Secure Your Insider Guide Unlocking My Support Calculator

Comprehensive Guide to Child and Spousal Support Calculators in Canada

Discover how to effectively use child and spousal support calculators with our detailed guide. Maximize your financial planning for a smoother divorce process.

Tips for using My Support Calculator:

Spouse – Child Support FAQ

Spousal support eligibility applies to married couples under federal law and common-law partners under provincial legislation

In Canada, spousal support is available through two main legal frameworks. The federal Divorce Act governs support arrangements for legally married couples who are separating or divorcing. Each province and territory also has specific legislation that addresses support rights for both married and common-law partners.

Individuals may qualify for spousal support if they meet the following criteria:

- Legally married spouses going through separation or divorce

- Common-law partners who have lived together for the required period (varies by province)

- Partners who can demonstrate financial dependency during the relationship

- Those who have experienced economic disadvantage due to the relationship or its breakdown

The amount and duration of support payments depend on factors like income disparity, length of relationship, and each partner’s ability to become financially self-sufficient.

You can apply for spousal support at any time, with no strict legal deadline in Canada

Under the Limitations Act, there is no fixed time limit for filing a spousal support application in Canada. However, it’s advisable to apply as soon as possible after separation because courts consider the timing of your application when assessing your genuine need for support.

Important factors that influence spousal support applications:

- Timing of application – earlier applications generally demonstrate more immediate need

- Financial circumstances – current income and ability to become self-sufficient

- Length of marriage/relationship – affects duration and amount of support

- Demonstrated need – must show legitimate requirement for financial assistance

Spousal support in Ontario can be denied based on legal agreements, remarriage, or financial independence.

In Ontario, courts may deny or terminate spousal support payments under specific circumstances that affect the recipient’s eligibility. Understanding these conditions is crucial for both parties involved in separation or divorce proceedings.

- Existence of a valid domestic contract or cohabitation agreement that specifically addresses spousal support arrangements

- The recipient spouse enters into a new marriage or common-law relationship

- Achievement of financial self-sufficiency by the recipient spouse through employment or other means

- Failure to demonstrate financial need or entitlement based on the relationship’s circumstances

- Evidence that the recipient has unreasonably refused to become financially independent when capable

Spousal support indexing automatically adjusts payment amounts based on cost-of-living changes to maintain purchasing power.

Spousal support indexing is a legal mechanism that helps protect the value of support payments against inflation. This adjustment process typically uses the Consumer Price Index (CPI) as a benchmark to ensure payments maintain their real-world value over time.

- Adjustments usually occur annually based on CPI changes

- Helps recipient maintain consistent standard of living

- Prevents need for frequent court applications to modify support

- Can be included in separation agreements and court orders

Most Canadian courts allow for indexing provisions in support orders, making it an important consideration in divorce settlements and support arrangements.

Spousal support obligations can be avoided in specific legal circumstances under Canadian family law

While spousal support is a common outcome of separation or divorce in Canada, there are several legitimate ways to avoid or reduce payment obligations. The courts consider multiple factors when determining spousal support requirements.

- Having a valid prenuptial or marriage agreement that addresses support obligations

- Demonstrating the recipient spouse is financially self-sufficient or has the capacity to become self-sufficient

- Proving a short-term marriage with no significant economic disadvantage to either party

- Showing both parties have similar income levels and earning potential

- Establishing that the recipient spouse has entered a new marriage or common-law relationship

It’s important to note that avoiding spousal support requires proper legal documentation and may need court approval. Consulting with a qualified family law lawyer is essential to understand your specific circumstances.

A prenuptial agreement can limit or eliminate spousal support obligations if properly structured and legally valid.

A prenuptial agreement can effectively address future spousal support obligations, but must meet specific legal requirements to be enforceable in Canadian courts. The agreement needs to be carefully drafted with full financial disclosure from both parties.

- Both parties must receive independent legal advice before signing

- Complete and honest disclosure of all assets and liabilities is required

- The terms must be fair and reasonable at both the time of signing and separation

- The agreement cannot leave one spouse requiring social assistance

- There must be no evidence of coercion or undue pressure

While a prenuptial agreement can help protect assets and establish support parameters, courts may still review and potentially override terms that have become significantly unfair over time or fail to meet basic support requirements under Canadian family law.

Financial independence of an ex-spouse typically reduces or eliminates the need for spousal support

When an ex-spouse demonstrates financial independence through stable employment, sufficient income, or adequate assets, courts generally consider this a compelling reason to deny or terminate spousal support. The primary purpose of spousal support is to help a former partner become self-sufficient, not to provide indefinite financial assistance.

Key factors courts consider include:

- Current employment and income level

- Professional qualifications and earning capacity

- Financial assets and investments

- Standard of living maintained post-divorce

- Ability to meet basic needs independently

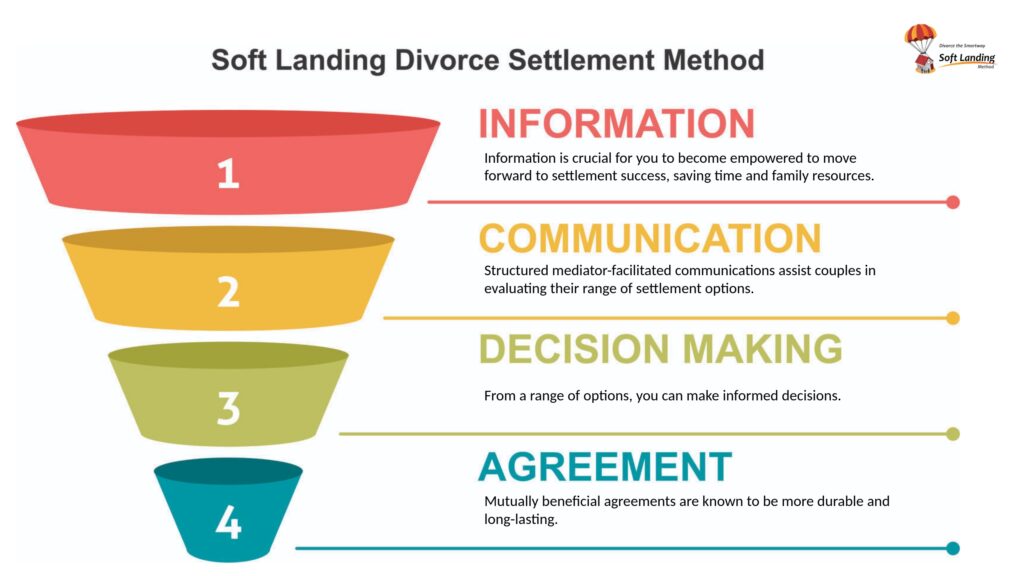

Mediation provides a collaborative, cost-effective way to negotiate fair spousal support arrangements

Mediation serves as a neutral, confidential forum where separating couples can work through spousal support decisions with professional guidance. A qualified mediator helps facilitate productive discussions while keeping emotions in check and focusing on practical solutions.

The mediation process offers several key advantages:

- Creates a less adversarial environment compared to courtroom proceedings

- Allows couples to develop customized support arrangements that work for their unique situation

- Typically costs significantly less than going to court

- Helps preserve relationships, especially important when children are involved

- Provides faster resolution than traditional litigation

Through mediation, couples can address both immediate and long-term support needs while maintaining control over the final agreement terms.

Professional legal advice is essential for navigating spousal support obligations and protecting your financial interests.

Consulting with a qualified family law professional is crucial when dealing with spousal support matters in Canada. An experienced lawyer or mediator can provide invaluable guidance specific to your situation and help safeguard your rights.

- Helps understand your legal entitlements and obligations under provincial laws

- Ensures proper documentation and filing of support agreements

- Identifies potential issues before they become costly problems

- Provides strategic advice for negotiating fair arrangements

- Helps protect your long-term financial security

Without proper legal counsel, you risk making decisions that could have serious long-term financial consequences. A family law specialist can help you avoid common pitfalls and ensure your support agreement is both fair and legally binding.

Consult a family lawyer and gather financial documentation to challenge spousal support obligations

If you believe spousal support payments are unwarranted, take strategic steps to address your concerns through proper legal channels. A qualified family law attorney can evaluate your situation and help build a compelling case.

- Collect comprehensive financial documentation including income statements, tax returns, and expense records

- Document any relevant factors like the marriage duration, recipient’s employment status, and standard of living

- Consider alternative dispute resolution through mediation before proceeding to court

- Request a formal review of the support order if circumstances have significantly changed

- Maintain detailed records of any existing support payments while pursuing modifications

Remember that unilaterally stopping payments is not advisable, as this could result in legal consequences. Always work through proper legal channels to modify support arrangements.

Courts rarely order zero child support as parents have a legal obligation to financially support their children

Under Canadian family law, child support is a fundamental right of the child and courts are extremely reluctant to waive this obligation. Only in exceptional circumstances might a court order no child support, such as:

- When the child has become financially independent

- If both parents share exactly equal custody and have identical incomes

- When a child has been legally adopted by another person

- If parental rights have been formally terminated by the court

Even in cases of shared custody or when children’s immediate needs appear met, courts typically still mandate some level of financial contribution from both parents. This ensures children maintain their standard of living and have adequate financial support for their development and well-being.

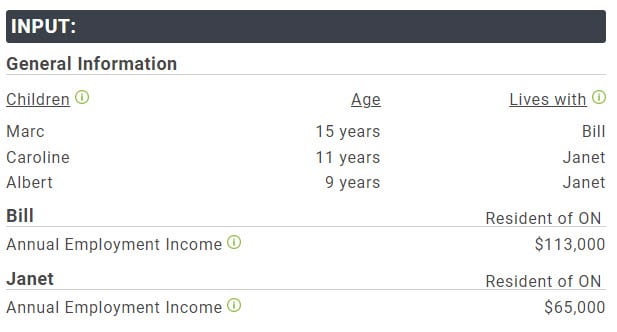

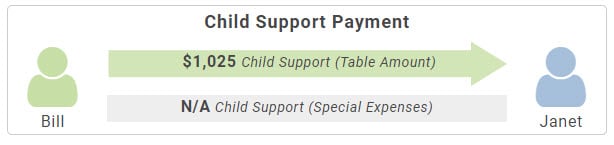

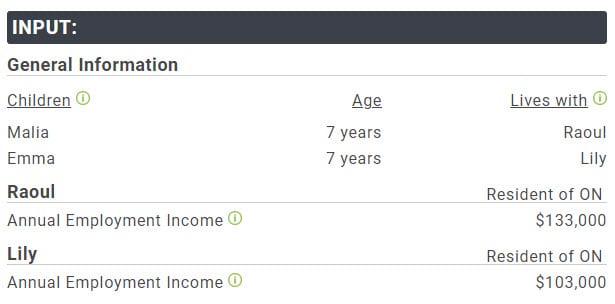

Federal and provincial child support calculators differ based on the legal context of separation or divorce.

The key difference lies in which legal framework applies to your situation. The Federal Child Support Calculator is used when parents are going through a divorce under the Divorce Act of Canada. The Provincial Calculator applies to cases under Ontario’s Family Law Act, specifically for:

- Parents who were never married

- Married couples who are separating but not divorcing

- Common-law partners who are separating

While both calculators use the same Child Support Guidelines to determine payment amounts, they operate under different jurisdictions and legal frameworks. The actual support amounts calculated are typically identical, as both follow the same standardized calculation tables established by the Department of Justice Canada.

The Ontario child support calculator remains unchanged since 2017, with no differences between 2022 and 2023 versions

The Ontario Child Support Guidelines and associated calculators have maintained consistent formulas and calculation methods since their last update in 2017. Parents using either the 2022 or 2023 versions will find identical:

- Base calculation tables and income thresholds

- Special and extraordinary expense considerations

- Section 7 expense calculations

- Income determination methods

- Shared custody adjustments

While the cost of living and economic factors may change yearly, the official calculation framework remains stable until the government implements formal updates to the guidelines.

Ontario’s child support calculator remains unchanged since the 2017 Federal Child Support Guidelines update

The Ontario Child Support Calculator continues to use the same calculation methods and tables established in 2017 under the Federal Child Support Guidelines. While the base calculation framework remains consistent, the actual support amounts reflect current income levels and economic factors to ensure fair support payments for Canadian children.

- Uses the same income-based calculation tables from 2017

- Maintains consistent provincial and territorial application

- Continues to factor in the number of children and parenting arrangements

- Still allows for special expense considerations and adjustments

Spousal support duration in Ontario depends on marriage length, with payments typically lasting 0.5 to 1 year for each year of marriage

The length of spousal support obligations in Ontario is determined through a careful assessment of multiple factors. The Spousal Support Advisory Guidelines (SSAG) provide a framework for calculating both amount and duration.

Key factors that influence support duration include:

- Length of marriage or cohabitation – longer relationships generally mean longer support periods

- Age and health of both former spouses

- Income disparity between the parties

- Recipient’s ability to become financially self-sufficient

- Child-rearing responsibilities and their impact on earning capacity

For short-term marriages (under 5 years), support may be temporary. For long-term marriages (20+ years), support might be indefinite, especially if the recipient is older or has limited employment prospects. Courts maintain the flexibility to adjust duration based on individual circumstances.

Spousal support in Ontario depends on relationship length, financial need, and multiple legal factors

Ontario courts determine spousal support entitlement by carefully evaluating several key factors established by the Divorce Act and Family Law Act. The assessment considers:

- Length of cohabitation or marriage – longer relationships typically warrant greater support

- Financial positions of both parties, including income and earning capacity

- Roles during the relationship, including childcare and career sacrifices

- The recipient’s financial need and ability to become self-sufficient

- The payor’s ability to pay and maintain a reasonable standard of living

- Any existing economic disadvantages resulting from the relationship breakdown

Courts may also consider additional circumstances like age, health, and future employment prospects when determining the amount and duration of support payments.

Spousal support in Ontario provides financial assistance between former spouses based on legal guidelines and individual circumstances.

In Ontario, spousal support is a legal obligation where one spouse provides financial support to the other following separation or divorce. The payment structure can be either monthly instalments or a one-time lump sum payment.

The courts consider several key factors when determining support:

- Length of marriage or cohabitation

- Income disparity between spouses

- Financial needs of the recipient

- Recipient’s ability to become self-sufficient

- Each spouse’s current financial situation

- Child care responsibilities

The Spousal Support Advisory Guidelines help calculate appropriate payment amounts, though judges maintain discretion to adjust these based on unique circumstances. Support arrangements can be modified if there are significant changes in either spouse’s financial situation.

Spousal support obligations in Canada can be limited or avoided through specific legal circumstances and agreements

While spousal support is a legal obligation in many Canadian divorces, there are several legitimate ways to potentially reduce or eliminate payment requirements:

- Sign a valid prenuptial agreement or marriage contract that addresses spousal support

- Demonstrate the recipient spouse is financially self-sufficient or has the capacity to become self-sufficient

- Prove the marriage was of very short duration with minimal financial integration

- Show evidence that the recipient spouse is in a new marriage or common-law relationship

- Document that both parties maintained financial independence throughout the marriage

It’s important to note that attempting to avoid spousal support by hiding income or assets is illegal in Canada. Any modification to support obligations must be done through proper legal channels with full financial disclosure. Consulting with a family law professional is essential to understand your specific rights and obligations under Canadian divorce law.

Ontario’s Spousal Support Advisory Guidelines calculate payment amounts based on income, marriage length, and family circumstances.

The Spousal Support Advisory Guidelines (SSAGs) in Ontario provide a structured framework to determine support payments between former spouses. While not legally binding, these guidelines help courts and separating couples establish fair and consistent support arrangements.

Key factors considered include:

- Length of marriage or cohabitation – longer relationships typically result in higher support amounts

- Income disparity between spouses – including current earnings and future earning potential

- Childcare responsibilities and their impact on earning capacity

- Standard of living established during the relationship

- Age and health of both parties

The guidelines use two main formulas: the with child support formula for couples with dependent children, and the without child support formula for those without dependent children. Support duration typically ranges from half to one times the length of the relationship, though permanent support may apply in long-term marriages.

Spousal support in Ontario is calculated using established guidelines based on income, relationship length, and financial need.

The Spousal Support Advisory Guidelines (SSAG) provide the framework for calculating support payments in Ontario. These calculations consider multiple factors:

- Income disparity between both parties

- Duration of marriage or cohabitation

- Financial needs of the recipient spouse

- Childcare responsibilities and career sacrifices made during the relationship

- Each spouse’s current and future earning capacity

- Age and health of both parties

Courts may adjust these calculations based on unique circumstances, including the recipient’s ability to become financially self-sufficient and any existing property settlements. The final amount aims to ensure fair financial transition while encouraging economic independence.

Child support obligations exist regardless of parents’ marital or relationship status

In Canada, the legal obligation to provide child support is based solely on being a biological or adoptive parent, not on the relationship between the parents. All parents have a legal duty to financially support their children, whether they were married, common-law partners, or never lived together.

The key factors that determine child support include:

- Biological or legal parent status – proven through birth registration, adoption, or DNA testing

- Income level – determines the amount of support according to federal guidelines

- Custody arrangement – affects how support payments are calculated

- Province or territory of residence – may impact specific rules and regulations

To establish child support, either parent can apply through their provincial court system or family justice services, regardless of their past or current relationship status.

Yes, remarriage of your ex-spouse does not affect your child support obligations in Canada

Child support is a legal obligation that continues regardless of either parent’s marital status. The financial responsibility for supporting your children remains with their biological or adoptive parents, not with any new spouse or partner. This is because child support is considered a fundamental right of the child under Canadian family law.

Several key factors remain unchanged when your ex remarries:

- Your child support payments must continue as ordered by the court

- The amount is still calculated based on the Federal Child Support Guidelines

- Only significant changes in income or the child’s circumstances can modify support amounts

- A new spouse’s income does not affect your support obligations

- Any existing support order remains legally binding

Failing to pay child support can result in serious legal and financial consequences in Canada

When you fail to meet child support obligations, the Family Responsibility Office (FRO) or provincial enforcement agency has significant legal authority to collect unpaid support payments. The consequences can escalate based on the duration and amount of missed payments.

Enforcement actions may include:

- Wage garnishment – up to 50% of your income can be automatically deducted

- Bank account seizure – funds can be taken directly from your accounts

- Property liens – legal claims placed against your home or other property

- Driver’s licence suspension – your driving privileges may be revoked

- Passport denial – restrictions on international travel

- Credit bureau reporting – negative impact on your credit score

- Legal penalties – including fines and possible jail time for willful non-payment

If you’re experiencing financial difficulties, it’s crucial to contact the court or enforcement agency immediately to discuss payment arrangements before these measures are implemented.

Child support in Canada is calculated using the Federal Child Support Guidelines based on income and number of children.

The Federal Child Support Guidelines provide standardized calculations for child support payments across Canada. The basic amount is determined by combining three key factors:

- The paying parent’s gross annual income

- The number of children requiring support

- The province or territory where the paying parent lives

Additional special expenses may be added to the basic amount, including:

- Childcare costs

- Medical and dental expenses not covered by insurance

- Post-secondary education expenses

- Extracurricular activities costs

Parents can use the Child Support Look-up Tables available through the Department of Justice Canada to determine the basic monthly payment amount. These tables are updated periodically to reflect economic changes.

Child support payments are not taxable income in Canada and do not need to be declared on tax returns

In Canada, child support payments are considered tax-neutral, which means they have no impact on your income tax return. The person paying child support cannot claim these payments as a tax deduction, and the recipient does not need to report them as income.

However, there are some important considerations:

- Child support payments made under agreements dated before May 1997 may have different tax implications

- You should keep detailed records of all payments made or received

- Support payments must be made according to a written agreement or court order

- The Canada Revenue Agency (CRA) may request documentation of your support arrangement

Yes, in certain circumstances you can be legally required to pay child support even if you are not the biological parent.

In Canada, child support obligations can extend beyond biological parents to include individuals who have acted as parental figures. The courts primarily consider the best interests of the child and recognize different types of parent-child relationships.

You may be required to pay child support if:

- You are listed as a parent on the birth certificate

- You have acted as a parent (in loco parentis) for an extended period

- You have demonstrated a settled intention to treat the child as your own

- You have legally adopted the child

- You were married to or lived with the child’s parent and treated the child as your own

If you believe you should not be responsible for child support, it’s crucial to seek legal counsel immediately. Challenging support obligations requires proper documentation and timely legal action through the appropriate provincial court system.

No, child support obligations cannot be waived or avoided through a prenuptial agreement in Canada

Under Canadian family law, child support is considered a fundamental right of the child, not the parents. A prenuptial agreement cannot override this legal obligation, as the courts prioritize the best interests of the child above any private contracts between parents.

Here’s why child support cannot be contracted away:

- Child support is a legal right belonging to the child, not the parents

- The Courts have final authority to determine child support amounts based on federal guidelines

- Any provisions attempting to waive child support in a prenup will be deemed void and unenforceable

- Child support calculations must follow the Federal Child Support Guidelines

- Parents cannot contract out of their legal obligation to financially support their children

Paying your child directly is not permitted under the RESP program rules

Educational Assistance Payments (EAPs) from a Registered Education Savings Plan must be paid directly to the beneficiary student, not to parents or contributors. These payments are specifically designed to help students cover their post-secondary education costs and must be processed through proper RESP channels.

The payment process works as follows:

- The RESP provider issues payments directly to the student

- Funds can only be released when proof of enrollment is provided

- The student must be attending a qualifying educational program

- Payments are considered taxable income for the student

This structure ensures proper tracking of educational funds and maintains the program’s tax advantages, as students typically have lower income levels and therefore pay less tax on these distributions.

Child support should be used to cover essential expenses that directly benefit the child’s wellbeing and development.

Child support payments are intended to help cover the basic living expenses and necessities required to raise a child. These funds should be allocated responsibly to ensure the child’s needs are met across all aspects of their life.

Common appropriate expenses include:

- Housing costs – rent/mortgage, utilities, and home maintenance

- Food and nutrition – groceries, school lunches, and healthy snacks

- Healthcare expenses – medical, dental, prescription medications, and health insurance

- Education needs – school supplies, tutoring, uniforms, and educational activities

- Clothing and personal care – seasonal wardrobes, shoes, and hygiene items

- Transportation costs – car expenses, public transit, or school transportation

- Extracurricular activities – sports, music lessons, clubs, and recreational programs

- Childcare expenses – daycare, after-school care, or babysitting services

While the receiving parent has discretion in how to allocate these funds, they should maintain records of child-related expenses and ensure the money is used responsibly for the child’s benefit.

Sports and recreational activities are typically considered special or extraordinary expenses separate from basic child support

While basic child support covers everyday necessities, extracurricular activities like sports usually fall under section 7 expenses in Canadian family law. These additional costs are generally shared between parents proportionally based on their incomes.

Common sports-related expenses that parents may share include:

- Registration fees for sports leagues and teams

- Equipment and uniforms

- Training camps and clinics

- Travel expenses for tournaments

- Private coaching or lessons

Parents must typically agree on these expenses beforehand, and the activities should be reasonable considering the family’s financial circumstances and the child’s needs and interests. If parents cannot agree, they may need to seek guidance from the court to determine if the expense is necessary and reasonable.

Self-employed income is calculated by subtracting business expenses from gross revenue to determine net profit

Self-employed income calculation involves determining your total business earnings after accounting for all allowable expenses and deductions. As a self-employed individual in Canada, you must report your net business income to the Canada Revenue Agency (CRA).

The basic formula includes:

- Calculate your gross revenue (all income from sales, services, and other business activities)

- Subtract eligible business expenses such as:

- Office supplies and equipment

- Vehicle and travel expenses

- Marketing and advertising costs

- Home office expenses

- Professional fees and insurance

- Account for GST/HST collected and paid if your business is registered

- Include any additional business-related income like grants or subsidies

Keep detailed records of all transactions throughout the year to ensure accurate reporting and maximize legitimate deductions on your tax return.

Register with FRO by submitting your court order and completed registration package

To register with the Family Responsibility Office (FRO) in Ontario for child support enforcement, you’ll need to complete a specific registration process. The FRO enforces court-ordered support payments and helps ensure children receive the financial support they’re entitled to.

Here are the steps to register:

- Obtain a valid court order or domestic contract that includes support payments

- Complete the FRO registration package, including:

- Support Deduction Order Information Form

- Payer Information Form

- Recipient Information Form

- Submit your documents to FRO through:

- Online portal (recommended)

- Mail or fax

- Keep copies of all documents for your records

Once registered, FRO will begin monitoring and enforcing support payments automatically. Remember to notify FRO of any changes to your contact information, employment status, or court order modifications.

The Family Responsibility Office (FRO) enforces court-ordered child and spousal support payments in Ontario

The Family Responsibility Office acts as an intermediary between support payors and recipients to ensure court-ordered financial obligations are met. This Ontario government agency monitors and processes support payments while enforcing compliance through various legal mechanisms.

The FRO’s key functions include:

- Collecting and distributing support payments from payors to recipients

- Tracking payment records and maintaining accurate account information

- Enforcing payment through methods like wage garnishment, bank account seizures, or driver’s license suspension

- Working with other jurisdictions to enforce support orders across Canada and internationally

- Providing online account access for both payors and recipients

- Mediating disputes and addressing payment-related concerns

When support is ordered by the court, the case is automatically registered with the FRO, which then becomes responsible for ensuring the regular transfer of payments between parties.

Failing to pay child support in Ontario can result in serious legal and financial penalties, including wage garnishment, property seizure, and license suspension.

The Family Responsibility Office (FRO) in Ontario has significant enforcement powers to collect unpaid child support. When payments are missed, the FRO can take several actions:

- Garnish up to 50% of the payor’s wages or salary

- Intercept federal payments, including tax refunds and GST credits

- Place liens on personal property and real estate

- Suspend the payor’s driver’s license, passport, and other federal licenses

- Report the payor to credit bureaus, affecting their credit rating

- Seize bank accounts or other financial assets

In severe cases of non-payment, the courts may find the payor in contempt of court, which can result in fines or imprisonment. Additionally, unpaid child support continues to accumulate interest and cannot be eliminated through bankruptcy. The FRO can also publish the payor’s name and photo online as part of their enforcement efforts.

Child support payments can be modified when significant changes in circumstances occur

Child support orders in Canada can be adjusted when there are substantial changes in either parent’s financial situation or the child’s needs. These modifications ensure that support payments remain fair and appropriate over time.

Common reasons for child support modifications include:

- Income changes – significant increase or decrease in either parent’s earnings

- Employment status – job loss, disability, or career changes

- Child’s needs – changes in education, healthcare, or special requirements

- Living arrangements – shifts in custody or parenting time

- New family obligations – additional dependents or remarriage

To modify child support, parents must file an application with the court and provide documentation supporting the requested change. Both parties typically need to disclose current financial information for the court to determine if a modification is warranted.

Bankruptcy does not eliminate child support obligations or arrears in Canada

Child support payments are considered non-dischargeable debts that remain fully enforceable even after declaring bankruptcy. The Canadian Bankruptcy and Insolvency Act specifically protects support obligations to ensure children’s wellbeing remains a top priority.

During bankruptcy proceedings:

- All current child support payments must continue without interruption

- Any outstanding child support arrears remain payable in full

- Support enforcement agencies maintain their right to collect payments

- The court may garnish wages or seize assets to ensure payment compliance

- Child support obligations take priority over most other creditors

Parents receiving support can continue enforcement actions even while the paying parent goes through bankruptcy proceedings. The family support obligation survives the bankruptcy discharge and remains a legal responsibility.

Child support is a legal obligation separate from access or visitation rights

Under Canadian family law, child support payments and parenting time are treated as two distinct legal matters. Child support is a fundamental right of the child that ensures their basic needs are met, regardless of the relationship between parents or access arrangements.

The legal framework is based on these key principles:

- Children have the right to financial support from both parents

- Support obligations exist independently of custody or access rights

- The child’s best interests remain the primary consideration

- Payment disputes cannot be used to deny visitation rights

If you’re being denied access to your child, the appropriate response is to seek legal remedies through the court system to enforce your parenting time rights, while continuing to meet your support obligations. Withholding child support payments can result in serious legal consequences, including wage garnishment or licence suspension.

External links that may interest you

- My Support Calculator – Canada’s only accurate Child and Spousal support calculator available to the public.

- [2024] Spousal Support Calculator – Free calculator for spousal and child support based on Canadian guidelines.

- Canada Spousal Support Calculator [2024] – Free spousal support calculator for any Canadian province, including tax considerations.

- 2017 Child Support Table Look-up – Based on updated Federal Child Support Tables effective November 22, 2017.

- Spousal Support Calculator – Divorcepath Canada – Trusted by family lawyers, instant and free spousal support calculations.

- Spousal Support Calculator | Alberta Alimony Calculator – Accurate estimates of spousal support for divorce settlements in Alberta.

- Spousal support – Simple online calculator considering employment income for basic calculations.

- Child Support Calculator | Canada Child Support Guidelines – Calculate child support payments as part of a separation agreement.

- Child Support Payments Calculation tool – Free, interactive tool for quick child support payment calculations.

- British Columbia Child and Spousal Support Calculator – Free and accurate support calculator for BC, Canada.

- Child and family benefits calculator – Calculate child and family benefits including the Canada child benefit.

- Links and Resources – Free online support calculator with additional resources and information.

- Ontario – Child Support Calculator – Useful for parents at the commencement of a family court action in Ontario.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.