Understanding: Section 7 Expenses in Ontario

Understanding Section 7 Expenses in Ontario Sparation

Discover what is included in Section 7 expenses for child support in Ontario, covering child care, medical, educational, and extracurricular costs to ensure fair financial contributions.

What are Section 7 Expenses?

“Section 7 expenses” and “special and extraordinary child support” in Canada refer to the same concept. Section 7 of the Federal Child Support Guidelines outlines certain expenses considered over and above the essential child support payments.

These expenses include child care, medical and dental insurance premiums, health-related expenses not covered by insurance, extraordinary extracurricular activities, and educational expenses, including post-secondary education.

Get Acquainted Call

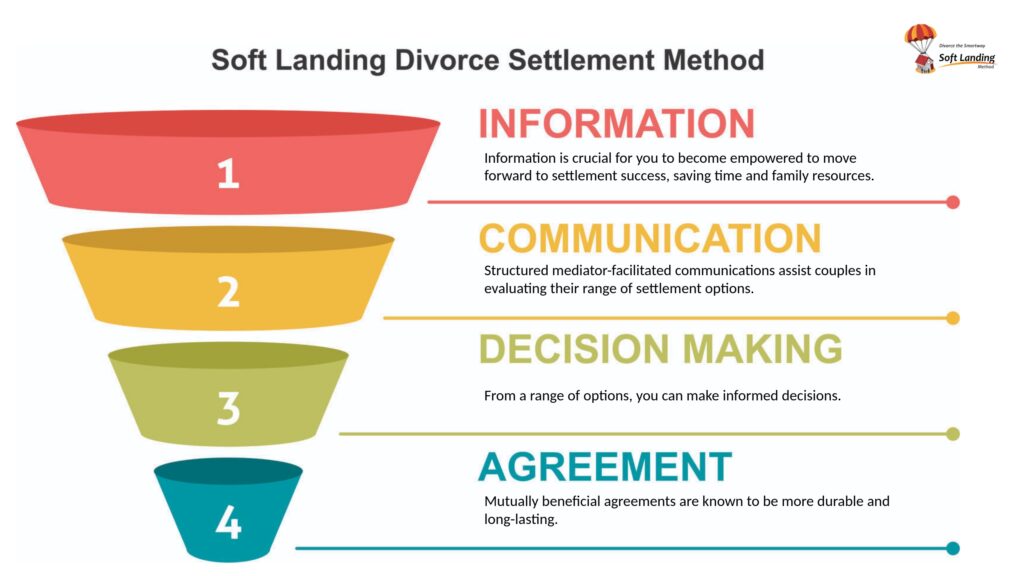

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

Special or extraordinary expenses might include amounts for various items that parents deem a child requires. However, for any expense to qualify as a section 7 expense, the general requirement is that it must be:

- Necessary, which means that it must be in the child’s best interests;

- Reasonable, especially when compared to the parents’ means; and

- Consistent, in relation to the family’s spending patterns before separation

When determining these expenses, the parent applying for a court order or presenting these expenses in mediation proceedings will have to prove the requested amounts.

Section 7 expenses, are also referred to as special or extraordinary expenses

Section 7 expenses also form part of the payments a parent might make as child support in Ontario

While certain expenses might be extraordinary for one family, they might fall within what is considered reasonable for another.

If there is no agreement about these payments, or if both parents agree that no section 7 expenses apply, then the applicable child support payment will be only the table amount in the Guidelines.

What expenses are included in child support?

As a rule, child support payments in Canada are calculated based on the government’s projection for what is reasonable for a child to live on (called the table amount) and section 7 expenses. The goal of child support is to provide additional income to a custodial parent to help them maintain a reasonable standard of living for a child.

The table amount is provided in the Child Support Guidelines which contains a Child Support Table for each Canadian province. How much each parent pays as child support will depend on their yearly gross income and how many children the marriage produced.

While these amounts are fixed within the Table, they are calculated to take into account usual expenses of a custodial parent. For instance, a parent living in a one-bed apartment might need to rent a two-bed because they now have custody of the child. Child support payments are intended to assist with this expense. Other usual expenses include feeding, electricity, heating, etc.

Compared to the table amount, section 7 expenses cover special or extraordinary expenses. By definition, these expenses are beyond the usual expenses that a child would ordinarily need to maintain a reasonable standard of living.

Is clothing a section 7 expense?

Not necessarily. Usual day-to-day clothing will usually be considered a normal expense associated with raising a child. However, major clothing items such as those required for sports or other extracurriculars, winter jackets or boots, etc. may qualify.

It is important to keep in mind that what amounts to a section 7 expense might differ from family to family. While certain expenses might be extraordinary for one family, they might fall within what is considered reasonable for another.

That said, the Child Support Guidelines lists items that would typically fall within special or extraordinary expenses. They include:

- Child care expenses relating to illness, education of a parent, employment, or disability. These expenses might cover the cost of private babysitting or day care

- Insurance premiums for dental or medical insurance covering the child

- Health expenses that exceed $100 a year, including payments for speech therapy, hearing aids, braces, physiotherapy, glasses, etc.

- Expenses for post-secondary education such as tuition, books, stationery for college or university

- Special expenses for extraordinary needs that the child might need in primary or secondary school. These might include private schooling or special needs education

- Expenses related to extracurricular activities for the child

You should also note that not all expenses fall comfortably within either section 7 expenses or usual expenses anticipated within the table amount. There might be confusion about how extra expenses like cell phones, laptops, bus passes, or similar expenses should be treated.

If you are facing this dilemma, a profession can help determine how these expenses should factor into your child support payments.

How are section 7 expenses calculated?

Generally, section 7 expenses are calculated by the parents based on what they believe to be reasonable and necessary extra payments. If there is no agreement about these payments, or if both parents agree that no section 7 expenses apply, then the applicable child support payment will be only the table amount in the Guidelines.

The amount to be paid by each parent will be calculated based on the gross income of each parent. The parent who earns more per year will often be required to pay the greater share of the amount. For instance, if one parent earns $65,000 per year while the other earns $35,000, the payment will be split by 65% and 35% respectively. Where the parents choose to, they might agree to split the section 7 expenses equally, meaning they each pay 50%.

But what happens in a case where the parents share custody of their child? The law only regards parents to have shared custody when the child spends more than 40% of their time with each parent. Where this is the case, both parents have an obligation to pay child support.

They will be required to calculate their child support payments individually, including whatever section 7 expenses are agreed on. However, the actual amount to be paid will be the difference between their child support obligation. For instance, if they determine that Parent A will pay $1,000, while Parent B has an obligation of $700, then Parent A will pay $300 to the Parent B.

Do I have to pay Section 7 expenses?

Section 7 expenses are expected to be agreed upon by the parents, except where the payment is ordered by the court. If you and the other parent have come to an agreement about these expenses, then you might be bound to pay according to the agreement. This will especially be the case where the agreement has been lodged with the court.

However, there are many circumstances where you might be able to contest these expenses. For instance, if you believe that the expenses are not reasonable or that the other parent has withheld information regarding the expenses, you can apply to the court to for a review.

The court will consider whether the expense should qualify as special or extraordinary based on several factors including:

- The nature of the expense

- Each parent’s income

- The child’s special needs or talents

How to enforce section 7 expenses?

First, consider how the section 7 expenses were determined. If the expenses were agreed upon in a separation agreement, then you need to register the agreement with the court, if you have not already done so. Once registered, the agreement counts as a court order.

If you already have a court order, the payment will be enforced automatically by the Maintenance Enforcement Program (MEP) aka Family Responsibility Office (FRO). If the court order is already enrolled with the MEP/FRO but the other parent is not complying, you can contact your enforcement officer with the details of your situation.

You can also contact a professional who can proffer advice about your situation and the next steps to enforce your section 7 expenses

11 Key Takeaways about Section 7 Expenses

- Definition: Section 7 expenses are special or extraordinary child support expenses outlined by the Federal Child Support Guidelines in Canada.

- Types of Expenses: These include child care, medical and dental insurance premiums, health-related expenses not covered by insurance, extraordinary extracurricular activities, and educational expenses.

- Shared Costs: Parents share these costs in proportion to their incomes.

- Necessity: Expenses must be necessary, reasonable, and consistent with pre-separation spending patterns.

- Disagreement: If parents disagree on these expenses, only the table amount from the Guidelines is applied.

- Included Expenses: Typical section 7 expenses include child care for work or education, health expenses over $100 annually, post-secondary education costs, and extraordinary extracurricular activities.

- Usual vs. Extraordinary: Ordinary clothing and living expenses are covered by the table amount, while major expenses for specific needs qualify as section 7 expenses.

- Calculation: Payments are based on gross income, with higher earners paying a greater share.

- Shared Custody: In shared custody, child support payments are the difference between each parent’s obligation.

- Enforcement: Agreements or court orders for section 7 expenses must be registered with the court for enforcement.

- Professional Guidance: Navigating section 7 expenses can be complex and may require professional help to ensure fair and accurate calculations.

Table of Contents

- Understanding Section 7 Expenses in Ontario Sparation

- What are Section 7 Expenses?

- What expenses are included in child support?

- Is clothing a section 7 expense?

- How are section 7 expenses calculated?

- Do I have to pay Section 7 expenses?

- How to enforce section 7 expenses?

- 11 Key Takeaways about Section 7 Expenses

- At DTSW

- Get Acquainted Call

At DTSW

We understand that navigating the complexities of a separation can be overwhelming, especially when it comes to agreement on what is a Section 7 expense. Our Team of Divorce Specialists and Certified Divorce Financial Analysts are here to support you every step of the way. We know what you are facing, and our Divorce Financial Planning services are designed to help you secure a stable and prosperous future for you and your children.

Don’t face this journey alone. Reach out to us and take the first step towards a brighter future. Schedule a Get Acquainted Call with our experts today.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

External Links that May Interest You

- Information sheet: New details on Section 7 expenses

- The Federal Child Support Guidelines: Step-by-Step

- MEP – Section 7 expenses

- Federal Child Support Guidelines ( SOR /97-175)

- Child Support and Section 7 Expenses

- Section 7 Child Support Expenses: A Comprehensive Guide

- What are Alberta section 7 child support expenses?

- Section 7 Expenses (Extraordinary Expenses, Special Expenses)

- Section 7 Child Support Expenses

- Section 7 Expenses: What are They, and Why Do I Have to Pay Them?

- Section 7 Expenses in Family Law Matters

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call

- Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/June 2, 2022

- Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/May 20, 2022

- Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/June 1, 2023