Secure Your Insider Guide Unlocking My Support Calculator

Comprehensive Guide to Child and Spousal Support Calculators in Canada

Discover how to effectively use child and spousal support calculators with our detailed guide. Maximize your financial planning for a smoother divorce process.

Tips for using My Support Calculator:

Spouse – Child Support FAQ

Canada’s Divorce Act sets the standards for spousal support orders for married couples. This federal law applies to all residents across the country. However, local provinces or territories may have laws defining how unmarried couples in common-law relationships should handle spousal support.

Need more certainty about your timeline? That’s perfectly fine! The Limitations Act ensures you don’t need to feel pressured by a looming deadline. You can apply for spousal support at any time without worrying about a strict deadline. The only reason to start as soon as possible is that a judge will consider your genuine need when granting support.

Spousal support may be denied in Ontario if:

- The couple has a cohabitation agreement that outlines spousal support.

- The recipient spouse remarries or starts living with a new partner.

- The recipient spouse is financially independent and does not require support.

Indexing spousal support refers to adjusting the amount of support payments based on changes in the cost of living. This is typically done using a specific formula or index, such as the Consumer Price Index (CPI), to ensure that the support amount keeps pace with inflation over time.

Yes, it is possible to avoid paying spousal support in certain situations. Factors such as the duration of the marriage, the financial independence of both spouses, and any prenuptial agreements in place can influence the outcome.

Yes, a well-drafted prenuptial agreement can outline terms regarding spousal support and potentially limit or eliminate the obligation, provided it is fair and both parties fully disclosed their financial situation when the agreement was made.

If your ex-spouse is financially independent and capable of supporting themselves, this could be a strong argument against the need for spousal support

Mediation allows both parties to discuss and negotiate spousal support terms in a less adversarial setting compared to court. This can lead to more customized and agreeable solutions without the need for lengthy legal battles.

Legal advice is crucial. An experienced lawyer or divorce mediator can provide guidance tailored to your specific situation, helping you understand your rights and options and assisting in drafting agreements that protect your interests.

If you believe you should not pay spousal support, gather all relevant financial documents, seek legal advice, and consider mediation to negotiate the terms. Being well-prepared and informed will strengthen your position.

Courts rarely issue orders for no child support. The responsibility to provide child support is almost inescapable unless there’s undeniable proof that the children’s needs are fully met, which is uncommon. Thus, when children are involved, it’s prudent to prepare for child support obligations.

In Ontario, Canada, child support is regulated by two distinct Acts. If child support claims are part of a divorce process, they fall under the Federal Divorce Act. On the other hand, for couples who were either never married or were married but opt for separation instead of divorce, the Ontario’s Family Law Act is the guiding legislation for child support applications.

The Ontario child support calculator 2022 and 2023 are the same as the 2017 version, there have been no updates since 2017.

The child support calculator Ontario 2023 has not changed since its last revision in 2017.

The duration of spousal support payments in Ontario varies based on factors such as the length of the marriage, the age of the spouses, and the roles during the marriage. As an Accredited Family Mediator, I help couples understand these factors and determine an appropriate timeline for support payments.

In Ontario, spousal support entitlement is determined by various factors including the length of the relationship, each party’s income, and the need of the spouse seeking support. As a Certified Divorce Financial Analyst, I provide detailed analysis and advice regarding spousal support entitlement.

Spousal support in Ontario is usually paid monthly but can be in the form of a lump sum. The amount and duration of payments depend on factors such as the length of the marriage, the income of each party, and the need of the recipient. As an Accredited Family Mediator, I assist couples in navigating these complexities.

Avoiding spousal support in Canada is a complex issue. Courts consider several factors to determine spousal support, and it’s designed to maintain financial fairness after a separation. However, there might be circumstances where spousal support may not apply. As a Certified Divorce Financial Analyst, I can guide you through this process.

The Spousal Support Advisory Guidelines in Ontario provide a framework for determining the amount and duration of spousal support. They consider factors such as the length of the marriage, the incomes of both parties, and whether children are involved. As an Accredited Family Mediator, I help couples understand and apply these guidelines.

In Ontario, spousal support is calculated based on factors like each party’s income, the length of the relationship, the roles during the relationship, and the need of the recipient. As a Certified Divorce Financial Analyst, I use these factors to assist in calculating a fair and appropriate spousal support amount.

Do I have to pay child support even if we were never married or haven’t lived together long enough to be considered common-law partners?

Will I still owe child support if my ex remarries?

What happens if I fail to pay child support?

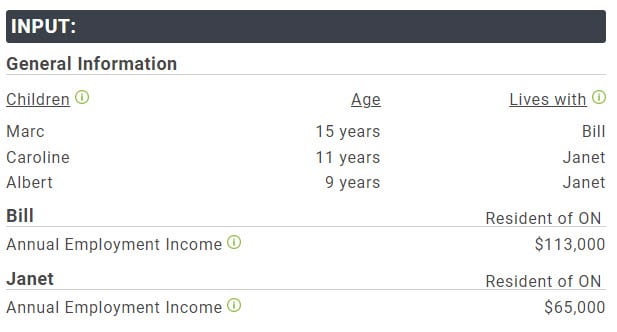

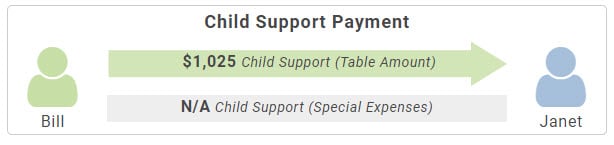

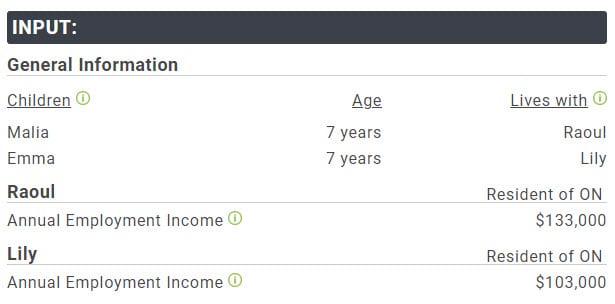

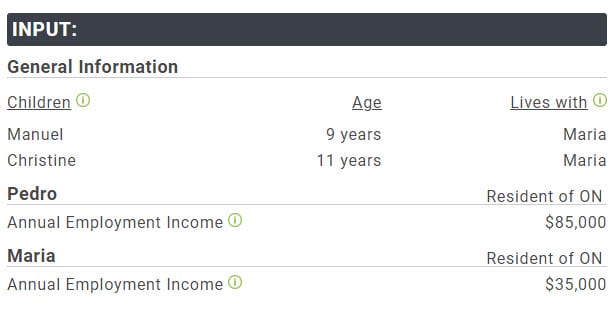

What is the formula for calculating child support?

Do I declare child support on taxes?

Can I be compelled to pay child support for a child that is not mine?

Can child support be avoided with a prenup?

Can I pay my child directly?

How should child support be spent?

Are sports included in child support?

How is self-employed income calculated?

How do I register with the Family Responsibility Office (FRO) for Child Support?

How does the Family Responsibility Office function?

What are the consequences of not paying child support in Ontario?

Can child support be modified?

How does bankruptcy impact child support?

Why am I obligated to pay child support even if I can’t see my child?

External links that may interest you

- My Support Calculator – Canada’s only accurate Child and Spousal support calculator available to the public.

- [2024] Spousal Support Calculator – Free calculator for spousal and child support based on Canadian guidelines.

- Canada Spousal Support Calculator [2024] – Free spousal support calculator for any Canadian province, including tax considerations.

- 2017 Child Support Table Look-up – Based on updated Federal Child Support Tables effective November 22, 2017.

- Spousal Support Calculator – Divorcepath Canada – Trusted by family lawyers, instant and free spousal support calculations.

- Spousal Support Calculator | Alberta Alimony Calculator – Accurate estimates of spousal support for divorce settlements in Alberta.

- Spousal support – Simple online calculator considering employment income for basic calculations.

- Child Support Calculator | Canada Child Support Guidelines – Calculate child support payments as part of a separation agreement.

- Child Support Payments Calculation tool – Free, interactive tool for quick child support payment calculations.

- British Columbia Child and Spousal Support Calculator – Free and accurate support calculator for BC, Canada.

- Child and family benefits calculator – Calculate child and family benefits including the Canada child benefit.

- Links and Resources – Free online support calculator with additional resources and information.

- Ontario – Child Support Calculator – Useful for parents at the commencement of a family court action in Ontario.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call