Expert Guide to Spousal Support Calculator Formulas

Calculating Spousal Support in Ontario

More About Spousal Support in Ontario

Spousal support eligibility applies to married couples under federal law and common-law partners under provincial legislation

In Canada, spousal support is available through two main legal frameworks. The federal Divorce Act governs support arrangements for legally married couples who are separating or divorcing. Each province and territory also has specific legislation that addresses support rights for both married and common-law partners.

Individuals may qualify for spousal support if they meet the following criteria:

- Legally married spouses going through separation or divorce

- Common-law partners who have lived together for the required period (varies by province)

- Partners who can demonstrate financial dependency during the relationship

- Those who have experienced economic disadvantage due to the relationship or its breakdown

The amount and duration of support payments depend on factors like income disparity, length of relationship, and each partner’s ability to become financially self-sufficient.

You can apply for spousal support at any time, with no strict legal deadline in Canada

Under the Limitations Act, there is no fixed time limit for filing a spousal support application in Canada. However, it’s advisable to apply as soon as possible after separation because courts consider the timing of your application when assessing your genuine need for support.

Important factors that influence spousal support applications:

- Timing of application – earlier applications generally demonstrate more immediate need

- Financial circumstances – current income and ability to become self-sufficient

- Length of marriage/relationship – affects duration and amount of support

- Demonstrated need – must show legitimate requirement for financial assistance

Spousal support in Ontario can be denied based on legal agreements, remarriage, or financial independence.

In Ontario, courts may deny or terminate spousal support payments under specific circumstances that affect the recipient’s eligibility. Understanding these conditions is crucial for both parties involved in separation or divorce proceedings.

- Existence of a valid domestic contract or cohabitation agreement that specifically addresses spousal support arrangements

- The recipient spouse enters into a new marriage or common-law relationship

- Achievement of financial self-sufficiency by the recipient spouse through employment or other means

- Failure to demonstrate financial need or entitlement based on the relationship’s circumstances

- Evidence that the recipient has unreasonably refused to become financially independent when capable

Spousal support indexing automatically adjusts payment amounts based on cost-of-living changes to maintain purchasing power.

Spousal support indexing is a legal mechanism that helps protect the value of support payments against inflation. This adjustment process typically uses the Consumer Price Index (CPI) as a benchmark to ensure payments maintain their real-world value over time.

- Adjustments usually occur annually based on CPI changes

- Helps recipient maintain consistent standard of living

- Prevents need for frequent court applications to modify support

- Can be included in separation agreements and court orders

Most Canadian courts allow for indexing provisions in support orders, making it an important consideration in divorce settlements and support arrangements.

Spousal support duration in Ontario depends on marriage length, with payments typically lasting 0.5 to 1 year for each year of marriage

The length of spousal support obligations in Ontario is determined through a careful assessment of multiple factors. The Spousal Support Advisory Guidelines (SSAG) provide a framework for calculating both amount and duration.

Key factors that influence support duration include:

- Length of marriage or cohabitation – longer relationships generally mean longer support periods

- Age and health of both former spouses

- Income disparity between the parties

- Recipient’s ability to become financially self-sufficient

- Child-rearing responsibilities and their impact on earning capacity

For short-term marriages (under 5 years), support may be temporary. For long-term marriages (20+ years), support might be indefinite, especially if the recipient is older or has limited employment prospects. Courts maintain the flexibility to adjust duration based on individual circumstances.

Spousal support in Ontario depends on relationship length, financial need, and multiple legal factors

Ontario courts determine spousal support entitlement by carefully evaluating several key factors established by the Divorce Act and Family Law Act. The assessment considers:

- Length of cohabitation or marriage – longer relationships typically warrant greater support

- Financial positions of both parties, including income and earning capacity

- Roles during the relationship, including childcare and career sacrifices

- The recipient’s financial need and ability to become self-sufficient

- The payor’s ability to pay and maintain a reasonable standard of living

- Any existing economic disadvantages resulting from the relationship breakdown

Courts may also consider additional circumstances like age, health, and future employment prospects when determining the amount and duration of support payments.

Spousal support in Ontario provides financial assistance between former spouses based on legal guidelines and individual circumstances.

In Ontario, spousal support is a legal obligation where one spouse provides financial support to the other following separation or divorce. The payment structure can be either monthly instalments or a one-time lump sum payment.

The courts consider several key factors when determining support:

- Length of marriage or cohabitation

- Income disparity between spouses

- Financial needs of the recipient

- Recipient’s ability to become self-sufficient

- Each spouse’s current financial situation

- Child care responsibilities

The Spousal Support Advisory Guidelines help calculate appropriate payment amounts, though judges maintain discretion to adjust these based on unique circumstances. Support arrangements can be modified if there are significant changes in either spouse’s financial situation.

Spousal support obligations in Canada can be limited or avoided through specific legal circumstances and agreements

While spousal support is a legal obligation in many Canadian divorces, there are several legitimate ways to potentially reduce or eliminate payment requirements:

- Sign a valid prenuptial agreement or marriage contract that addresses spousal support

- Demonstrate the recipient spouse is financially self-sufficient or has the capacity to become self-sufficient

- Prove the marriage was of very short duration with minimal financial integration

- Show evidence that the recipient spouse is in a new marriage or common-law relationship

- Document that both parties maintained financial independence throughout the marriage

It’s important to note that attempting to avoid spousal support by hiding income or assets is illegal in Canada. Any modification to support obligations must be done through proper legal channels with full financial disclosure. Consulting with a family law professional is essential to understand your specific rights and obligations under Canadian divorce law.

Ontario’s Spousal Support Advisory Guidelines calculate payment amounts based on income, marriage length, and family circumstances.

The Spousal Support Advisory Guidelines (SSAGs) in Ontario provide a structured framework to determine support payments between former spouses. While not legally binding, these guidelines help courts and separating couples establish fair and consistent support arrangements.

Key factors considered include:

- Length of marriage or cohabitation – longer relationships typically result in higher support amounts

- Income disparity between spouses – including current earnings and future earning potential

- Childcare responsibilities and their impact on earning capacity

- Standard of living established during the relationship

- Age and health of both parties

The guidelines use two main formulas: the with child support formula for couples with dependent children, and the without child support formula for those without dependent children. Support duration typically ranges from half to one times the length of the relationship, though permanent support may apply in long-term marriages.

Spousal support in Ontario is calculated using established guidelines based on income, relationship length, and financial need.

The Spousal Support Advisory Guidelines (SSAG) provide the framework for calculating support payments in Ontario. These calculations consider multiple factors:

- Income disparity between both parties

- Duration of marriage or cohabitation

- Financial needs of the recipient spouse

- Childcare responsibilities and career sacrifices made during the relationship

- Each spouse’s current and future earning capacity

- Age and health of both parties

Courts may adjust these calculations based on unique circumstances, including the recipient’s ability to become financially self-sufficient and any existing property settlements. The final amount aims to ensure fair financial transition while encouraging economic independence.

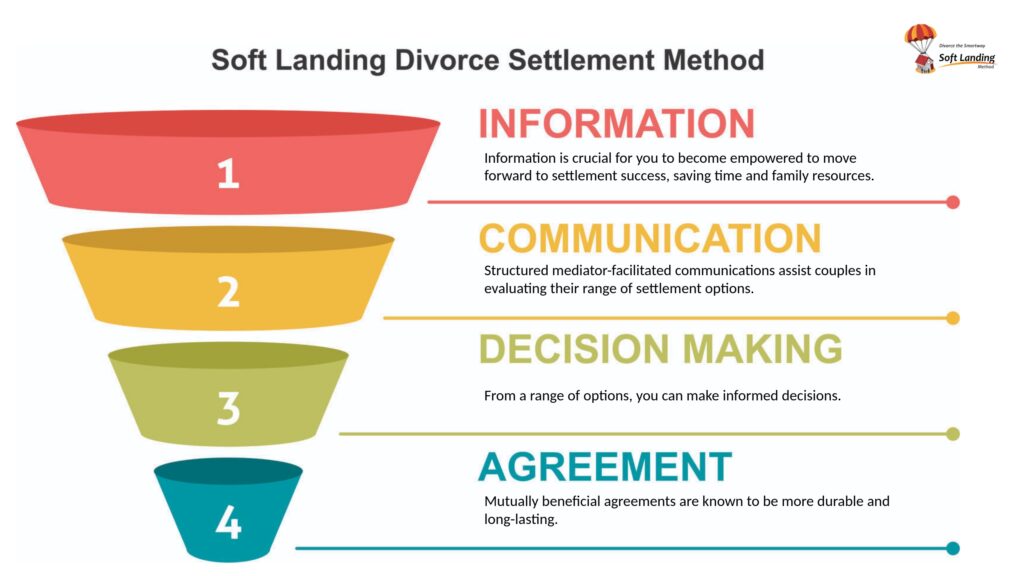

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.