Divorce Financial Specialist Case Study – The Jones Family

Separation and Divorce does not have to be devastating

It’s common knowledge today that the costs of separation and divorce can be devastating. And that’s if the two parties remain amicable throughout the process. Consider the benefits of working with someone who specializes in divorce settlement agreements. A Divorce Financial Specialist aka Certified Divorce Financial Analyst® (CDFA) can improve your chances of a positive outcome. A Divorce Financial Specialist will work through the financial requirements of both parties. I will also lay the necessary framework needed to adjust to life after the divorce.

Often, what’s missing in divorce settlements is sound, impartial, financial expertise. As a Divorce Financial Specialist aka CDFA I can forecast and explain the short and long-term effects of divorce settlement proposals.

Here’s an example of how a divorce settlement expert like a CDFA® can help plan your financial future before, during, and after divorce.

SAMPLE CASE STUDY

A couple in their early 30s, married for six years, is going through a separation and divorce. Both parties have legal counsel. They’ve also sought the help of a Divorce Financial Specialist. They’re really hoping to avoid a lengthy and protracted negotiation.

The couple has two children. The eldest child is five, and the youngest is one. Dad earns approximately $80,000 per year. Mom will earn $36,000 per year once she finishes her degree in three years. As for the children, their primary residence will be with their mother. Based on dad’s income, support payments for the two children will be $1,245 per month. This will go down to $774 monthly once the eldest child reaches the age of majority. The mother’s expenses for herself and the two children, if she remains in the matrimonial home, are $4,995 per month. This includes her tuition expenses.

The couple owns a home with $90,000 of equity. The balance of the mortgage is $130,000. The couple also owns a rental property with $33,700 in equity and the balance of the lease is $100,000. The man runs a small business with a tax-adjusted value of $201,000. The tax-adjusted value of the woman’s RRSP is $14,450. The credit card debt owing totals $22,600.

The potential settlement suggested by the husband and his lawyer

The mother and the children will continue to live in the matrimonial home. The title to the house will transfer to her. After selling the rental property, the mother will keep the net proceeds. She’ll also continue her RRSP and manage the credit card debt, which she’ll pay down monthly. He retains his business and pays $2000/month for the first year. He then pays $1,500/month for two additional years while she finishes her degree. To pay the balance of the equalization payment owing to the mother for $44,725, the father will get a line of credit.

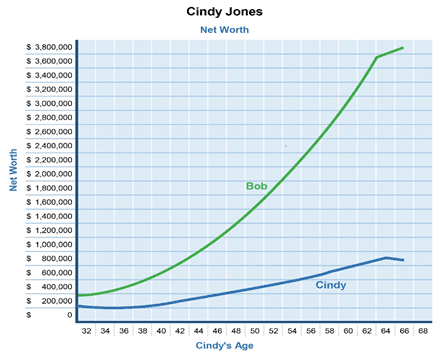

Net Worth Analysis

Net Worth Analysis Notes: Based on the father’s proposed settlement, this is the projected long-term financial future of both parties.

The green line represents the father, and the blue line represents the mother.

My Notes

Although the husband is doing much better than the wife, her future doesn’t look all that bad. Now let’s look at her working capital to see whether her situation is as promising as it appears.

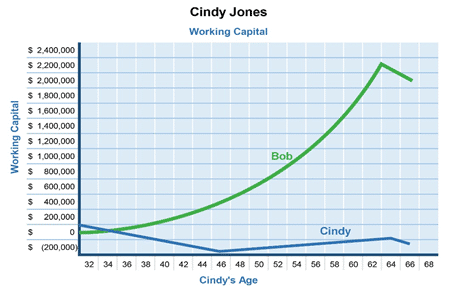

Working Capital Analysis

Working Capital Analysis Notes: Her case seems to be worse than illustrated in the net worth graph. She starts with a negative cash flow of $19,504 in the first year because her expenses exceed her income. The mother begins with the working capital amount of $76,425. By the third year, it will be down to $2,485 to cover her costs. Once the working capital is gone, she must withdraw from her retirement accounts. By age 36, her total spendable assets will be exhausted.

My Revised Settlement Proposal

Now let’s look at the revisions to the proposal made by the mother’s lawyer with the help of a CDFA® professional.

After the sale of the matrimonial home, the mother will retain the sale proceeds. The mother and the children will move to the rental property, and she’ll keep her RRSP. The father pays $2,000/month in spousal support for three years, indexed on an annual basis. He’ll keep his business and the credit card debt, which he’ll pay down monthly. The mother will need to live in the rental property due to her income to liability ratio. The sale of the matrimonial home frees up working capital. By assuming the credit card debt, the equalization payment owing to the woman is reduced. The mother and her legal team propose that the amount due be paid to her in annual installments. This gets rid of the need for the man to secure a line of credit and pay additional interest.

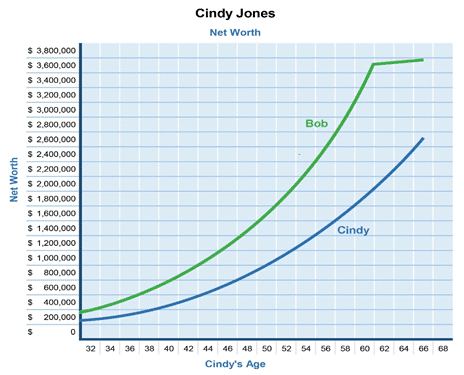

Revised Net Worth Analysis

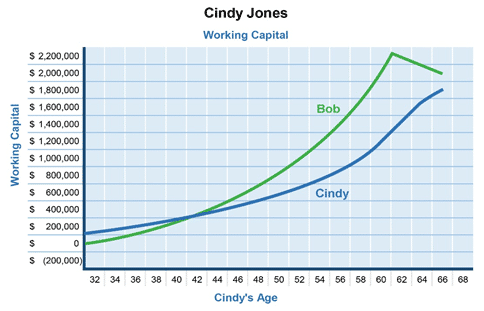

Revised Net Worth Analysis: A few changes in distributing assets can create a much more equitable financial future for both. His net worth has not been affected, but hers has increased significantly. Now let’s look closely at the working capital.

Working Capital Analysis: His working capital has changed little from the initial proposal. Her wealth has increased substantially. By selling off the matrimonial home and moving into a rental, the mother reduces her expenses to $30,050 per year. She’s also reduced her mortgage payments. Also, there’s an increase in working capital from the increase in spousal support and the proceeds from the house. And she doesn’t need to withdraw from her retirement accounts to cover her expenses, so they’ll grow to more than $230,000 by the time she retires. This creates financial independence for both parties into the future.

Conclusion

Divorce law in Ontario favours equalization above all else. While that gets everything off to a good start, your ability to secure a neat divorce depends on your ability to work things out in the various agreements you must sign before, during, and after your marriage ends.

Are you having trouble reaching an agreement on your finances? Do you want to avoid going before the judge and asking for help? Consider working with a family mediator who can help you end your marriage in a way that is peaceful, cost-effective, and child-focused.

Would you like to learn more? Get in touch for a Get Acquainted Call to learn more about finding a separation agreement with a soft landing.

Articles that may interest You!

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.