What Happens to Savings Account When You Separate or Divorce?

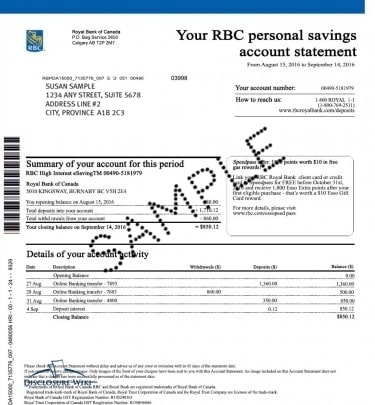

Making your Savings financial disclosure

Saving financial disclosure Documents Details

To obtain this document, you may need these dates:

- Inclusive date of marriage

- Inclusive date of separation

- The current date that you are obtaining the document.

Obtaining a digital copy of this document:

How Do I Get Digital Copy of This Document

You can download an electronic copy (pdf) to your laptop from several online outlets. You may also use “Print to PDF” for most up-to-date browsers to print to a document.

How To Scan Your Hard-Copy Document

You may do so either from your own home or office scanner or even with Staples Company Depot.

Protect your financial interests by separating accounts, tracking expenses, and seeking professional guidance

Managing finances during separation requires careful planning and documentation to protect both parties’ interests. Taking prompt action to organize your financial affairs helps create a clear path forward during this transition.

- Establish separate bank accounts and credit cards immediately

- Create a detailed post-separation budget for your new living expenses

- Document all shared assets and debts as of the separation date

- Keep thorough records of all child-related expenses and support payments

- Consider freezing or closing joint investment accounts by mutual agreement

- Update your will, insurance policies, and beneficiary designations

Consulting with financial professionals, such as a Certified Divorce Financial Analyst or accountant, can help you understand tax implications and make informed decisions about property division, investments, and long-term financial planning.

Joint bank accounts can be legally contested through proper court proceedings in Canada

While joint bank accounts typically operate under the principle of equal ownership, disputes over these accounts can and do arise. Parties can contest ownership rights, contribution amounts, or distribution of funds through legal channels.

- Account holders must provide evidence of their financial contributions

- Courts consider the original intent behind creating the joint account

- Documentation of deposits and withdrawals may be required

- The presumption of joint ownership can be challenged with proper evidence

To contest a joint account, parties should seek legal counsel and be prepared to demonstrate their rightful claim to the funds through proper documentation and evidence.

Yes, you can open a new bank account during divorce proceedings, but transparency is essential

Opening a separate bank account during divorce is a common and legal step in Canada. However, it’s important to maintain financial transparency throughout the divorce process. To protect yourself and comply with legal requirements, follow these best practices:

- Inform your divorce lawyer before opening the account

- Document all deposits and withdrawals carefully

- Disclose the new account in your financial statements

- Use the account only for post-separation income and expenses

- Keep detailed records of all transactions

Remember that any income earned or assets acquired during the separation period may still be subject to division of property laws, depending on your province’s regulations and your specific circumstances.

Bank accounts are considered family property and divided equally through Ontario’s equalization process

During a divorce in Ontario, bank accounts opened during the marriage are treated as matrimonial property and subject to equal division. The equalization process ensures both spouses receive a fair share of all family assets, including savings, chequing, and joint accounts.

Several factors affect how bank accounts are divided:

- Accounts opened during the marriage are typically split 50-50

- Pre-existing accounts may be excluded if kept separate throughout the marriage

- Joint accounts are usually frozen until both parties agree on division

- Date of separation determines the valuation of accounts

- Business accounts may require special consideration if used for family expenses

It’s important to note that couples can negotiate different arrangements through a separation agreement or seek the court’s guidance if they cannot reach a mutual decision.

Separate joint accounts and establish individual banking arrangements immediately upon separation

Financial separation requires careful planning and decisive action to protect both parties’ interests. The key steps involve establishing clear financial boundaries and documenting all transactions.

- Close all joint bank accounts and divide the assets according to agreement

- Open new individual bank accounts at separate financial institutions

- Cancel or freeze joint credit cards and apply for individual ones

- Document and photograph all household assets and their values

- Create a detailed list of shared debts and financial obligations

- Redirect your direct deposits and automatic payments to new accounts

- Consult a financial advisor or accountant familiar with separation matters

Consider working with a Certified Divorce Financial Analyst (CDFA) who can help develop a comprehensive financial separation plan and ensure all legal requirements are met. Keep detailed records of all financial changes and agreements made during this transition period.

Emptying your bank account before divorce is illegal and can result in serious legal consequences

Withdrawing all funds from joint or personal accounts before divorce proceedings is considered financial misconduct under Canadian family law. This action can severely impact your divorce settlement and may result in penalties.

The courts require full financial disclosure and fair division of matrimonial assets. Taking such actions could lead to:

- Court-ordered repayment of withdrawn funds

- Negative impact on your equalization payment calculations

- Potential legal sanctions and fines

- Damage to your credibility during divorce proceedings

- Additional legal costs and delays in settlement

Banks cannot disclose account information without consent or a court order

Due to Canadian privacy laws and banking regulations, financial institutions are legally prohibited from revealing personal account details about any individual without their explicit permission. During divorce proceedings, there are specific legal channels to obtain this information:

- Request financial disclosure through the formal divorce process

- Obtain a court order compelling disclosure of banking information

- Work through your divorce lawyer to access financial records legally

- Use the financial statement Form 13.1 which requires full disclosure of all accounts

Separate bank accounts are typically considered marital property in Ontario and subject to division during divorce.

Under Ontario’s Family Law Act, any assets acquired during marriage, including separate bank accounts, are generally considered part of the matrimonial property regardless of whose name is on the account. This applies to:

- Personal chequing and savings accounts

- Joint accounts between spouses

- Business accounts owned by either spouse

- Investment accounts opened during marriage

The key factor is not whose name appears on the account, but rather when the funds were acquired. Money earned or deposited during the marriage typically becomes part of the net family property subject to equalization upon separation or divorce.

In Ontario, savings are subject to equalization rather than automatic 50/50 division during separation or divorce

Under Ontario’s Family Law Act, the division of matrimonial property follows an equalization process that considers the net worth of both spouses. Rather than simply splitting savings accounts, the law requires calculating the difference in wealth accumulated during the marriage.

The equalization process includes:

- Determining each spouse’s net family property value on the date of separation

- Calculating assets acquired during the marriage, including savings, investments, and pensions

- Subtracting pre-marriage assets and excluded property like inheritances or gifts

- Equalizing the difference between both spouses’ net family property values

This means your spouse may be entitled to more or less than half your savings, depending on your complete financial picture and other factors considered in the equalization calculation.

Related Documents:

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Financial disclosure is the process by which both sides (you and your spouse) exchange reports about income, property, and debts of the other person.

Financial disclosure is the process by which both sides (you and your spouse) exchange reports about income, property, and debts of the other person.