Separation Valuation Date: Your Bookend To Money In Separation

Divorce Self-Filer

Our Naked Divorce Self-Filer offers a time-saving and cost-effective solution for your divorce process. Check if your situation qualifies for this streamlined approach

- Figure out the date you separated – Steps to Justice – Learn why the date of separation is important and how it affects your divorce timeline.

- How do I determine the date we separated? – Learn how to establish your date of separation and its legal importance.

- Separation date for common law couples – Discover the significance of the separation date for property division in common-law relationships.

- What is my date of Separation? Evidentiary Sources to Consider – Explore the sources of evidence used to establish the date of separation.

- Separation and the Law – Understand the legal framework surrounding the date of separation and its effects on family law matters.

- What is a separation date? – Get a clear definition of the separation date and its implications.

- Separation date or “living separate and apart” | Divorce in Edmonton – Learn about the concept of living separate and apart and how it determines the separation date.

- Determining Your Separation Date – Discover how to determine your separation date and its impact on property division.

- Why Does the Date of Separation Matter in BC Family Law? – Understand the importance of the separation date in British Columbia family law.

- Marital status – Common Law – Learn how to report your date of separation for tax purposes.

- Determining the Date of Separation in Marriage — Blog Posts – Find out how to determine the date of separation in marriage and its legal effects.

- Date of separation | California Courts | Self Help Guide – Understand the process of figuring out your date of separation and its legal significance.

- How the Separation Date Can Affect Spouses’ Property – Discover how the separation date can impact property and income division in divorce.

- The Importance of the Date of Separation in BC Family Law – Learn why the separation date is crucial in British Columbia family law and its implications.

Ken Maynard CDFA, Acc.FM

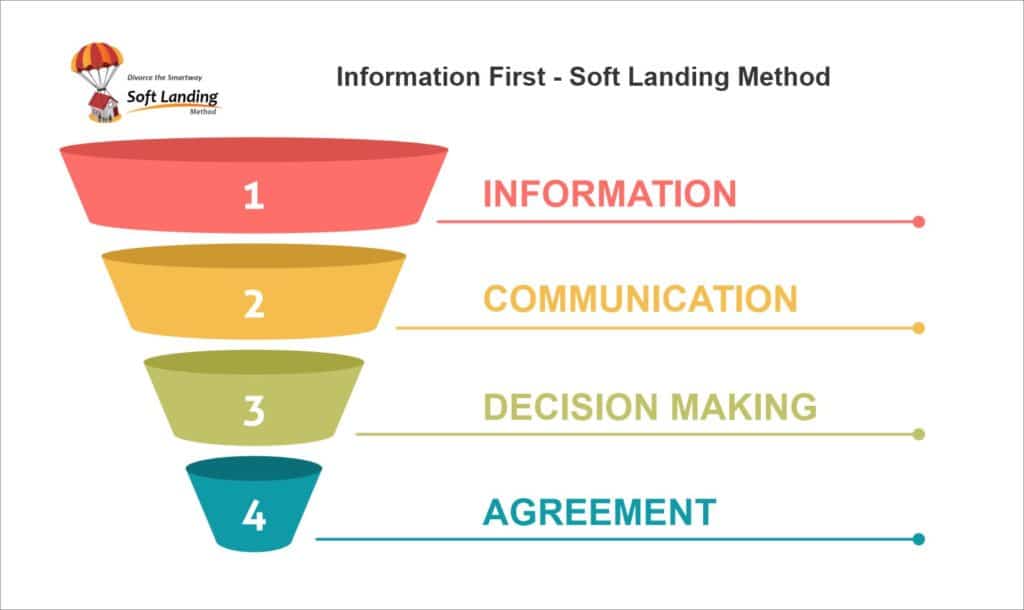

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call