Ontario Separation Agreements: Your Comprehensive Roadmap

- Common to view separation and divorce as the same thing, however, the two are not the same.

- No two separation agreements are the same, just as no two situations are the same.

- A separating couple can live separately and apart (be legally separated) without ever drafting or signing a separation agreement.

- You do not need a separation agreement to live apart from your spouse.

- No law forces couples into a separation agreement.

- Gives both spouses a measure of control over what each spouse gets.

- It is vital to understand that a separation agreement is a legal document.

- When drafting a separation agreement state every detail.

- Debts – acknowledge their existence. State how they will be paid, by who and when.

- Consider retaining family dental and medical coverage.

- Provisions for when a supporting spouse dies.

- You do not have to go to court to finalize a separation agreement.

- Rights to move the children outside specified areas.

How to write a Separation Agreement

What is a Separation Agreement?

What makes a separation different from a divorce?

Why should you consider a separation agreement?

- They feel a need to separate for the time being but do not want to go through a divorce: When couples go through a rough patch, it is not uncommon for them to live separately and apart for a time while trying to figure out what their next steps would be. In cases like this, they may be unsure of what the future holds, but they would like the time apart to figure out their differences and find a way to work them out. If this is you, a separation agreement will help you because you still have shared responsibilities even though you are separated. With it, you can make provisions for those responsibilities while figuring out a way back to each other

- They have decided to go for divorce: A divorce is a big step for a couple and one that they most likely did not take lightly. The two must have weighed their options and decided that filing for a divorce was the next step possible to take. Here, a separation agreement will help because, in drafting one, they would have agreed on how to handle their properties and responsibilities, including children, if they have any. It will then be a simple matter of attaching their separation agreement with the divorce proceedings and making it part of the judgment.

- They want to separate but remain married: Human relationships have various quirks. Sometimes, a married couple may wish to live separately and apart but maintain their legal relationship status. A separation agreement helps them determine who will be responsible for what.

What do you stand to benefit from a separation agreement?

- You enjoy a degree of flexibility: Whether you are going through a divorce or separating, a separation agreement allows you and your spouse to decide what works best for you and your family instead of a court deciding it for you.

- You save on costs: When you can agree on issues, you save the cost of time and money you could have spent if you had to go to court and have the court decide on those issues for you.

- It solidifies the arrangement between you and your spouse: The separation agreement is legally binding and provides unshakeable evidence of the decisions you and your spouse made. It also solidifies things and makes it more difficult for either party to renege on the agreement.

- You have a say on who gets to view the contents of your agreement: Divorce proceedings are, by nature, more on the public side, and many people may be able to access the files. However, with a separation agreement, you can keep things more private, and only those to whom you grant access may be able to view it, such as the people involved in your children’s care, if this applies to you.

- You can use it to get help if there is a problem with getting spousal or child support: The Family Responsibility Office will provide you with the service you need.

- Children: Here, you will state all your dependent and independent children’s names and ages. If you do not have any children, you will say whether you are expecting any.

- If any of the children are stepchildren to one of the spouses, you will be required to state so. Note that a stepparent is not obligated to support a stepchild unless they have been doing so for at least a year or had done so for at least a year and stopped. However, the latter will only count if one spouse had brought a claim for the support within a year of the date the stepparent had last contributed. If there is any pertinent information regarding any child, such as disabilities, special needs, or attendance at post-secondary education, you should also state those here.

- The reason you are drafting the separation agreement. The following options apply:

- Separation

- You want to avoid controversy

- You want to have a final settlement of rights

- You want to draw an interim settlement or partial settlement

- You want to draft a settlement whose arrangements are in the best interests of the children. This is essential if your separation is a precursor to filing for a divorce, and you must give supporting reasons for it.

- You also need to decide whether to include a non-variation clause. This clause essentially states that both of you have resolved all matters between you and that you intend for the entire agreement to stand. It also says that you do not want a court to vary your property division and spousal support provisions.

- The issues you expect the separation agreement to deal with. They could be any of the following:

- Guardianship/Decision making, parenting schedule, and parenting arrangements

- Child support

- Who manages or owns family property or other property after separation, or the division / equalization of property.

- The property you would want to be excluded from the agreement

- The spouse that will be responsible for debts

- Have you had any previous agreements? If yes, the following applies:

- You have to identify all prior agreements, including marriage or cohabitation agreements and interim agreements.

- Then you can either rescind or replace prior agreements, or

- Vary prior agreements, or

- Continue all or part of the prior agreement if it applies.

- Are there any previous and current court orders? If yes, do you want to vary them by this agreement?

- Are there any previous or current legal proceedings?

- Are you drafting this agreement as a result of mediation, or is it a collaborative process?

- Give a legal and municipal description of your family residence and any other real property you have.

- List all property, including assets and liabilities of both spouses.

- State whether each party is aware of the other party’s assets. Note that you have to give full and frank financial disclosure of your assets, as failure to disclose fully may result in the court setting aside the agreement. To this end, you and your spouse must give statements acknowledging that you have made complete financial disclosures of your assets and liabilities and are aware that your partner is relying on your being frank. You must also recognize that the court can set the agreement aside if any party fails to make full financial disclosure. You also need to attach sworn statements of your property.

- State what you both acknowledge as a family or communal property and acknowledge that it should be excluded from the individual property. You also need to recognize and state any third-party contributions made to your family and whether the third party made the gift to one or both of you.

- State the occupation and income of both parties, including your most recent Line 15000 income. You also need to identify any disabilities you or your spouse may have.

- State whether either of you has retained or had the opportunity to retain independent legal advice or representation.

What to include in your separation agreement?

Key Dates in a Separation Agreement

- In cases where the separation agreement is a precursor to a divorce, the date helps courts determine whether or not the couple has been living separately and apart for a year. Since Canada is a no-fault state, living separately and apart for a year or more is one of Canada’s grounds for a divorce.

- The date of separation is vital when calculating the commencement of child support, as you cannot start paying child support before the date of separation.

- You also need the date of separation to show that you did not start paying spousal support before you drafted the agreement. If the date of the agreement is later than the commencement of spousal support payment, you have to tag the earlier payments as prior spousal support.

It would also be best to get tax advice on making the prior spousal support payments tax-deductible to the payor spouse (the spouse paying the spousal support). If you do not do this, the courts or even the Canada Revenue Agency may consider your actions fraudulent and impose sanctions on you.

Names and addresses of parties in the agreement

- Your full name and address, and what term will be used when referring to you throughout the agreement, such as your first name.

- Your spouse’s full name and address and what term will be used when referring to them throughout the agreement, such as their first name.

Background facts and purpose of the agreement aka Recitals

- Details about your marriage such as:

- The date and the place where you got married: If your relationship were a marriage-like relationship, i.e., cohabitation, you would also need to state the date you started cohabiting and where you lived.

- You and your partner’s age and birthdays

- Whether or not the both of you had cohabited before you got married and the relevant dates

- Details about your separation, including:

- Whether you had had any prior separation and reconciled, you will need to supply the dates of those separations and for how long the reconciliation lasted.

- Whether or not you expect to continue with this separation without planning to reconcile.

Introduction and general clauses

- You are stating that the recitals you gave above are correct and form part of the agreement.

- Stating that any schedules to the agreement form a part of the agreement.

- Stating the governing law: you may want to include a statement that you and your partner are aware of governing statutes and that regardless of any subsequent amendment to these laws or legislative changes, you intend for the terms in your separation agreement to hold.

- You are stating that you and your partner have been advised of your rights, and you have chosen either to obtain legal advice or not to obtain it.

- You are stating that you and your partner sign the agreement voluntarily without undue influence or coercion. Further, you both agree that the agreement adequately provides for your present and future needs.

- Definition of terms and acronyms.

- Stating that the agreement establishes the full and final settlement of all issues and that it may only be amended by the agreement of both parties in writing.

- Stating that you and your partner release each other of all claims, including claims in trust arising out of your marriage or marriage-like relationship, or joint ownership of property, except those you state in the agreement.

- Stating that the agreement holds even if you divorce each other. You may also insert provisions for getting a divorce, including who will pay for it and that there will be cooperation concerning the service of divorce papers.

- Stating that you and your partner have read and understood the agreement’s contents and that you are aware of its effect, purpose, and intent.

- Including provisions that the agreement binds an estate. You will also have to decide whether or not you should include estate support payments.

- Stating that the words of the agreement are those of you and your spouse and that contra proferentem rules will not apply. Note: contra proferentem is a legal doctrine in contract law that essentially means that any ambiguous clause in a contract is best interpreted against the party’s interests that created the contract. This does not apply in separation agreements.

- Dispute resolution: you may want to state different dispute resolution processes for various issues. Examples include parenting coordinator for specified child-related matters, mediation, or arbitration for disputes regarding income, and litigation for some other types of problems such as difficulty in agreeing to the terms of supervised contact.

- Stating when the agreement goes into effect.

- Stating that any headings are merely for references and do not have any legal meaning.

- Go a bit personal; here, you include statements like:

- When drafting the agreement, you do not see any reasonable prospect of reconciliation (if it applies to you).

- You and your partner have the right to live separate and apart from each other as though you were not married,

- That the agreement does not constitute a bar to actions based on subsequent misconduct

- What reconciliation looks like for both of you, and what its effect(s) will be.

Decision Making aka Guardianship

- Sole decision making: you will need to spell out what it means for you and when one parent alone might exercise decision making rights. Some laws guide the meaning of this, and you may want to consider boning up on them or seeking legal counsel about them.

- Joint decision making: define it and state the terms that will govern it. This should include how you plan to share and allocate parenting responsibilities between the two of you and how you will resolve disputes if you can’t agree.

- Non-custodial guardian of the children: what authority will the person have over the child or children and their estate? A guardian is not automatically entitled to receive children’s property, hence the need to state what authority the guardian has.

- State that the above provisions should be included in wills.

Parenting arrangements

- If you choose joint decision making, you have to set out the allocation of parenting responsibilities. You will also need to define further terms and expectations regarding joint decision making, such as parenting schedule, the amount of time the child(ren) will spend with each parent, with each parent having complete control of the child(ren).

- How much time will the children spend with each parent? This should include how they will spend holidays, special events, and sudden changes in schedules. Acknowledge that both of you are fit to be parents and that you continue to have responsibilities as parents. You will also need to define your and your spouse’s roles as parents.

- State that you and your partner agree to cooperate and support each other in your respective parenting roles.

- Education and upbringing

- What type of education will the children have?

- What type of religious instruction will they have?

- State other aspects of the children’s upbringing that you deem important enough to discuss

- Include a “right of first refusal” clause. A right of first refusal means that when a on duty parent is not available to watch over the children, they have first to offer the off duty parent the opportunity to watch over them before calling anyone else. However, it is essential to note that rights of first refusal for short periods like, say, two hours, may be impractical and lead to further conflict.

- State the children’s views: seeing as a court will accept a separation agreement as part of divorce only if the agreement is in the best interest of the children, it is vital to state that you took the children’s wishes into account when you set out the terms of the agreement.

- Include a provision for what happens if there is a need for emergency care for the children.

- State what happens if a parent dies.

- What right does a parent have to move with the children, especially outside specified areas? If you feel there should be restrictions against this? You may state so here. Some of the restrictions may include:

- Stating that a parent must not move the children’s primary residence out of a specific area without first getting the written consent of the other parent or court order. You may also want to spell out what constitutes a “relocation”. For example, some areas in Canada are large enough that while moving from one point to another may not constitute a relocation, it can be inconvenient for joint parenting.

- State that any relocating parent must notify all other parent of not only the intended move but its date, the new telephone number, and address. You may also want to consider how the parent may be notified far ahead of the intended move.

- If the parent moves outside a specified area, who bears the costs of parenting or contact time, including increased travel time?

- If a parent is taking the children out of Canada, what are the specific areas of note?

- Both parties must give their signed consent before passports are obtained for the children. Note that neither party may withhold consent unreasonably.

- If necessary, a parent may provide a passport for another to travel with the children. However, the traveling parent must provide an itinerary, contact coordinates, and proof of adequate medical insurance.

- State that the partner who takes the children out of Canada will be responsible for getting travel insurance for the children during the time away. You should also state that if the partner fails to get the travel insurance, they will be solely responsible for the costs that a standard travel policy would have covered.

- Do you wish to execute non-expiring travel letters when you execute the agreement? If so, you may want to consider the specific protocols for traveling with children and whether they should only travel on Canadian passports or not. You may also want to consider restrictions to countries that are signatories to the Hague Convention and factor that into your travel plans.

- What if one of the partners wants to introduce new partners to the children? Is there a specific protocol to be observed?

- How will you deal with disputes? You may want to consider any of the following options for this:

- Variation,

- Counselling,

- Mediation,

- Parenting coordinators,

- Arbitration, or

- Collaborative law

- To conclude the section on parenting arrangements, it would be best that you include provisions acknowledging that you recognize that the children’s needs will change, so you will both review the arrangements regularly to keep them in the children’s best interests.

Let’s talk taxes: child support paid under court orders or agreements after April 30, 1997, are NOT taxed as income for the supported parent or deducted from income by the supporting parent. If you need more information on this, please click here to schedule a consultation.

Paying child support

- What type of payment will it be? Monthly? If so, specify the formula or method that you used to determine the amount. You may want to consider your expected extra and special expenses (section 7 expense) and use that as a guideline for drafting the separation agreement.

- How will the child support be paid? By cheque or etransfer from the supporting parent or direct deposit into the receiving parent’s account?

- Review and variation of child support. What circumstances may warrant this?

- The change in either parent’s income

- A child has reached the age of 18 but still requires support for reasons other than pursuing post-secondary education.

- Change in the financial status of the either parent, such as job changes or unemployment due to sickness, accident, strike, or lay-off.

- If the supporting parent defaults in paying child support for a while, will there be interest on the arrears?

- How will you ensure the payment of arrears? You may do any of the following:

- Include a clause that gives the supported parent control on the supporting parent’s assets for the amount of the arrears.

- Include a clause that gives the supported parent the right to deduct an amount equal to the arrears from the proceeds should the family residence be sold.

- Post a cash sum to be held in trust as long as the support payments are not in arrears.

- File against the supporting parent’s real property.

- Use post-dated cheques

- Insert a clause that would require life insurance to secure support obligations. Again, it would be best to have the proposed wording reviewed by your insurer to ensure its effectiveness.

- Insert a clause that secures the child support by binding the supporting parent’s estate.

- What other events could trigger ending or varying the obligation to pay support? The child stops being a child in the marriage in any of the following ways:

- The child has reached age 18 and is now dependent

- The child completes a first degree, diploma, or certificate from an accredited post-secondary institution.

- The child stops attending an educational institution full-time. It will be up to you to define full-time.

- The child takes on full-time employment. It would be best that you defined full-time and stated the possibility of an obligation to revive the support if the child later becomes unemployed and does not get EI benefits.

- The child stops living with the supported spouse and now lives away from home to attend an educational institution full-time.

- The child marries

- The child dies

- The supporting spouse dies.

- Other expenses you may want to consider include

- medical insurance premiums,

- dental insurance premiums, and health-related costs that are not included in the basic insurance coverage,

- educational fees,

- expenses for extracurricular activities,

- and support for children older than 19 years.

- What if one of the parents dies?

- Both parents are obligated to maintain life insurance that includes:

- irrevocable designation of the children or a trustee as beneficiaries,

- the length of time for which the insurance is to be provided,

- a process for ensuring that the life insurance premiums are paid, and

- any other enforcement provision you deem fit.

- Both parents are obligated to provide for their children in their wills

- In cases where the insurance funds may not be adequate, you may place the obligation to pay support on the payor’s estate and make it binding

- Both parents are obligated to maintain life insurance that includes:

Spousal support

- Will there be Spousal Support paid, or a release of Spousal Support obligations

- How much will this be? When will the payment start, and what will be the continuing dates of all payments? You may also consider specifying the purpose of the payments if it applies to your case.

- What type of payment will it be? For example, monthly, yearly, or lump-sum payments? Also, it would be in your best interest to consider income tax implications when choosing the payment type.

- For how long will the payments be made, or will it be indefinite?

- In what manner will the payment be made?

- Monthly cheque or electronic funds transfer from the supporting spouse.

- Purchase of life annuity.

- Purchase of annuity for a specified number of years.

- Payment to a third party.

- Using post-dated cheques.

- Direct deposit.

- Will there be a variation in the amount payable? If yes, on what is it based?

- Sliding scale based on the supporting spouse’s income

- Sliding scale based on the supported spouse’s income

- Combination of the two items above

- Sliding scale tied to the Consumer Price Index (for Canada or a specified city or region).

- Provision for payment reduction where the supporting spouse is unemployed due to sickness, accident, strike, or lay-off.

- Will there be interest on the arrears of spousal support?

- How will you ensure the payment is made?

- What events can trigger review or termination of support obligations?

- The supported spouse remarried or commenced a new marriage-like relationship.

- The supported spouse has taken up cohabitation with another person for a specified time frame. It will be up to you to assess whether the termination based on cohabitation is fair based on the compensatory basis for support.

- The supported spouse has started earning a pre-agreed-upon amount of money from employment.

- The specified time for paying spousal support has elapsed.

- One of the spouses dies

- One of the spouses retires

- When reviewing the payment of spousal support, you should decide on a time frame, which party has to determine whether or not to continue, vary or terminate support, and how the review will take place.

- Decide the terms of the review and whether or not support should continue while the review is ongoing. Also, consider events that would not constitute a material change of circumstances that trigger a review or variation.

- What if the supporting spouse dies? This should be treated in the same manner as the child support payment above.

- Divorce and support provisions: you may choose to go any of the following routes:

- Blanket incorporation of support provisions into the order for divorce

- Incorporating support provisions into the order for divorce at the option of the supported spouse.

- Choosing whether or not to merge support provisions upon order for divorce.

- Prior spousal support: if the supporting spouse had been paying spousal support before the date the agreement came into effect, the agreement might state that the prior payments are taxable in the hands of the supported spouse.

- If neither of you is obligated to pay spousal support, insert a clause that prevents either party from later claiming interim or permanent support.

Extended Health and Dental Benefits

- Regarding dental and medical benefits

- Consider retaining family coverage. However, it is essential to note that many insurance plans do not cover spouses who have not cohabited for a specified period or are divorced. Thus, it behooves you to check with your insurance provider to see what works.

- Is the supporting spouse obligated pay the premiums?

- State the duration for which the supporting spouse is obligated to pay the premiums.

- Since most insurance companies do not cover a person who is no longer a spouse or after a specific time following separation, you may want to include a provision for the responsibility of paying medical and dental expenses.

Debts

- Family debts – acknowledge their existence.

- State how they will be paid – who pays what and in what schedule?

- How will they be paid, e.g., from the proceeds of the sale of the family property?

- Non-scheduled debts – who gets responsibility or indemnity for them?

- Individual debts

- State which ones are payable by the first party.

- State which ones are payable by the second party

- Insert a clause indemnifying each party against third-party claims brought forward because of a failure to pay.

- Insert a clause that says that undisclosed debts are to be assumed by the party who incurred them.

- Loaned property – how will it be recovered?

- Did either of you pledge property to secure debts? Then, decide what to do about it.

- Any joint obligations to third parties? What’s the plan?

- Continue with joint obligations

- Close joint accounts

- One partner assumes the responsibility of the obligation. However, this will not be sufficient to release the other partner from the obligation unless the debt document is renegotiated with the third party.

- Insert clause indemnifying non-assuming party

- Is there any amount due by either spouse to the Canada Revenue Agency for income earned? Who will be responsible for it?

- Return all credit cards to the spouse responsible for payment

- Insert a clause that essentially states that the supported spouse indemnifies the supporting spouse for any debts contracted in the supported spouse’s name after the date of the agreement. If the supporting spouse pays any of those debts, the amount will be deducted from the regular support payments.

- Insert a provision that each spouse is solely responsible for any debts and liabilities incurred after the date of the agreement.

Property division

- If it is a family residence, which spouse gets the title? State the date of transfer, its costs, and insert clauses for releasing the transferor from liability under existing mortgage and indemnity.

- Deferred sale: state every detail regarding the property, including whether or not to sever the joint tenancy

- Other real property: what is the state of the title pending disposition? How will you be disposing of it? Who will be responsible for the capital tax gains?

- Motor vehicles: who has the right to possession, the obligation to make payments, and insure them? How will you transfer the title? What obligations are under leases?

- Insurance policies: how will you dispose of them?

- What are the obligations of the supporting spouse where the supported spouse is named as beneficiary?

- What are the special rights of the supported spouse concerning the policy?

- What events may trigger a termination of the supported spouse as named beneficiary?

- RRSPs, RESPs, pension plans, pensionable earnings credits under the Canada Pension Plan and Old Age Security, securities (stocks, bonds, and notes receivable), stock options, funds on deposit, club memberships, air miles, frequent flyer and loyalty program points: how will you handle them?

- What if a spouse has undisclosed property?

What will your separation agreement cost?

At DTSW:

Articles that may interest You!

Final Thoughts

Ready to create a Soft Landing for your divorce?

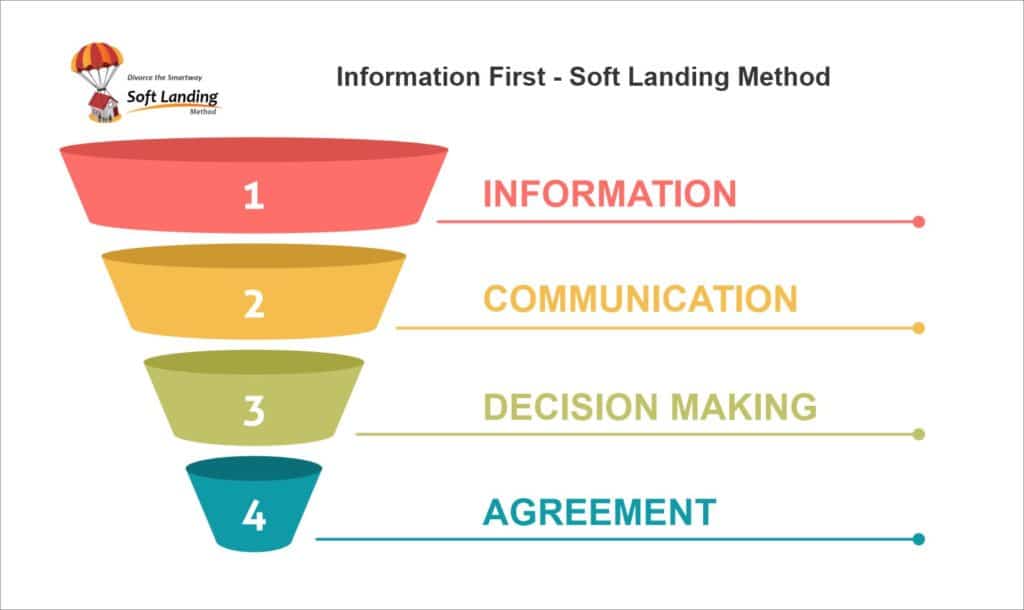

Discover the Soft Landing Divorce Settlement Method – a comprehensive approach to separation and divorce that ensures a fair and equitable division of assets and liabilities.

This method involves a detailed financial walkthrough, including identification and valuation of assets, income assessment, expense analysis, financial projections, and settlement scenarios.

With the Soft Landing Method, you gain a clear understanding of your financial situation, empowering you to negotiate a settlement that meets your needs. Don’t navigate this complex process alone – work with a Certified Divorce Financial Analyst (CDFA) who specializes in separation and divorce cases.