Certified Divorce Financial Analyst can help.

But What Happens If A Spouse Refuses To Sign A Separation Agreement Ontario?

Beware that if you choose the path of creating your own separation agreement and then one of you decides to get a lawyer to check it before you sign it ‘just in case’ or ‘just to make sure’, you will be creating major problems for yourselves.

While it may seem the sensible option to get legal advice, if you have written your own separation agreement and put it in front of a lawyer, quite simply it is a shortcut to serious problems, even disaster.

Lawyers, who are expert wordsmiths when it comes to drafting such documents, are likely to rip apart the wording of your self-penned separation agreement, and with it will go that so-far, so peaceful and fairly relaxed separation you and your spouse have had.

But getting a lawyer to review the terms of your separation agreement is surely common sense? After all, that’s the best way to get legal information regarding your rights. And if you’re feeling a little overwhelmed by the potential implications of what you’re being asked to sign, seeking a professional opinion makes sense.

Yes, it certainly does, but that professional doesn’t have to be a lawyer. And, if you take my expert advice, you need to show your separation agreement to a different kind of separation or divorce professional, BEFORE getting lawyers involved.

Why You Shouldn’t Immediately Show A Lawyer Your Self-Written Separation Agreement

Getting a lawyer to review your separation agreement will not necessarily mean your lawyer will give you the ILA you’re looking for.

Many lawyers regard the job of reviewing separation agreements that haven’t been written by legal professionals as high risk, low reward work, so will often steer clear of getting involved. Think about it from the lawyer’s perspective. They have office rent and staff to pay, and spending a couple of hours reviewing a separation agreement you have written yourselves is not going to be as lucrative as working for a client who’s going through full-on divorce proceedings. What’s more, the risks associated with such work just aren’t worth the fee.

This reluctance of lawyers to take on such work can help explain the difficulty some separating couples can have accessing independent legal advice about separation agreements. Many are turned away by legal firms or told that the lawyer in question does not offer ILA for self-produced separation agreements.

Even those who do manage to find lawyers willing to impart ILA, find they are subject to vastly different price quotations for the work, ranging from $300 with some lawyers, right up to $2,500 with others.

Independent Legal Advice Ontario Cost

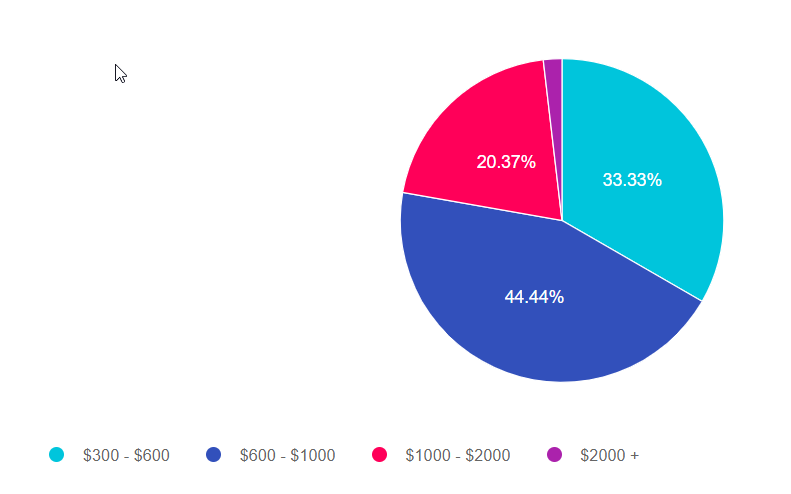

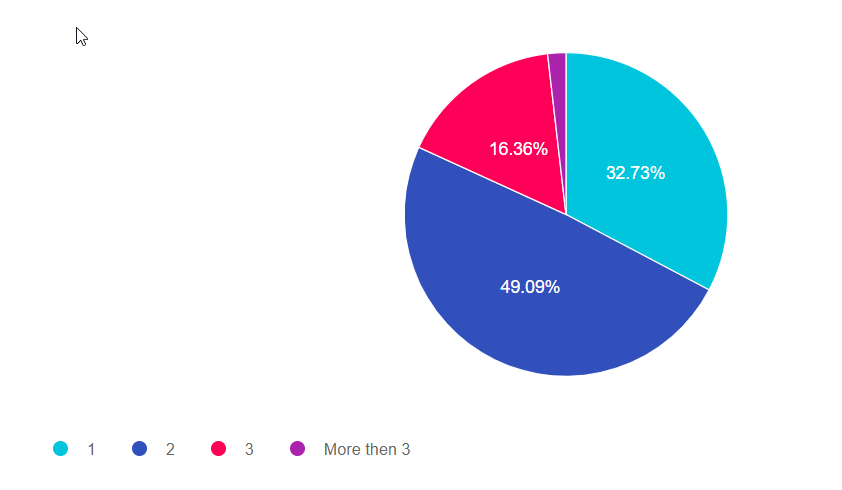

We conducted a survey of into the issues facing spouses wanting ILA about their separation agreements. We send out 1000 surveys to family law lawyers, of the 85 lawyers who responded, 54 said they would be prepared to provide independent legal advice concerning a separation agreement. But what of their charges for this service?

Survey of ILA Cost

Summary

- 33% charged between $300 – $600

- 44% charged between $600 – $1,000

- 20% charged between $1,000 and $2,000

- 2% charged over $2,000

An interesting trend that emerged from the survey is that the least experienced lawyers were the ones charging the most for providing ILA for separation agreements. Those with over 20 years’ experience were at the lower to middle end of the fee spectrum.

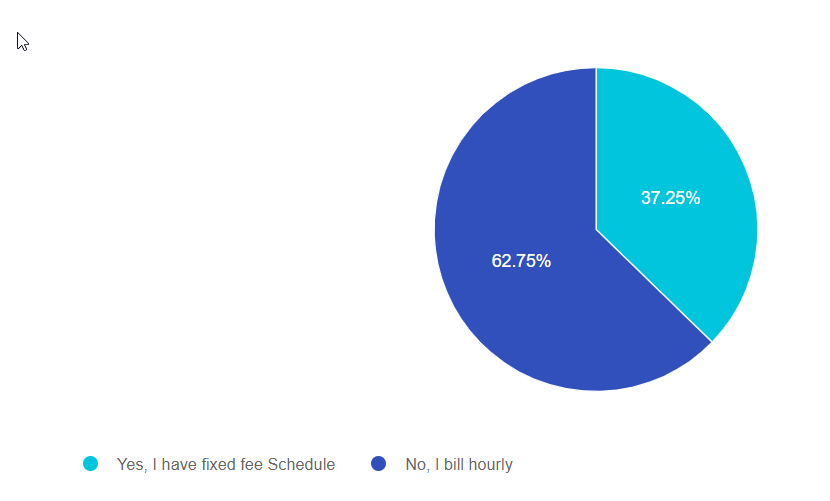

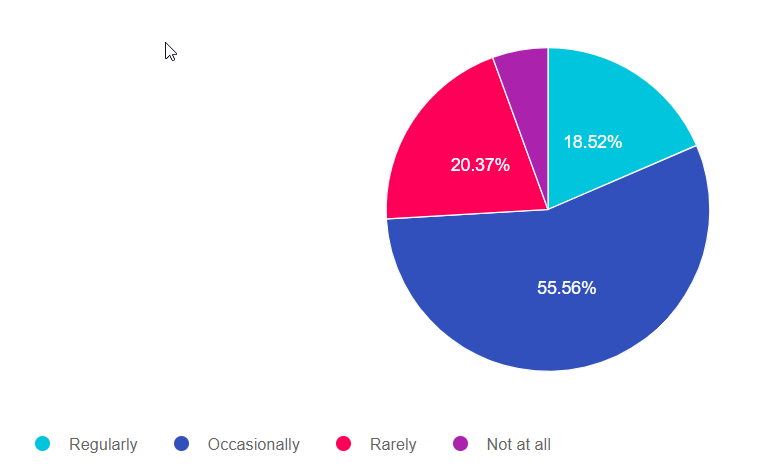

Flat or Fixed Fee vs Hourly Billing

Summary

Those lawyers who responded to the survey, 37% said they offered fixed fees rather than hourly charges.

Number of meetings required

Summary

Estimated number of meetings required by lawyers to deliver ILA for separation agreements:

- 1 meeting 32% of lawyers

- 2 meetings 49% of lawyers

- 3 or more meetings 18% of lawyers

After Hours and Weekend meetings

Summary

Availability of lawyers for after hours or weekend meetings

- 18.5% regularly available for such meetings

- 55% occasionally available for such meetings

- 26% rarely or never available for such meetings

The Problem With Lawyers And Separation Agreements You’ve Written

Hiring a lawyer (assuming you can find one willing to take on the work) could be the catalyst for a dramatic and unwelcome change in the nature of your separation. What had been up until then an amicable process can quickly turn complicated because:

- You and your spouse will lose control of the process once lawyers get involved

- You’ll each need to hire your own lawyer to review the separation agreement from your perspective

- Each lawyer will see it as their role to defend your best interests, regardless of the impact it may have on your spouse (and children)

Before you have a Lawyer look at your agreement!

You Could Choose The Wrong Lawyer

Your Separation Agreement Is Incomplete

Trying to write something as important and water-tight as a separation agreement aka domestic contract is a tough ask. You are going to need to make sure you’ve got every angle covered and then some. Such as financial disclosure, the resolution of the matrimonial home ownership. If you have children, then support payments according to the child support guidelines or are you financially supporting the children some other way. How will you know if you’ve got all potential loopholes filled? The simple answer is you won’t because you don’t have the experience of writing separation agreements.

Your Separation Agreement Is Badly Worded

It only takes one sentence in your separation agreement to be loosely phrased or vaguely presented for the whole thing to collapse. Under these circumstances, you’re going to need to hire a lawyer to fix things, even renegotiate the whole agreement and, as you can imagine, that won’t come cheap. It’s easy to see why so many self-drafted separation agreements come off the rails when one or other partner involved in writing them seeks ILA.

The Uninformed Decisions Conundrum

Here’s another way your self-penned separation agreement can die a painful death. If one partner claims they made a decision or concession during the writing of the separation agreement while being uninformed of the facts, or coerced or under duress, then the whole agreement falls. On this basis, one spouse might claim they didn’t get enough property, or the family lawyers they have hired decide they are not getting enough child or spousal support.

THE SOLUTION - have your agreement reviewed by a NEUTRAL

Most Do-it-Your separation agreements are drafted at a point when the two of you are stressed, unhappy and in a overwhelmed headspace, and it is precisely the time when many important considerations can get overlooked, avoided, or brushed aside as “too difficult.” For these reasons, it is of particular importance to have the assistance of a neutral professional such a mediator, divorce financial specialist or parenting specialist apply a trained eye to your settlement arrangements. A Neutral knows who the good ILA lawyers are, and will prepare each of you for moving through independent legal advice smoothly.

Where to find a Neutral Professional

Are you looking for a “Done for you Separation Agreement without lawyer”

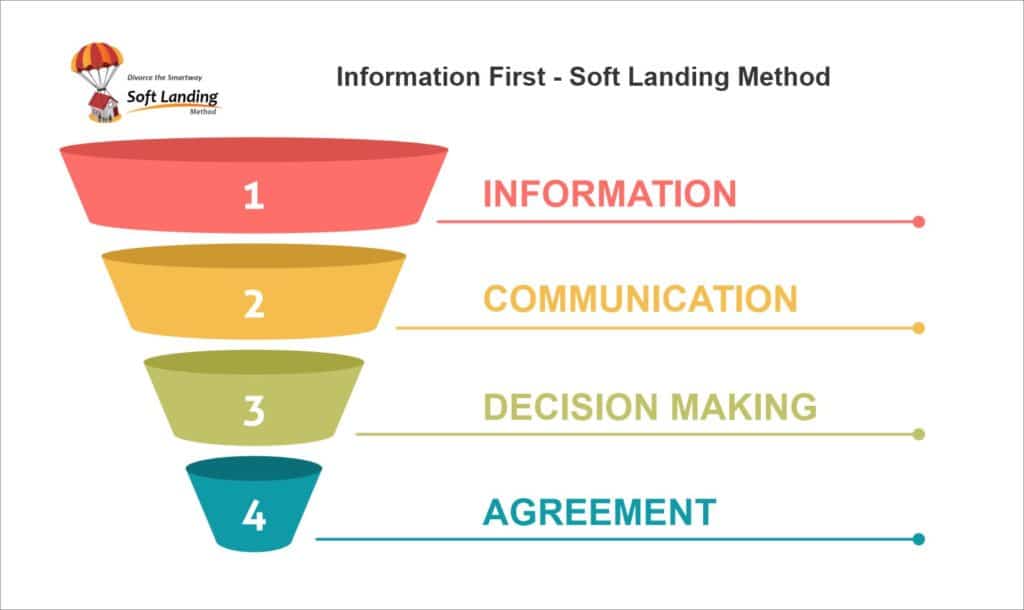

I help conflicted and outcome-focused separating couples create separation agreements with clarity and soft landings for secure futures in 4 meetings or less without lawyer created overwhelming conflicts, confusion and costs.

What will your separation agreement cost?

Ready to create a Soft Landing for your divorce?

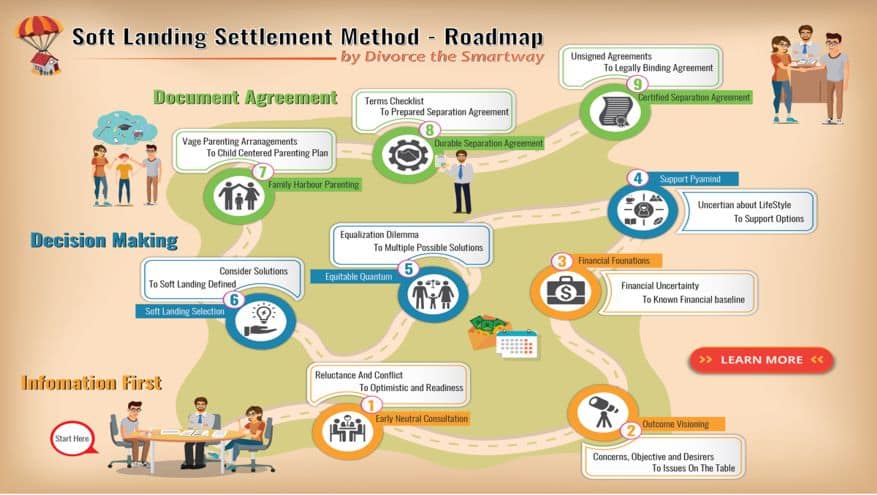

Discover the Soft Landing Divorce Settlement Method – a comprehensive approach to separation and divorce that ensures a fair and equitable division of assets and liabilities.

This method involves a detailed financial walkthrough, including identification and valuation of assets, income assessment, expense analysis, financial projections, and settlement scenarios.

With the Soft Landing Method, you gain a clear understanding of your financial situation, empowering you to negotiate a settlement that meets your needs. Don’t navigate this complex process alone – work with a Certified Divorce Financial Analyst (CDFA) who specializes in separation and divorce cases.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call

-

Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/May 23, 2023

-

Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/June 2, 2022

-

Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/May 20, 2022