The Rise of Grey Divorce in Canada

The rise of grey divorce in Canada can be attributed to several socio-economic factors. One such factor is the overall increase in life expectancy. Canadians are living longer, healthier lives compared to previous generations. As a result, individuals in their 50s and 60s are more likely to reassess their relationships and consider divorce as a pathway to personal fulfillment.

Another significant contributing factor to the rise of grey divorce in Canada is the changing social and cultural landscape. Over time, attitudes towards divorce have evolved, and societal stigma surrounding divorce has diminished. This cultural shift has empowered seniors to feel more comfortable and pursue divorces later in life.

Furthermore, the financial independence of many Baby Boomers plays a role in the rise of grey divorce. Compared to previous generations, retirement for many seniors today does not mean complete financial dependency on a spouse. This financial autonomy enables individuals to make independent decisions about their relationships, including deciding to divorce.

Moreover, the rise of grey divorce in Canada has also been influenced by the “empty nest syndrome phenomenon.” As children grow up and leave the family home, couples may face an “empty nest,” leading them to reevaluate their relationship dynamics. The absence of children in the household can sometimes highlight underlying issues previously masked by the demands of parenting.

Technological advancements and social media have also created new avenues for social connections and self-exploration, especially for older adults. This increased connectivity can expose individuals to new ideas and lifestyles, prompting them to question their current relationships and seek personal growth outside their marriage.

Factors Contributing to Grey Divorce

Several factors contribute to the rise of grey divorce in Canada. Firstly, empty nest syndrome can trigger marital dissatisfaction. Once children leave home and the focus shifts from parenting to the couple’s relationship, spouses may discover that they have grown apart and no longer share common interests.

Additionally, retirement can be a turning point in a marriage. The newfound freedom and increased time spent together may intensify existing marital issues or unearth previously unnoticed problems. Couples may realize they have different retirement dreams and aspirations, leading to conflict and divorce.

Health concerns can also be a contributing factor to grey divorce. Individuals may undergo health crises or be faced with a chronic illness, which can put a strain on the relationship. The stress of caregiving and the changing dynamics within the partnership can lead to marital breakdown.

Lastly, the desire for personal growth and self-fulfillment is prevalent among seniors. With increased life expectancies, many individuals have ample time to pursue their interests and passions. This may lead to a reassessment of their relationship and a decision to separate in search of personal happiness.

Another significant factor contributing to grey divorce is financial strain. As couples age, they may face unexpected financial challenges such as inadequate retirement savings, mounting healthcare costs, or uneven wealth distribution. These financial stressors can create tension in the marriage and ultimately lead to a decision to divorce to alleviate the financial burden.

Moreover, societal attitudes towards divorce have evolved, making it more socially acceptable for older individuals to end their marriages. Unlike in previous generations, where divorce was stigmatized, today’s seniors may feel empowered to seek divorce as a means of reclaiming their independence and pursuing a more fulfilling life.

Financial Implications of Grey Divorce

Grey divorce can have significant financial implications for both parties involved. After decades of shared assets and joint financial decisions, untangling finances during divorce can be complex and time-consuming.

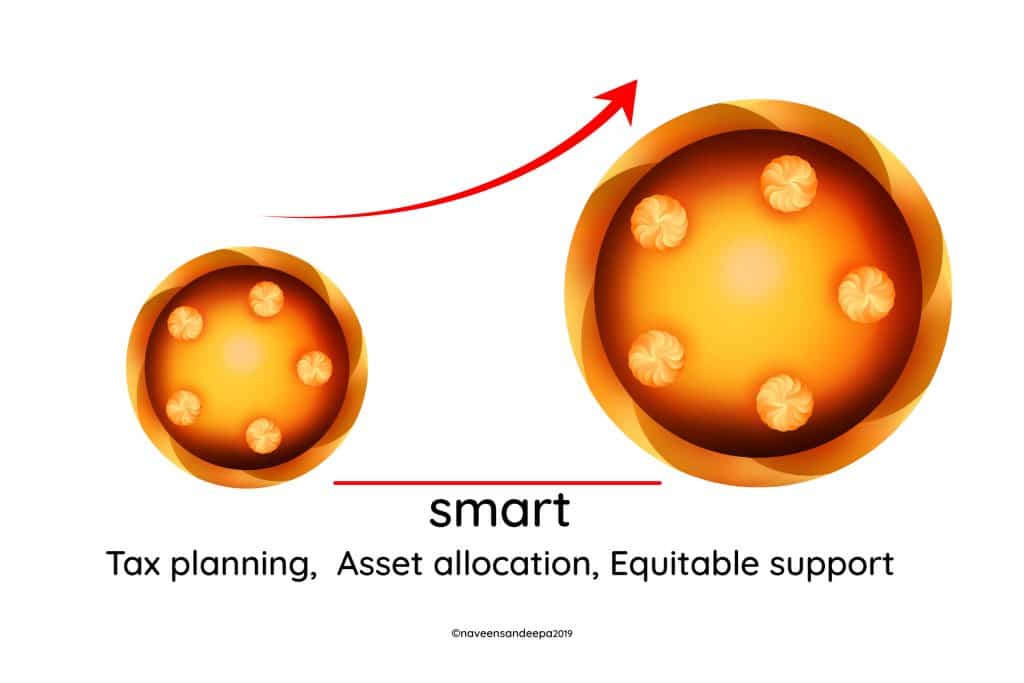

One primary consideration is the division of assets. In Canada, assets acquired during marriage are generally subject to equal division, regardless of who earned or contributed to their acquisition. This often involves the assessment and valuation of various properties, investments, and pensions.

Retirement savings are also a crucial financial aspect of grey divorce. Couples who have planned for retirement together may need help separating those funds. The division of retirement savings requires careful consideration to ensure a fair and equitable distribution.

Furthermore, the emotional toll of grey divorce can also impact the financial decisions made during this process. Individuals may be more inclined to make hasty financial choices or overlook essential details due to the stress and emotional strain of ending a long-term marriage.

Lastly, spousal support may be a factor in grey divorce cases. The financial circumstances of both parties and their ability to support themselves post-divorce are taken into account when determining spousal support obligations. Given the complexity of these financial matters, seeking legal advice and financial planning assistance is not just beneficial, but essential to navigate the process successfully.

Emotional Challenges Faced by Seniors in Divorce

Grey divorce can be emotionally challenging for seniors who have spent years building a life together. A sense of loss, isolation, and fear of the unknown future can compound the emotional impact of divorce in later life.

One key emotional challenge is adjusting to living alone after a long-term relationship. The sudden change in daily routines and social dynamics can be overwhelming, and seniors may feel a sense of emptiness and loneliness as they navigate this transition.

Additionally, divorce can strain relationships with adult children. Adult children may find it challenging to understand or accept their parents’ decision to divorce. The news of their parents’ separation may bring up feelings of sadness, confusion, and concern for the well-being of their parents.

It is crucial for seniors going through a grey divorce to prioritize self-care and seek emotional support. Counselling, support groups, and maintaining social connections are not just helpful, they’re vital in helping individuals cope with the emotional challenges associated with divorce, reducing feelings of isolation and providing a strong support network.

Another significant emotional hurdle that seniors face in divorce is the reevaluation of their identity and sense of self. After years of being part of a couple, individuals may struggle to redefine themselves as individuals rather than as part of a pair. This process of self-discovery and self-acceptance can be daunting but is essential for personal growth and healing.

Moreover, the financial implications of divorce can add another layer of emotional stress for seniors. Concerns about economic stability, retirement funds, and property division can exacerbate anxiety and uncertainty about the future. It is common for seniors to experience a sense of betrayal or injustice during the financial negotiations of a divorce.

Amidst these emotional challenges, seniors should practice patience and self-compassion. Healing from a grey divorce is a gradual process that requires time and understanding. By acknowledging and addressing their emotions, seniors can embark on self-discovery and resilience as they navigate this significant life transition.

Legal Considerations for Grey Divorce in Canada

While the legal process of divorce is similar regardless of age, there are unique considerations for grey divorce in Canada. Consulting with a family lawyer specializing in grey divorce can help individuals navigate the legal complexities of their situation.

One important legal consideration is the division of pensions. Pensions are a significant asset for many seniors, and their division requires careful analysis and understanding of the applicable laws and regulations.

Another consideration is estate planning. Grey divorce may require the revision of wills, powers of attorney, and beneficiary designations. Updating these documents to reflect new circumstances and ensure that wishes are carried out as intended is crucial.

Spousal support may be a significant legal consideration in cases where one spouse has been financially dependent during the marriage. Determining the amount and duration of spousal support requires a thorough assessment of both parties’ financial situations and future needs.

Moreover, grey divorce can have implications for retirement planning. Dividing assets accumulated during a long marriage, such as retirement savings and investments, can impact both parties’ financial security in retirement. It is essential to consider the long-term effects of asset division and make informed decisions to safeguard financial well-being.

Additionally, healthcare considerations become crucial in grey divorce. As seniors age, health issues may become more prevalent, and access to healthcare becomes increasingly essential. Understanding how divorce may impact health insurance coverage, long-term care planning, and medical decision-making is vital for individuals going through a grey divorce.

Strategies for Navigating Grey Divorce Successfully

Navigating grey divorce successfully requires careful planning and consideration. The following strategies can help individuals going through a grey divorce ensure a smoother transition:

Grey divorce, also known as late-life divorce, presents unique challenges due to the long-term nature of the marriage and the financial complexities involved. Individuals in this situation need to approach the process with a clear understanding of their rights and responsibilities.

- Seek professional advice:

Consulting with a family lawyer who specializes in grey divorce can provide individuals with the necessary legal guidance and ensure their rights are protected.

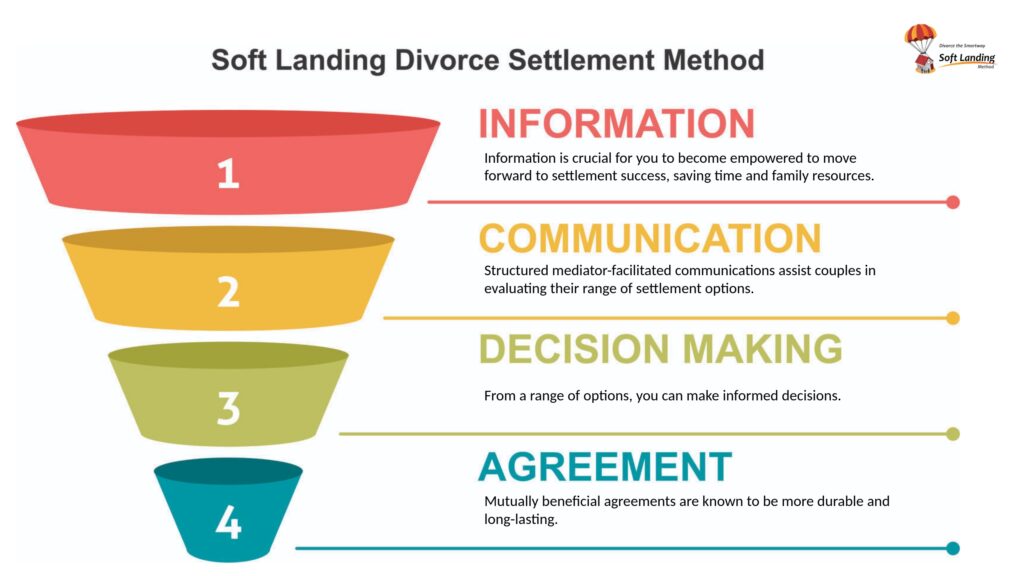

- Consider mediation:

Mediation can be a more amicable and cost-effective alternative to litigation. It allows couples to work with a neutral third party to make mutually agreeable decisions.

- Focus on communication:

Open and honest communication is crucial during divorce proceedings. Discussing shared goals and concerns can lead to more constructive and fair outcomes.

- Take care of yourself:

Prioritize self-care and seek emotional support throughout the process. Engaging in activities that promote physical and emotional well-being can aid in coping with the challenges of divorce.

Moreover, individuals navigating grey divorce must consider the impact on their retirement plans. Dividing assets accumulated over a long marriage can have significant implications for both parties’ financial security in retirement. Seeking advice from a financial planner or retirement specialist can help individuals make informed decisions about their post-divorce financial future.

Impact of Grey Divorce on Adult Children

Grey divorce, the dissolution of marriages among older couples, can profoundly impact adult children and their perception of relationships. While adult children may intellectually grasp that their parent’s decision to divorce is rooted in their pursuit of individual happiness, the emotional repercussions can be significant.

One critical impact of grey divorce on adult children is the adjustment to a new family dynamic. Adult children may navigate unfamiliar territory as they encounter changes in holiday traditions, family gatherings, and their relationships with each parent. This adjustment period can be emotionally taxing and may necessitate candid and empathetic conversations among family members.

Furthermore, grey divorce can strain adult children’s interpersonal relationships. Witnessing their parents’ separation later in life may prompt adult children to reflect on their own partnerships, leading them to reevaluate the stability and longevity of their relationships.

It is imperative for parents undergoing grey divorce to engage in transparent communication with their adult children, offering reassurance of their unwavering love and support. By fostering an open dialogue and understanding environment, parents can help assuage any apprehensions or anxieties their adult children may harbour during this challenging transition period.

Support Systems for Seniors Going Through Divorce

Seniors going through a divorce can benefit from various support systems. These support systems can provide emotional guidance and practical advice and help individuals navigate the challenges of divorce.

Support groups specifically tailored for seniors going through divorce can offer solace and a sense of community. Interacting with individuals with similar experiences can provide valuable emotional support and insights into the divorce process.

Family and friends can also serve as crucial support systems during this challenging time. Trusted individuals willing to listen, provide a shoulder to lean on, and offer practical assistance can make a significant difference in the well-being of seniors going through divorce.

Seeking the assistance of professionals, such as therapists or counsellors, can provide seniors with the necessary emotional support and coping strategies. These professionals can help individuals process their emotions, develop healthy coping mechanisms, and navigate the challenges associated with divorce in a supportive environment.

Furthermore, engaging in self-care practices can also be a vital aspect of a senior’s support system during a divorce. Taking time for activities that bring joy and relaxation, such as meditation, exercise, or hobbies, can help seniors maintain their mental and emotional well-being amidst the turmoil of divorce.

Legal support is another essential component for seniors navigating the complexities of divorce. Consulting with experienced attorneys specializing in senior divorce cases can ensure that individuals receive proper legal guidance and representation to protect their rights and assets during the divorce process.

Exploring alternative dispute resolution methods, such as mediation or collaborative divorce, can offer seniors a more amicable and cost-effective way to settle their divorce. These approaches focus on open communication and cooperation, aiming to reach mutually beneficial agreements without lengthy court battles.

Redefining Relationships After Grey Divorce

After a grey divorce, individuals can redefine their relationships and create a fulfilling post-divorce life. It is essential to approach this new chapter with a positive mindset and a focus on personal growth.

One aspect of redefining relationships is developing a support network. Building new and meaningful connections with peers, community groups, or support organizations can help combat feelings of loneliness and isolation.

Self-reflection and self-discovery are also integral to redefining relationships. Understanding one’s values, goals, and aspirations can lead individuals to make choices that align with their newfound independence and personal fulfillment.

Furthermore, embracing new hobbies and interests can significantly affect post-divorce life. Exploring activities that were previously unexplored or rediscovering past passions can bring a sense of joy and purpose. Whether painting, hiking, cooking, or joining a book club, engaging in these activities can help individuals connect with like-minded people and foster personal growth.

Another important aspect of redefining relationships after a grey divorce is setting boundaries. Establishing boundaries with ex-partners, family members, and friends can help individuals navigate their new reality confidently and self-assuredly. Boundaries are essential for maintaining emotional well-being and respecting personal needs.

Celebrating New Beginnings: Life After Grey Divorce

Life after a grey divorce can be seen as an opportunity for new beginnings. It gives individuals the chance to embrace their independence, pursue their passions, and redefine their happiness.

Many seniors find solace in engaging in activities they have always wanted to try but were unable to during their marriage. Travel, hobbies, volunteer work, or furthering education can bring a sense of fulfillment and joy.

It is important to remember that each individual’s journey after a grey divorce is unique. Reflecting, healing, and rebuilding can lead to a life filled with personal growth, self-fulfillment, and new adventures.