Simplify Your Divorce with DTSW’s Support Payments Solution

Support Payments in Ontario

Support payments in Ontario are an essential aspect of family law that aims to support needy individuals financially. Understanding the basics of support payments is crucial for both payors and recipients in navigating this complex legal landscape.

Understanding the Basics of Support Payments in Ontario

In Ontario, support payments refer to financial assistance provided by one party to another to fulfill the needs of the recipient. These payments are typically made by one former spouse or parent to the other to ensure that the recipient can maintain a reasonable standard of living.

The primary types of support payments recognized in Ontario are child support and spousal support. Child support is intended to assist with the costs associated with raising a child. In contrast, spousal support addresses the economic disadvantages one spouse faces due to the end of a relationship.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

Types of Support Payments Recognized in Ontario

Child support payments in Ontario are determined based on the paying parent’s income and the number of children involved. The province has established child support guidelines to provide a framework for calculating the appropriate amount of support. These guidelines consider factors such as the income of both parents, the custody arrangement, and any special needs of the child.

Spousal support is more relaxed by set guidelines. The amount and duration of spousal support payments in Ontario can vary depending on factors such as the length of the marriage, the financial circumstances of each spouse, and the roles each spouse played during the marriage. The Spousal Support Advisory Guidelines offer further guidance in assessing the amount and duration of spousal support.

Factors Influencing Support Payments in Ontario

Several factors influence the calculation of support payments in Ontario:

- Child Support:

- The income of the paying parent

- Number of children

- Custody arrangements

- Special needs or extraordinary expenses related to the child

- The standard of living the child would have enjoyed if the parents had stayed together

- Spousal Support:

- Duration of the marriage

- Roles played during the relationship

- Age and health of the parties

- Potential for self-sufficiency

- Financial consequences of caregiving responsibilities during the marriage

Legal Obligations and Rights Regarding Support Payments

Support payments in Ontario are legally enforceable obligations. The Family Responsibility Office (FRO) plays a crucial role in this, monitoring and enforcing support orders. This means that if a payor fails to comply with support payments, the FRO can take actions such as wage garnishment, driver’s license suspension, or even imprisonment.

Both payors and recipients have rights and responsibilities regarding support payments. Payors have the right to request a review of support if their income or circumstances change significantly. Recipients have the right to receive support promptly and without interference.

When a support order is issued, both parties must fully understand the terms and conditions outlined in the order. This document specifies the amount of support to be paid, the frequency of payments, and any additional requirements, such as providing proof of income. Payors should keep detailed records of all payments made, including the date and method of payment, to avoid disputes or misunderstandings.

Recipients must use the support payments to provide for the needs of the supported individual. It is advisable for recipients to keep track of all expenses related to the supported individual, as they may be required to provide an account of how the support funds are being utilized.

Tax Implications of Support Payments in Ontario

Support payments in Ontario have specific tax implications for both payors and recipients:

- Child Support:

- Not taxable for the recipient

- Not deductible for the payor

- Spousal Support:

- Taxable for the recipient

- Tax-deductible for the payor

The Canada Revenue Agency (CRA) has specific guidelines to determine what qualifies as child support versus other types of payments. Payments designated as child support in a legal agreement or court order are generally not taxable income for the recipient. Misreporting these payments can lead to potential tax issues.

Spousal support payments must meet the criteria the CRA sets to qualify for tax deductibility. It is essential to seek professional tax advice to ensure compliance with Canadian tax laws and optimize the tax consequences of support payments.

Resources and Support Services Available

Several resources and support services are available in Ontario to assist individuals in navigating support payments:

- Family Law Lawyers and Legal Aid Clinics: Offer guidance and support.

- Family Responsibility Office (FRO): Provides enforcement of support orders, payment collection, and support calculation assistance.

- Support Groups and Counseling Services: Provide emotional support and advice.

- Financial Advisors and Accountants: Offer assistance with budgeting, financial planning, and tax implications related to support payments.

How to Apply for Support Payments in Ontario

Applying for support payments in Ontario is a significant step that requires a thorough understanding of the legal processes involved. This understanding, especially in complex situations or disputes, can empower you to make informed decisions. It is advisable to seek legal advice to ensure you are fully prepared for the process.

- Steps to Apply:

- Apply for support with the court or negotiate an agreement outside of court.

- If an agreement cannot be reached, a court may determine the appropriate support order after considering relevant factors and circumstances.

Once the support order is established, your responsibility doesn’t end there. Timely payments and compliance with all legal obligations are essential. Ongoing communication with the other party and adherence to any updates or changes to the support order are crucial. This proactive approach can help maintain a healthy support system.

By understanding the basics, types, factors, and legal obligations surrounding support payments, you can navigate the complexities of support payments in Ontario more effectively. This understanding can provide you with a sense of reassurance and confidence in managing your support payments.

11 Key Takeaways about Support Payments

- Child Support Basics: Child support is essential for covering the costs associated with raising a child post-divorce.

- Spousal Support: Addresses economic disadvantages faced by one spouse after separation.

- Guidelines: Ontario uses specific guidelines to calculate child and spousal support, ensuring fairness.

- Income Considerations: The paying parent’s income significantly impacts the support amount.

- Custody Impact: Custody arrangements affect child support calculations.

- Special Needs: Special needs or extraordinary expenses of the child are considered in support calculations.

- Legal Enforcement: The Family Responsibility Office enforces support orders to ensure compliance.

- Tax Implications: Child support is not taxable or deductible, while spousal support is taxable for the recipient and deductible for the payor.

- Application Process: Support can be applied through court orders or mutual agreements.

- Factors for Spousal Support: Includes marriage duration, roles during marriage, and financial circumstances.

- Resources Available: Legal aid, family responsibility office, and financial advisors provide support and guidance.

Table of Contents

- Simplify Your Divorce with DTSW’s Support Payments Solution

- Support Payments in Ontario

- Understanding the Basics of Support Payments in Ontario

- Types of Support Payments Recognized in Ontario

- Factors Influencing Support Payments in Ontario

- Legal Obligations and Rights Regarding Support Payments

- Tax Implications of Support Payments in Ontario

- Resources and Support Services Available

- How to Apply for Support Payments in Ontario

- 11 Key Takeaways about Support Payments

- At DTSW

- Get Acquainted Call

At DTSW

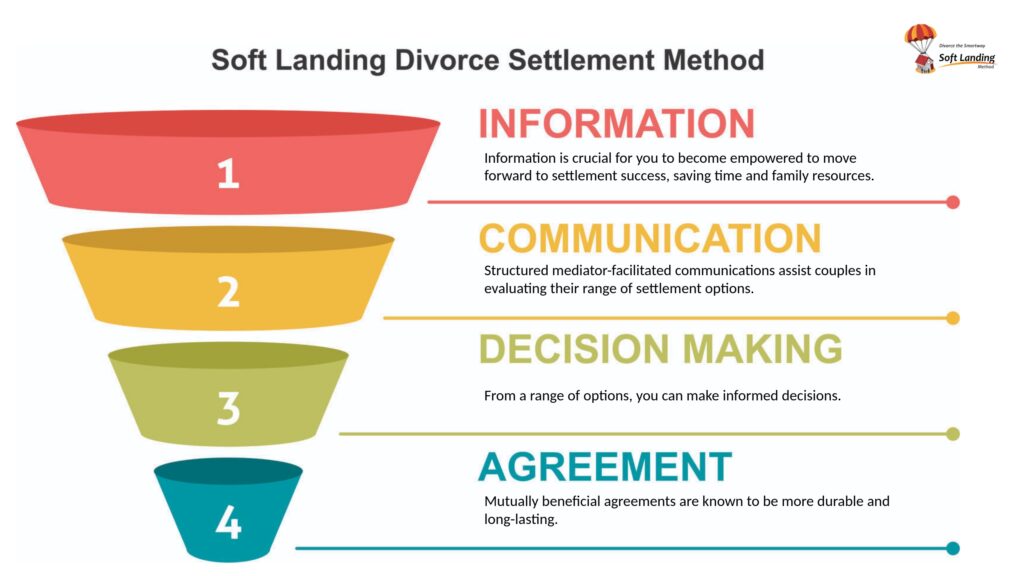

We understand that navigating support payments can be overwhelming. Whether you’re dealing with a court order, written agreement, or looking to establish child support, our Soft Landing Divorce Settlement Method is here to help. Our team of Family Mediators and Accredited Divorce Financial Analysts work diligently to create personalized solutions that consider all aspects, from payment history to tax rules.

You didn’t come to this webpage by chance. You’re seeking clarity and a path forward. We encourage you to reach out and take the first step towards a smoother transition. We offer various payment options, including direct deposit and state disbursement units, to ensure you receive the support you need efficiently. Our approach considers special circumstances like child custody and extraordinary expenses, ensuring that all guidelines are met to calculate child support fairly.

Don’t face this alone. Schedule a Get Acquainted Call with us to explore how we can assist you in making payments and securing your family’s future. We’re here to provide the support and information you need to make informed decisions.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.