The Matrimonial Home: Spousal Buyout or Sell, or Keep

Buy out your spouse, Sell or Keep

The matrimonial home may be a property that is owned outright by either or both spouses, or it could be a rental apartment.

Ownership of the home is regarded as joint. It would not matter that they did not contribute equal shares to the purchase of the home.

All that matters is that the purchase was a joint effort.

If joint, both spouses are still entitled to share the value of the property.

Regardless of who actually or legally owns the home, both spouses have an equal right to live in it.

The concept of the matrimonial home does not apply to partners in a common-law relationship.

The matrimonial home is given special treatment, and you cannot deduct the pre-marriage property value as you would with other assets.

In every union, the matrimonial home holds significant importance to both parties, acting as an emotional and financial anchor. Apart from being a sanctuary filled with cherished memories tied to both individuals, it often represents a substantial financial investment in the marriage. This valuable asset is likely to encompass thousands of dollars in contributions from either or both individuals, rendering it more than just a physical structure but a symbol of their joined lives.

Just as vital in the separation process, as it is during the marriage, the matrimonial home becomes a cornerstone in numerous issues that require resolution. This includes living arrangements for the involved parties and their children and concerns surrounding the equalization payment. As one might anticipate, these matters may ignite contentious disputes, potentially leading to a prolonged and acrimonious divorce.

Given the profound role of the matrimonial home in the lives of the involved parties, it’s essential to comprehend how Ontario family law interprets the matrimonial home’s value and what it could signify for you and your family’s future.

What is the matrimonial home?

The matrimonial home refers to the primary residence occupied by both individuals post-marriage and at the time of separation. It may be a property entirely owned by one party or jointly owned, or it could even be a rental apartment. The key aspect is that it’s the regular living space for both parties and their children if they have any.

Section 18 of the Ontario Family Law Act views the matrimonial home as encompassing both the structure and the property it resides on. However, this definition strictly applies where the property is owned by the spouses. In cases where the property serves non-residential purposes, this interpretation doesn’t hold.

While the common presumption might be that the matrimonial home is solely the primary residence where the family resides, the actual definition is more encompassing. Secondary residences often fall under the umbrella of the matrimonial home, which means vacation chalets, rental properties owned by the couple, or even yachts could qualify. Consequently, a family might have more than one matrimonial home.

Given the broad interpretation of what constitutes a matrimonial home and its legal implications, the stakes can be high when defining it. This is why both the definition and application are often hotly debated. We’ll delve deeper into this in the following sections.

Dual Matrimonial Homes: Cottage and City Residence

The concept of a matrimonial home is crucial in family law, especially when considering properties like the family cottage alongside the primary family residence. When married spouses, particularly in Ontario, face property division, the designation of a matrimonial home or home comes into play.

This is where terms like “second matrimonial home” and specific legal distinctions under the Ontario Family Law Act become pertinent.

The second matrimonial home

“Is the cottage a matrimonial home?” This question arises frequently. The answer is affirmative: a cottage and a city residence can be acknowledged as matrimonial homes concurrently. This dual recognition is vital, mainly when both properties are in Ontario and are regularly utilized by the parties involved.

If a cottage is deemed a marital home, it stands apart from other types of family property. Consequently, both parties are mandated to divide their value equally, illustrating the unique stance of matrimonial homes within property division.

Legal Implications and Advice

To navigate these matters adeptly, it is essential to consult an experienced family law lawyer or a divorce lawyer. These professionals can guide the drafting of a marriage contract or a prenuptial agreement that explicitly addresses potential concerns with cottage properties or other real estate assets. Legal advice is paramount to managing peculiar assets and ensuring fair property division upon divorce.

Understanding the role of marital homes—whether a primary residence or a vacation property like a cottage—is essential. These properties receive special treatment under family law, emphasizing the need for informed legal counsel and clear separation agreements.

In Ontario, the designation of a second matrimonial home, especially when it involves properties like cottages, requires meticulous legal consideration. The Ontario Family Law Act provides specific guidelines on this, underlining the importance of legal expertise from seasoned family law professionals.

How is family residence ownership treated?

The landscape of matrimonial homeownership is quite diverse and generally varies depending on whether the home is outright owned or rented by the couple. If the residence is owned by the couple, it could be under individual or joint ownership.

There could also be instances where both parties contributed to the property purchase, but only one individual’s name is on the deed. Similarly, there might be cases where neither party’s name is listed on the deed, such as when the home was gifted by parents or friends.

In the case of rented homes, both parties or just one may have their name on the lease. Thus, matrimonial homeownership can take on various forms.

However, it’s crucial to note that the mode of ownership doesn’t significantly impact the proceedings in family law. The fact that only one spouse’s name is on the deed or lease doesn’t preclude the property from being regarded as a matrimonial home. As will be discussed later, the question of who owns the house doesn’t really influence a spouse’s interest or rights to the spouse’s half of the home’s net proceeds.

Rights of spouses to the matrimonial home

In a marriage, spouses have numerous well-established rights concerning the matrimonial home, a large portion of which are covered by the Ontario Family Law Act. The law safeguards the rights of both parties to the use and enjoyment of the matrimonial home in multiple ways.

Foremost, both parties are entitled to a non-negotiable “right to possess” the matrimonial home. This suggests that irrespective of who legally owns the home, both individuals hold an equal right to reside within it. This right extends to “exclusive possession,” which may lead to one spouse being required to vacate the property during a specific timeframe or throughout the separation process.

The exclusive right to occupy the matrimonial home might be granted to one party due to a court order or under a domestic contract. This may occur when the court orders one spouse to vacate the home due to domestic violence or when the court allows one spouse to stay in the home temporarily or permanently. A similar situation could arise if a separation agreement specifies who will move out post-separation.

However, any domestic contract between the spouses cannot influence these possession rights related to the matrimonial home. Agreements regarding these rights can only be implemented at the time of separation, not when the marriage initially took place.

Another key right related to the matrimonial home is the veto power against selling, mortgaging, or borrowing against the home without mutual consent. In essence, one party can stop the other from engaging in these actions concerning the matrimonial home, even if they didn’t contribute to its purchase or have their name on the deed.

If either party wishes to sell the matrimonial home, they must obtain the written or express consent of the other spouse. If this is not given, the aggrieved spouse can request the court to halt the sale.

Both spouses also have an equal right to share in the value of the matrimonial home. This is crucial because, for other marital assets, the general rule is that spouses only share in the increase in the asset’s value. In contrast, when it comes to the matrimonial home, there’s a right to share in the total value of the property for equalization purposes.

Lastly, if the ownership is joint, both spouses have a right to jointly benefit from the property’s value, meaning they each have the right to an equal share of the property. This differs from sharing the value of the property for equalization purposes.

The spouses’ rights to the matrimonial home, however, are not infinite. These rights cease when the matrimonial home is sold or when the lease concludes. The right to possess the matrimonial home also concludes post-divorce, especially if one spouse’s name isn’t on the property title. That spouse can only retain rights over the home if a separation agreement or court order allows it.

What if you are in a common law relationship?

The concept of a matrimonial home does not extend to common-law relationships. Only legally married couples enjoy special rights related to the use and enjoyment of the matrimonial home, leaving partners in a common-law relationship without these protections.

The treatment of homeownership in a common-law relationship depends on whether the property is jointly owned or belongs to just one partner. If the property is jointly owned, both partners have equal rights to reside in the home, and each can prevent the other from selling or mortgaging the property.

However, these rights could change if a court orders one partner to vacate the property or if both parties agree to sell the home. Alternatively, one partner may propose a spousal buyout to acquire the other’s share in the property. If the partners cannot agree on whether to sell the home or how to deal with it, they can request the court to facilitate the property’s sale.

On the other hand, if only one partner owns the home, the other partner could be compelled to leave at any time. They could be locked out, or the property could be sold or mortgaged without their knowledge or consent. In this situation, there is no inherent right to possess the home. However, some exceptions may apply, such as if there’s an agreement allowing the non-owner partner to remain in the property or if a court issues an order to that effect. Furthermore, the non-owner partner might argue for an ownership stake in the house based on claims of unjust enrichment or perceived unfairness.

How to buy out your common law spouse

As part of a common-law couple, if you jointly own a property or have both been contributing to the payments, you may need to execute a spousal buyout of your partner’s share. However, if the property is solely in your name and you’ve been independently covering the costs, you might not need to buy out your partner.

To initiate a spousal buyout, it’s essential first to ascertain the value of your partner’s contribution to the property. Once you’ve determined the total value of the home, consider the amount your partner has invested and calculate the corresponding percentage of the home’s current value that represents.

As you calculate your partner’s contribution percentage, consider the property’s equity. For instance, if your home’s estimated value is $1,000,000, but you owe $400,000 in the existing mortgage, the net equity equals $600,000. Your partner’s share would be a percentage of this net equity.

While your desire to retain the property and buy out your partner might be strong, it’s crucial to assess your financial capabilities and readiness. Undertaking a spousal buyout program is a significant financial decision and requires careful consideration. If your partner resists the buyout, the situation could become complex and potentially contentious.

Remember, dividing assets should always be managed fairly and respectfully, focusing on achieving a mutually beneficial outcome that enables both parties to begin their journey toward financial recovery.

What Does It Mean to Buy Out Your Former Spouse?

During the process of divorce, Ontario family law recognizes the respective contributions each party made to the marriage. It’s generally accepted that both spouses have invested their efforts to enhance their life together, and as such, they are entitled to a fair distribution of the accumulated wealth. This principle applies to all assets acquired during the marriage, including the most valuable asset – the matrimonial home. This distribution is often referred to as the equalization of family net property.

However, the matrimonial home differs from other marital assets in that its value isn’t merely what has been accrued during the marriage. Both spouses are entitled to a share in the total value of the home, whether it’s solely or jointly owned.

In scenarios where one party has exclusive possession or sole ownership, both spouses are entitled to a portion of the property value, unless a marriage contract stipulates otherwise. However, this applies only for the purpose of equalization, meaning each spouse may end up with a small percentage of the home value. Equalization aims not to split the house poor – the value of the home – right down the middle, but to ensure both spouses receive an equal share of the net family property. The matrimonial home is therefore treated as an integral part of this net property, rather than a separate entity.

When the matrimonial home is jointly owned, each spouse’s interest in the property equates to half. This situation arises because both parties have legal ownership of the property, enabling each to exercise their rights fully. In such cases, several options exist for dealing with the family home, including selling the property and dividing the proceeds or a spousal buyout – where one spouse buys out the other’s half of the equity.

Determine the Value of the Home and Your Equity

When deciding to buy out the matrimonial home from your spouse, determining its precise property value is vital. Any ambiguity or assumptions can impede one or both parties from making informed decisions during the separation process, potentially jeopardizing their financial recovery.

Without a doubt, the matrimonial home is a valuable asset. Its assessment should be carried out with the utmost accuracy and care. There are several methods to estimate the value of your home, though the reliability of these methods may vary.

The quickest method may be to use an online service for an instant, free valuation. However, such services often caution that their estimates might not be accurate, rendering them unreliable. Enlisting a qualified individual to scrutinize and evaluate the property can provide more accurate and exact figures.

It’s worth remembering that your house’s value is ultimately what a willing and able buyer would pay for it today. Several factors contribute to this value, including the property’s age, location, size, and any home improvements or their absence.

One of the most accurate methods to determine your home’s value is to examine the sale prices of similar properties in your neighbourhood that were sold recently. This is where timing is key – in fluctuating markets; property prices can change daily. Sales data from a year or two ago may not be relevant. Only the most recent sales can provide a solid estimation of what your home might fetch.

While homeowners cannot accurately value their homes, they can opt for one or both of these reliable options: a formal appraisal by a licensed appraiser or a Comparative Market Analysis (CMA) prepared by a real estate agent. Whichever method you choose, be wary of agents who inflate values to secure your listing. If possible, seek more than one opinion to ensure the credibility of the valuation.

Buy out your spouse: Mortgage Considerations

As part of a legally binding separation agreement, it’s common for one party to retain the matrimonial home. The other party, or the former spouse, might then sign over the title but overlook the existing mortgage. This oversight is a frequent misstep among separating married couples.

When you purchase a house, ownership is established through a grant deed, which certifies you as the new owner. The decision on whose name appears on the title document and the form of ownership is made at this time.

If one party chooses to relinquish ownership rights, this is done through a transfer deed in the case of a divorce settlement.

The mortgage taken to buy the property is a separate document from the title. Transferring the title does not affect the existing mortgage. If your name is on the loan, you remain responsible for the obligation until it’s paid off, regardless of who holds the title.

Even a court-ordered change of ownership doesn’t absolve the signer from the mortgage responsibility. The options to remove your name from this loan include paying it off, refinancing, or selling the property. Refinancing involves obtaining a new mortgage to replace the old one. While the original loan is paid off, the new one may have different terms and signers.

Refinancing can also serve as a way to carry out a spousal buyout program. However, it can be challenging to qualify for refinancing if the other spouse can’t afford the new mortgage payments. A loan modification may be considered, but in most cases, it will not remove the signer’s name from the loan. Therefore, selling may be the most feasible option.

Selling the matrimonial home

Deciding to sell the matrimonial home can be one of the most emotionally challenging aspects of the divorce process. The home may hold many memories tied to your married life that you’re not ready to part with. However, the decision to sell or retain the property should be based more on practical considerations than emotions.

While this decision may be difficult, it’s not necessarily complex. Your options are straightforward: either keep or sell the house. It’s crucial to carefully examine what both choices involve. Can your income comfortably support the house-related expenses? If you opt to keep the house, will you be relying on spousal support payments or child support? Even if you have a court order mandating specific support payments, what happens if your ex-spouse is unreliable or loses their job?

Bear in mind, every situation is unique. You may be capable of maintaining the house on your own, but is it worth the financial strain and emotional toll? If the circumstances surrounding the divorce were particularly tumultuous, selling the house might provide a fresh start and support your new life. The key is to introspectively consider what you genuinely want. If children are involved, their best interests should also guide your decision.

Rash decisions rarely lead to optimal outcomes and could leave you saddled with a property you no longer desire. Therefore, it’s essential to take the time to thoroughly consider your options.

Final Thoughts

Navigating the separation process can be daunting, especially when it involves dividing assets like your most valuable asset – the matrimonial home. It’s not just about the financial recovery but also about helping children transition smoothly and preserving memories tied to the home.

In Ontario family law, a legally binding separation agreement is crucial. It outlines the terms of the spousal buyout program, the division of the spouse’s half, and other fees involved. A divorce lawyer or a divorce mediator can help negotiate these terms.

The value of your home and the existing mortgage play a significant role in the separation agreements. Mortgage lenders, including your existing mortgage broker, will assess the property value and the total value of assets before agreeing to a spousal buyout.

The spouse’s interest in the home and the equalization payment are also factors to consider. If one party cannot afford to pay the other’s share, they might have to sell the house, which could lead to a house-poor situation.

Not everyone has enough equity in their home to buy out their ex-spouse’s share. In such cases, a new mortgage might be necessary. However, it’s essential to consider whether you can afford the new mortgage payments, child support, and spousal support payments.

Remember, the goal is not just to divide the assets but also to ensure that both parties can start a new life without financial burdens. It’s about moving memories forward, not just dividing the home’s value.

Married couples should also consider the implications of the separation on their credit. A spousal buyout might impact your credit score, which could affect your ability to get a new mortgage or other loans in the future.

In conclusion, the separation process is complex and requires careful consideration. It’s not just about the money but also about the emotional and psychological well-being of all parties involved. It’s always recommended to seek professional help from a divorce mediator or a family law expert to guide you through this process.

At DTSW:

We understand that navigating the complexities of a divorce, especially when it comes to the division of a matrimonial home, can be overwhelming. Our team of Family Mediators and Certified Divorce Financial Analysts are here to provide support and guidance during this challenging time.

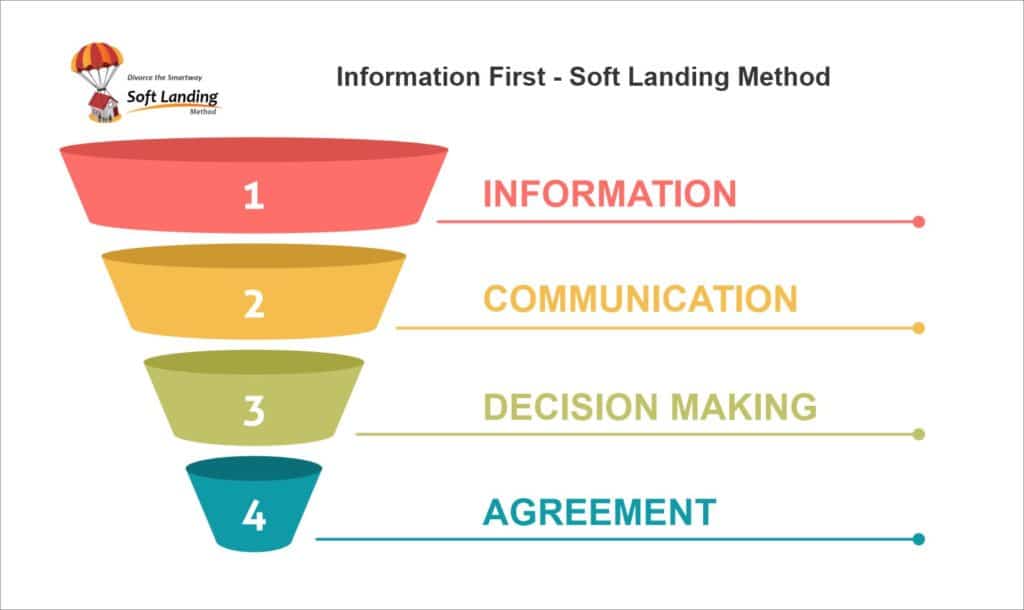

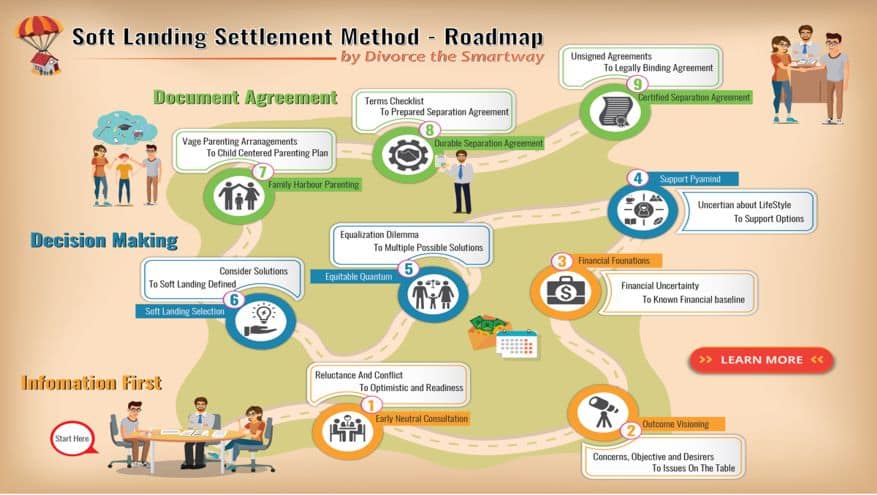

We know that every situation is unique and requires a tailored approach. That’s why we’ve developed our Soft Landing Divorce Settlement Method. This method is designed to help you and your partner reach a fair and equitable agreement without the stress and conflict often associated with traditional divorce proceedings.

Our goal is to help you transition smoothly into your new life, ensuring your financial security and peace of mind. We believe that with the right strategy and support, you can turn this challenging situation into an opportunity for a fresh start.

We invite you to take the first step towards a smarter, less stressful divorce process. Schedule a Get Acquainted Call with us today. Let’s explore how we can help you divorce the smart way.

Articles that may interest You!

So, you may be pondering some real nitty-gritty stuff about handling finances and property when splitting with a partner. Like, how does that Home Buyers Plan for RRSPs work? And if my partner wants to buy me out of the house, how do we calculate that? You may have heard about spousal buyout programs and financing options, like the CMHC plan. Or you are also curious about swaps, offsets, and other lump sums. What are your mortgage options for a buyout? Can I remortgage to get it done? And what if I decide to sell the house later? Just trying to wrap your head around all these alternatives and consequences, Tap here for the real nitty-gritty

External Links:

- Divorce & Your Mortgage: How Spousal Buyouts Work – Richmond Tymchuk Family Law: This article explains how spousal buyouts work, particularly in relation to mortgages.

- How to Buy Out Your Spouse’s Equity During a Divorce – Chris Allard: This article provides tips on how to buy out your spouse’s equity during a divorce.

- Spousal Buyout Of A Mortgage – Loans Canada: This article explains how a spousal buyout of a mortgage works.

- If Your Marriage is Ending and You Want to Keep the Family Home, Consider a Spousal Buyout – Kelly Hudson: This resource provides considerations for those wanting to keep the family home through a spousal buyout.

- Spousal Buyout Programs – Dominion Lending Centres: This article provides information about spousal buyout programs.

- How to buy out your partner in a mortgage in Canada – Alpine Credits Ltd: This article provides information on how to buy out a partner in a mortgage in Canada.

Ready to create a Soft Landing for your divorce?

Discover the Soft Landing Divorce Settlement Method – a comprehensive approach to separation and divorce that ensures a fair and equitable division of assets and liabilities.

This method involves a detailed financial walkthrough, including identification and valuation of assets, income assessment, expense analysis, financial projections, and settlement scenarios.

With the Soft Landing Method, you gain a clear understanding of your financial situation, empowering you to negotiate a settlement that meets your needs. Don’t navigate this complex process alone – work with a Certified Divorce Financial Analyst (CDFA) who specializes in separation and divorce cases.

Have a Question or two about a Soft Landing?

Schedule a Complimentary

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call

-

Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/May 23, 2023

-

Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/June 2, 2022

-

Ken Maynard CDFA, Acc.FMhttps://divorcethesmartway.ca/author/wardman/May 20, 2022