The Certified Divorce Financial Analyst and the Redhead

I say a Certified Divorce Financial Analyst and she says is “is that even a thing?”

The Redhead, as I refer to her, aka my Lady Partner, and I was out at one of her corporate dinner parties the other night. “No shop talk,” the Redhead said as she lay down the rules of engagement for the evening.

(All I could think about was if they’d be serving crème brûlée again.)

“I wish I’d met you sooner. I could have used you during my divorce years ago.” She says

Seated for dinner, I had Bill on my right, June on my left, and across the table is the watchful Redhead. The idle cocktail chit-chat turned to a more probing dialogue over the course of dinner.

I was anticipating the crème brûlée, then out it came. “So Ken, what do you do for work?” Bill asks. I reply, “I am a Certified Divorce Financial Analyst.” June responds, “Certified Divorce Financial Analyst (CDFA certification)? Is that even a thing?” Now, with the no “shop talk directive kicked to the curb, I jump right in. Sally, another person at the table, interjects, “I wish I’d met you sooner. I could have used you during my divorce years ago.”

So I dive right in. I explain to Sally that when she went through her divorce, couples really only had one option: head to a lawyer. Often, this meant a great deal of time spent going back and forth over assets. That time meant money.

Bill, who used divorce mediation for his separation 3 years ago, adds, “things have changed. Now divorcing couples have choices. My brother used mediation. He skipped the bulk of the lawyer expense, and his divorce was done in a snap”

At that point I could feel just feel it. I didn’t need to look, but I did. There was the Redhead with a raised eyebrow and eyes rolling. Clearly, it was time to escape the subject, but not before I heard a few common sound bites from around the table:

- Bill says an out of court settlement is the way to go. It saved him big bucks.

- John says to Sally, “don’t get any ideas, we’re both retired we cannot divorce, it would ruin us.

- Fred says he would never pay monthly spousal support he would want it all over with a one-time payment.

- Judy says her kids are special needs. There’s no chance she’d let some Judge make decisions about their future. “I’m sure Sam and I can work something out…”

- Sam adds, “she runs all the finances, I am not sure what I would do…”

- Fred adds, “I am self Employed. How does that work?”

A Divorce Finances Expert certainly finds divorce finances make a lively dinner conversation. And these are all questions that, as a Divorce Finance Expert, I hear consistently from clients navigating their divorce. But the Redhead was not having it, so I switched the topic to something less uncomfortable.

Do you have some of these same questions? We can continue the conversation right here. So, is a Divorce Financial Specialist the right choice for you?

The Top 9 Reasons You Should Use a Divorce Financial Specialist

1. Out of Court Settlement

It’s no secret that divorces settled in court cost big money. Usually, more money than they need to. Now, more than ever, separating couples are using alternative dispute resolution methods. Most want to stay away from litigation and Family Court. The most popular options are mediation and collaborative team practice. These specialists can help divorcing couples reach a fair and amicable divorce settlement together. It’s a way to avoid all the back and forth.

Knowing this, it’s only natural the use of a Certified Divorce Financial Analyst [CDFA] is becoming popular. Figuring out the financial details makes up a huge part of the divorce process. It’s a good idea to work with someone who can iron out those details in an equitable way, without having to take the matter to a judge.

2. Reduce Costs

No matter how you look at it, divorce is expensive. However, the way you approach it determines just how expensive.

Perhaps you’ve done well financially. You’ve have accumulated significant investments, such as real estate properties, pension, business interests, annuities, restricted stock units, or stock options. Unfortunately, these fixed assets can’t pay your living expense each month. That said, there may be ways to activate fixed holdings without cashing them out.

Working with a Divorce Financial Specialist can help decrease costs, preserve family wealth, and ultimately help you profit from your divorce.

3. Reduce the Financial Knowledge Power Imbalance

Who handles the finances in your home?

In approximately 70% of households, one partner handles the family finances. Usually, the other partner has limited involvement. When a couple prepares for divorce, the uninvolved partner may be at a disadvantage. It can also jeopardize the possibility of avoiding litigation. A Divorce Financial Specialist can balance the field of play. This helps better position the parties for post-separation life.

4. Households with Special Needs Children

When there are children involved, the divorce process becomes more complex. This is especially true if your child has special needs.

Smart estate planning is an absolute necessity for parents with special needs children. Separation and divorce amplify the need for financial planning beyond. Family trusts are often created to protect the child without affecting government aid.

5. Self-Employed Spouse

One of the family’s most valuable assets may be a family business. However, often its value is disputed. Just dealing with the business itself can drag a divorcing couple to court.

A Divorce Financial Specialist can establish the value and develop the means of dividing the business while maintaining the operations.

Ken Maynard talks about a fresh conceptual approach...

Ken interviewed by Family Lawyer

6. Complex Insurance Needs

Life insurance, health insurance, disability, long-term care… when any of these are on the line you need to make sure they’re handled correctly.

In many provinces, the support payer must carry life insurance. This is to ensure their support obligations are met, should an untimely death occur. Disability insurance is also often recommended. However, there could be affordability concerns. Additionally, sometimes the support payer is uninsurable and cannot obtain coverage. A Divorce Financial Specialist can help determine other means of protecting the support receiver

7. Lump-Sum Support Considerations

Establishing the amount of support payments can be hard. This is especially true in cases of indefinite support. Often, spousal support can lead to feelings of anger and grief, particularly when they’re deemed unfair. However, these feelings may be greatly reduced when the settlement is determined on fair, neutral ground.

For example, monthly spousal support payments are tax deductible for the support payer and ruled as income by the support receiver. However, lump-sum spousal support does not attract tax treatment. A Divorce Financial Specialist can help you understand all the options.

8. Augmenting Income

What about when employment income and support can’t maintain a client’s post-separation lifestyle? Assets received in the equitable divorce financial distribution can generate income. A Divorce Financial Specialist can advise clients on investment options.

9. Grey Divorce

Let’s face it, when you’re divorcing later in life you want to spend the least amount of time on this as possible. The problem is, grey divorce comes with its own set of complexities.

In cases involving older clients, there may be more assets, but less income to work with. There are also financial complexities about pension planning and estate planning. There’s also healthcare and pension payout options. By working with a Divorce Financial Specialist, you can usually reach an agreeable divorce settlement in a much shorter period of time.

Survey Says

Recently, the Institute for Divorce Financial Analysts™ conducted a survey. It showed there’s been a significant shift in how separating couple approach divorce financial settlements. With the volatile nature of real estate and financial markets, and the locked in nature of pensions and retirement accounts, divorcing couples are now focusing on cash flow to meet their immediate needs, often with the help of a Financial Divorce Specialist.

What is divorce financial planning? – with CDFA

About Ken Maynard

As a Certified Divorce Financial Analyst (CDFA) aka a Divorce Financial Specialist and Family Mediator, I take a facilitative role with my mediation clients.

Before I elaborate on my mediation background, I would like to share with you how my greatest pain in life became my greatest passion.

As a survivor of separation and divorce, I have been through this life-altering event twice over a 25-year span. I can tell you not much has changed in family law over that time. My first separation cost us collectively $120,000 in legal and other professional fees, while taking over 2 years to work through the “system”. I remember my lawyer saying to me “Ken, now that we have the property issues settled, we should address the child custody issues. I will need another $30,000 retainer to get started.”

My second separation and divorce was far more troubling for me as I saw a ‘system’ in disarray, lawyer fees were higher and the courts were jammed beyond capacity. Nothing had improved. It remains a system that often consumes families and leaves them broken and broke.

Where are those Canadian Peacekeepers?

I remember thinking at the time that Canada is known internationally as a nation of peacekeepers, yet our family justice system forces our own citizens and families to go to WAR in family court.

I came away from this horrific experience with a single-minded passion:

I would never want any family to go though what my children and I went though.

That was my first step in a journey that has been very enlightening, rewarding and fulfilling.

My children and I on our first vacation together 6 years after the court actions started and 3 years after my last court appearance.

How a Divorce Financial Advisor through Financial Planning - Helps Individuals and Couples

The financial ramifications of a divorce can be devastating. However, with proper divorce financial planning and expert help from a professional advisor certified (financial divorce specialists ) in financially equitable divorce settlements, you can increase your chances of arriving at a settlement that fully addresses your long-term financial needs and your spouse’s too. What’s missing in most divorce processes is the financial expertise of a Divorce Finance Advisor. As a CDFA™ I can help forecast the long-term effects of the settlement. By using a Divorce Financial Specialist, both partners have a clearer view of their financial futures – only then can they approach a settlement that fully addresses the financial needs and capabilities of each.

I help clients determine the short-term and long-term financial impacts of any proposed divorce settlement. I also provide valuable information on financial issues that are related to the divorce, such as tax consequences, dividing pension plans, continued health care coverage, stock option elections and much more.

More about as CDFA in Canada

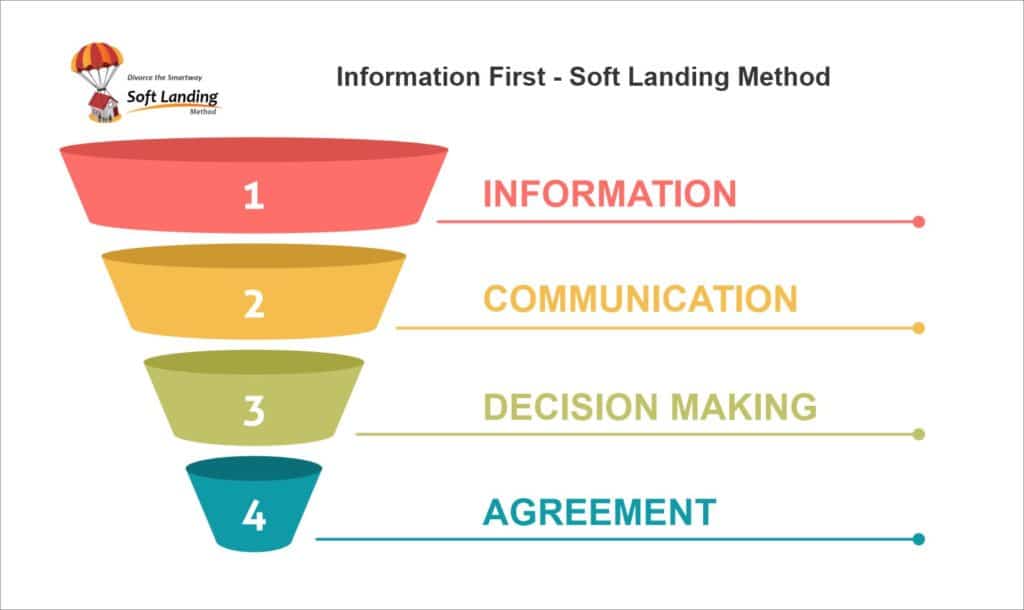

As professional divorce advisor, I bring a wealth of personal and practical experience to my clients, with more than 25 years of experience as a senior business executive. Leading the Divorce the Smartway team, I am committed to guiding and facilitating couples through Divorce the Smartway’s Soft Landing™ Settlement Method. This unique, step-by-step approach to divorce mediation is a new paradigm, delivering acceptable outcomes for all parties.

I feel my unparalleled financial, negotiation, business experience, family mediation training and CDFA designation, combined with our own innovative Soft Landings process, can help to save clients money, provide clarity to property division, accelerate timelines, reduce emotional chaos and empower each couple faced with separation/divorce.

Ken S. Maynard CDFA

PROFESSIONAL CERTIFICATIONS

- Certified Divorce Financial Analyst™, Institute for Divorce Financial Analysts (CDFA)

- New Ways 4 Families Practitioner, Licensed by the High Conflict Institute

- BIFF Response, Licensed by the High Conflict Institute

BUSINESS EXPERIENCE

- Divorce the Smartway: Divorce Financial Specialist, January 2010-Present

- Divorce the Smartway: Accredited Family Mediator, January 2010-Present

Prior to founding Divorce the Smartway, Ontario Divorce Financial, Harbour Valuations, I enjoyed a 27-year career as a Financial Analyst, Business Analyst, and as a Real Estate Analyst for various companies. This included project work for BPI Mutual Funds, CI Mutual Funds, GE Capital Commercial Finance, Goldman Sachs, Century 21 of Canada, Royal Bank, Bank of Montreal and Time Warner, Price Waterhouse Coopers and Ernst & Young.

CONTINUING EDUCATION

- Alternate Dispute Resolution – Level I: University of Windsor, October 2010

- Alternate Dispute Resolution – Level II: University of Windsor, December 2010

- Institute for Divorce Financial Analysts: CDFA Certification, December 2010

- Family Mediation: Richard Shields – ADR Institute, February 2011

- Collaborative Team Practice Level I: Brain Galbraith and the Divorce Team May 2012

- Business valuation and income for support calculations: Cory Smith OFCL, September, 2012

- Coping with Bill 133 provincial pensions: Peter Martin, March 2013

- Managing High Conflict Personalities: Bill Eddy, May 2013

TV APPEARANCES & SPEAKING

- Rogers Community TV – Daytime

- Rogers Community TV – Tony Guergis Live

- myDivorceBootCamp – Know Before You Go

Ready to create a Soft Landing for your divorce?

Discover the Soft Landing Divorce Settlement Method – a comprehensive approach to separation and divorce that ensures a fair and equitable division of assets and liabilities.

This method involves a detailed financial walkthrough, including identification and valuation of assets, income assessment, expense analysis, financial projections, and settlement scenarios.

With the Soft Landing Method, you gain a clear understanding of your financial situation, empowering you to negotiate a settlement that meets your needs. Don’t navigate this complex process alone – work with a Certified Divorce Financial Analyst (CDFA) who specializes in separation and divorce cases.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.