Proven Tips for Notice of Assessment Review with Sample

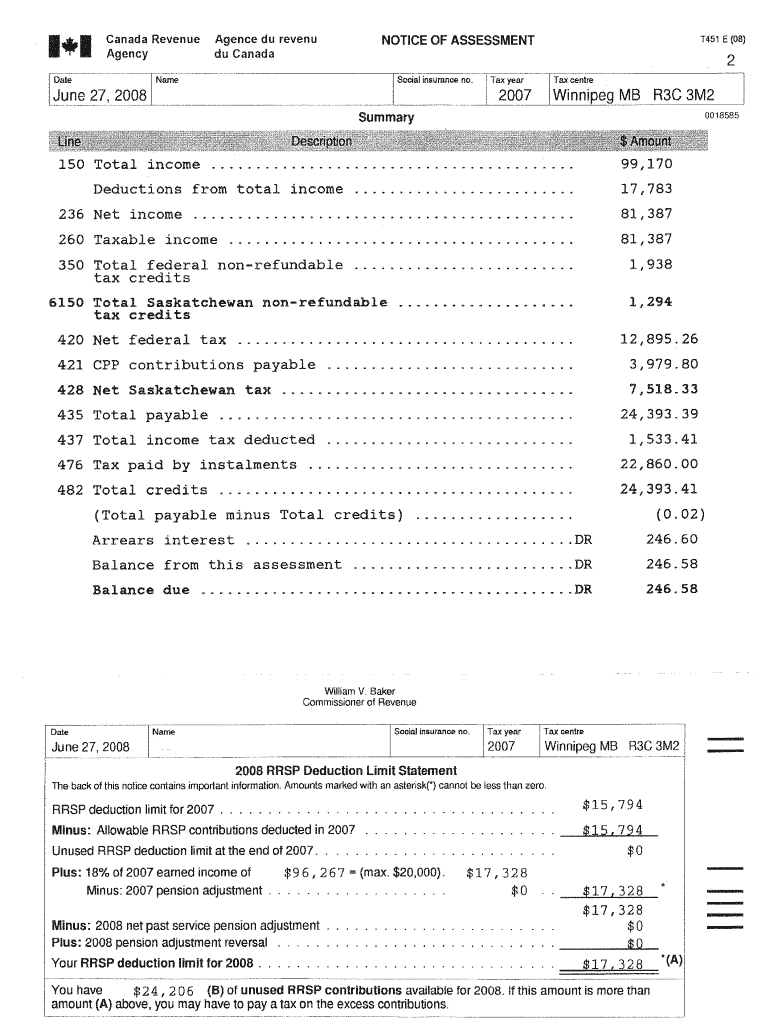

Understanding your Notice of Assessment (NOA) is crucial for managing your taxes effectively in Ontario. This comprehensive guide will help you grasp “what is a notice of assessment, what does a notice of assessment look like, how to get a notice of assessment” and why these aspects are essential. A Notice of Assessment is a document sent by the Canada Revenue Agency (CRA) that outlines the details of your tax assessment for the current year, including any taxes owed or refunds due.

Knowing “what is a notice of assessment” and recognizing “what does a notice of assessment look like” can help you keep track of important information such as your registered retirement savings plan (RRSP) contribution limit, deduction limits, and any balance owing. Additionally, understanding “how to get a notice of assessment” is vital for tax filers, as it provides a summary of your tax bill and contributions, ensuring you stay informed about your financial standing.

In this blog post, we will provide you with proven tips for reviewing your Notice of Assessment, complete with a sample for reference. You’ll learn about the assessment summary, how the CRA sends this document, and the role of authorized representatives. We’ll also cover related articles on tax news and retirement savings. Continue reading to gain valuable insights and practical advice on handling your NOA efficiently, helping you manage your finances better and avoid any surprises with your tax bill.

Remember, your NOA is an important document that serves as an official record of your income and tax payment history for a specific year. It’s recommended to review it carefully and keep it for your records.

Distinguishing Between a Tax Return and a Notice of Assessment

A tax return also referred to as a T1 General, is a compilation of all your earnings and claims for a specific tax year. It includes either the amount you’re due to receive as a return or the amount you owe.

On the other hand, a Notice of Assessment (NOA) is an official government document containing this information. Generally, your T1 General will match your NOA unless the Canada Revenue Agency (CRA) identifies errors or necessary changes before finalizing your return.

In essence, while your T1 General and NOA contain similar information, the T1 General is a document that has yet to be an official document. The NOA, which the CRA must verify, is the officially recognized and used document.

NOA Required Dates

Understanding how these important dates in separation and divorce will make a material difference: The When, Then and Now of Divorce

How to find my notice of assessment?

Where to Find Your Notice of Assessment

How can I get a copy of my notice of assessment?

How to get Notice of Assessment online – CRA access how-to video

My Account, the Canada Revenue Agency’s secure portal

Why the Notice of Assessment is important in Separation and Divorce?

Separated individuals must file taxes independently and declare their separation date to the CRA

When filing taxes after separation in Canada, you need to inform the Canada Revenue Agency (CRA) of your change in marital status and the effective date of separation. This change can significantly impact your tax situation and available benefits.

Your separation affects several key tax considerations:

- Child benefits and credits may be recalculated based on individual income

- GST/HST credits will be based on your income alone

- Spousal support payments may be tax deductible for the payer and taxable for the recipient

- Property transfers between separated spouses may have tax implications

- Principal residence exemption claims need to be coordinated with your former spouse

It’s important to update your CRA account as soon as possible after separation to ensure you receive the correct benefits and credits based on your new status.

Notices of Assessment typically arrive within 2-8 weeks after filing, with potential delays during peak periods

The Canada Revenue Agency (CRA) processes millions of tax returns annually, and several factors can affect when you receive your Notice of Assessment. Common reasons for delays include:

- Filing method – Electronic returns process faster (2-8 weeks) than paper returns (8-10 weeks)

- Peak season congestion – Returns filed close to deadlines may take longer to process

- Verification requirements – The CRA may need additional time to review your information

- Complex returns – Returns with multiple income sources or deductions require more processing time

- System updates – Occasional CRA system maintenance can cause temporary delays

If it has been longer than 10 weeks since filing, contact the CRA directly or check your status through My Account online.

The CRA typically issues Notices of Assessment within 2-8 weeks after receiving your tax return

The Canada Revenue Agency (CRA) processes and issues Notices of Assessment based on how you filed your return. Processing times vary depending on your filing method:

- Online returns (NETFILE): 2 weeks or less

- Paper returns sent by mail: 8 weeks or longer

- Pre-authorized representatives (like tax preparers): 2-3 weeks

You can check your assessment status through your CRA My Account or the CRA mobile app. If you haven’t received your assessment within these timeframes, contact the CRA directly for assistance.

The CRA sends Statements of Account to notify taxpayers of account balances, changes, or required actions.

A Statement of Account from the Canada Revenue Agency (CRA) serves as an official record of your tax account status. The CRA typically issues these statements for several important reasons:

- You have an outstanding balance on your tax account

- Recent account adjustments have been made to your return

- Interest or penalties have been assessed

- Changes to your tax credits or benefits have occurred

- A payment schedule needs to be established

It’s important to review your Statement of Account carefully and respond to any requests for action to maintain good standing with the CRA.

Line 15000 (formerly Line 150) shows your total taxable income for the tax year before deductions

Line 15000 on your Notice of Assessment represents the sum of all your income sources for the tax year. This includes:

- Employment income (T4 slips)

- Self-employment earnings

- Investment income

- Pension payments

- Rental income

- Government benefits

- Other taxable income sources

This line is a crucial reference point used by the Canada Revenue Agency (CRA) and various organizations to verify your annual income. It represents your gross income before tax deductions and credits are applied.

Access your Notice of Assessment through CRA My Account online portal

You can easily obtain your Notice of Assessment through the Canada Revenue Agency’s My Account service. This secure online platform provides 24/7 access to your tax documents and information.

Here’s how to download your Notice of Assessment:

- Log in to CRA My Account using your secure credentials

- Navigate to the Tax Returns section

- Select the tax year you need

- Click on Notice of Assessment

- Download the PDF document to your device

If you haven’t registered for My Account, you can sign up through the CRA website using your SIN and personal information. The service also allows you to view other tax documents, submit returns, and track refunds.

Access your Notice of Assessment online through CRA My Account or request it by mail

The Canada Revenue Agency (CRA) provides multiple ways to obtain your Notice of Assessment. The fastest and most convenient method is through the secure CRA My Account portal, where you can view and download current and previous assessments instantly.

Here are the main ways to get your Notice of Assessment:

- CRA My Account: Log in to view, download, or print your assessment immediately

- MyCRA mobile app: Access your notice through the official CRA smartphone application

- Phone request: Call CRA at 1-800-959-8281 to have a copy mailed to your registered address

- Mail request: Submit a written request to your local tax centre

For security purposes, notices requested by phone or mail will only be sent to your address on file with the CRA.

Notice of Assessment processing takes 8-14 days for electronic returns and 4-6 weeks for paper returns

The Canada Revenue Agency (CRA) processes tax returns and issues Notices of Assessment according to your filing method. Electronic filing (NETFILE) offers the fastest processing time, while paper filing takes considerably longer due to manual processing requirements.

- Electronic returns: 8-14 business days

- Paper returns: 4-6 weeks

- Complex returns may require additional processing time

- You can check your status through My Account on the CRA website

A T1 tax return and Notice of Assessment are two distinct tax documents serving different purposes.

The T1 General Income Tax Return is the form Canadian taxpayers complete and submit to report their annual income and calculate taxes owed. In contrast, the Notice of Assessment (NOA) is an official document issued by the Canada Revenue Agency (CRA) after reviewing your T1 submission. The NOA outlines:

- Your assessed tax position

- Any adjustments made to your original filing

- Tax refund amount or balance owing

- RRSP contribution room for the next year

- Important tax account information

Related Documents:

External links that may interest you

- Get a copy of your notice of assessment – Canada.ca – Learn how to get a copy of your notice of assessment (NOA) that the CRA sends you yearly after you file your tax return.

- Notice of Assessment – We issue a notice of assessment for every income tax return you file. Notices are generally mailed out, unless you specifically ask to receive yours online.

- How to Get Your CRA Notice of Assessment (NOA) – A CRA Notice of Assessment (NOA) is like a receipt for your tax return. This document details the results of your assessment and other information.

- You file online. Now get your Notice of Assessment – Don’t wait! Use Express NOA to get your notice of assessment and see a summary of your refund, amount owing, deposit information, and more.

- All you need to know about your Notice of Assessment – Log into your CRA My Account (registration required) to view and print any of your NOAs or notices of reassessment issued after February 9, 2015.

- Notice of Assessment (NOA): Definition, Details, Objection – A notice of assessment is an annual statement sent by Canadian revenue authorities to taxpayers detailing the amount of income tax they owe.

- How do I get a copy of my Proof of Income Statement or NOA? – You can order a copy to be mailed to you by calling Canada Revenue Agency (CRA) for your Notice of Assessment at 1-800-959-8281 or Proof of Income Statement.

- Getting my tax assessment – Singapore – Got your tax bill? IRAS helps you understand it. Learn about your tax assessment, payment, and possible refunds. Simplify your taxes.

- Pay a Bill (Notice of Assessment) | Virginia Tax – Log in to QuickPay using your Virginia Tax account number and any 5-digit bill number. Have your bank routing and account numbers ready.

- CRA’s notice of assessment: everything you need to know – The CRA notice of assessment is a summary of your income and shows all the credits and deductions you’ve claimed on your taxes.

- OBTAINING TAX INFORMATION FOR YOUR RENT – This document provides instructions on how to obtain your Notice of Assessment or Proof of Income Statement from Canada Revenue Agency (CRA).

- Sample Notice of Assessment – Revenue Canada – Notice of assessment. We assessed your 2015 income tax benefit return and calculated your balance. You have a refund. Use direct deposit to get your tax.

- Income Tax Act (RSC, 1985, c. 1 (5th Supp.)) – Objections to Assessments · 165 (1) A taxpayer who objects to an assessment under this Part may serve on the Minister a notice of objection, in writing, setting.

- How do I download my Notice of Assessment? – Help Centre – To download a PDF copy your Notice of Assessment from the Canada Revenue Agency (CRA) website, you can follow the three easy steps below.

- Notice of assessment number | Québec Parental Insurance Plan – The notice of assessment number comprises 11 characters (letters and numbers) and can be seen on the notice of assessment sent by Revenu Québec to all.

- What is a Notice of Assessment and Why is it Important? – Where can I find my Revenue Québec assessment number? To find your notice of assessment number, take the notice of assessment itself and look for a combination.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Financial disclosure is the process by which both sides (you and your spouse) exchange reports about income, property, and debts of the other person.

Financial disclosure is the process by which both sides (you and your spouse) exchange reports about income, property, and debts of the other person.