The New Reality of Grey Divorce: A Guide

Grey Divorce FAQ

A grey divorce typically reduces retirement savings by 40-50% and requires careful financial restructuring

A divorce later in life (also called a grey divorce) can dramatically impact your retirement financial planning. When couples separate after age 50, their accumulated retirement assets must be divided, which often includes:

- Pension benefits and retirement accounts that may need to be split through a pension division order

- Investment portfolios and RRSPs that must be fairly distributed

- CPP credits earned during the marriage that can be divided between spouses

- Shared real estate equity that may need to be liquidated or refinanced

To protect your financial future, consider working with a Certified Divorce Financial Analyst (CDFA) who can help develop a post-divorce retirement strategy and ensure you understand your pension and benefit entitlements under Canadian law.

Yes, you can keep your home in a grey divorce if you can afford to buy out your spouse’s share and maintain the property independently.

Retaining ownership of the matrimonial home during a grey divorce requires careful financial planning and negotiation. The house is typically considered a shared matrimonial asset, regardless of whose name is on the title.

To keep your home, you’ll need to:

- Obtain a professional property appraisal to determine current market value

- Calculate your spouse’s equity share that must be bought out

- Demonstrate financial ability to maintain mortgage payments and property expenses

- Refinance the mortgage in your name only

- Negotiate terms through divorce mediation or legal counsel

Consider consulting with a financial advisor and real estate professional to evaluate whether keeping the home aligns with your long-term retirement goals and financial stability.

Manage grey divorce emotions through professional support, self-care, and positive life changes

Navigating a grey divorce (separation after age 50) requires a thoughtful approach to emotional healing and personal growth. While ending a long-term marriage presents unique challenges, there are proven strategies to help you move forward confidently.

- Connect with a professional counsellor who specializes in late-life divorce

- Join support groups specifically for grey divorce to share experiences with peers

- Maintain close relationships with family and trusted friends

- Focus on self-care routines including exercise, healthy eating, and adequate sleep

- Explore new hobbies and interests to rebuild your independent identity

- Consider working with a divorce mediator to reduce stress during legal proceedings

- Practice mindfulness or meditation to manage anxiety and emotional stress

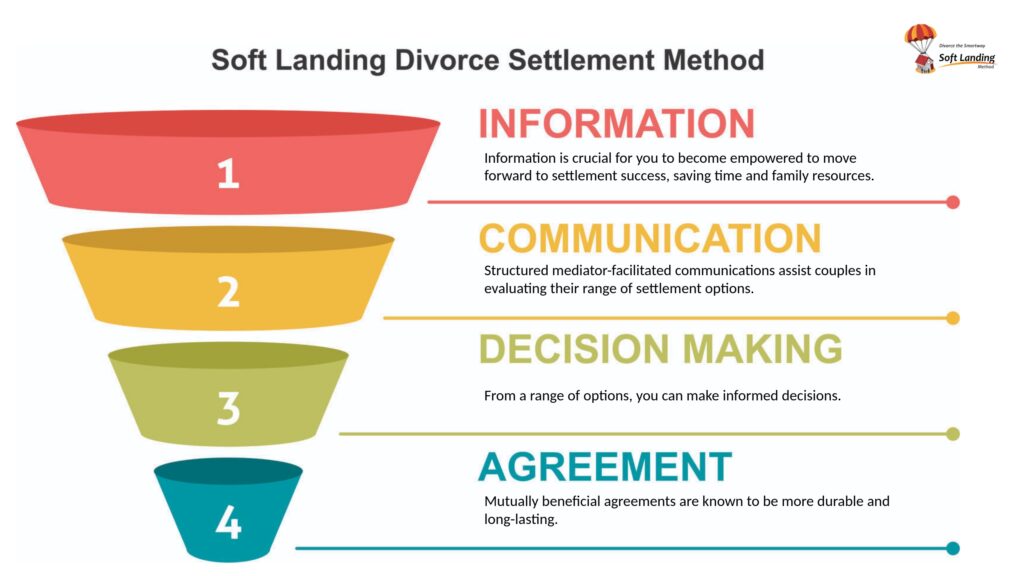

A mediator is highly recommended for grey divorces to navigate complex financial and emotional challenges

A qualified divorce mediator can be invaluable during a grey divorce (separation after age 50), helping couples navigate their unique challenges with less stress and lower costs than traditional litigation.

A mediator provides several key benefits:

- Facilitates fair division of complex retirement assets and pensions

- Helps resolve emotional issues common in long-term marriages

- Maintains privacy and dignity throughout the process

- Reduces legal costs and expedites settlement

- Preserves family relationships, especially with adult children

- Assists with healthcare and insurance transition planning

While not legally required, professional mediation typically results in more satisfactory outcomes for both parties in late-life divorce settlements.

Grey divorce asset division requires careful evaluation of retirement funds, property, and investments to ensure fair distribution

Dividing assets in a later-life divorce requires special consideration due to the complex financial portfolios typically accumulated over decades of marriage. Equitable distribution of assets must account for both partners’ retirement security and living standards.

Key assets that require careful evaluation include:

- Pension and retirement accounts including CPP credits, RRSPs, and workplace pensions

- Real estate holdings including the family home, vacation properties, and investment properties

- Investment portfolios such as stocks, bonds, and mutual funds

- Insurance policies and their cash surrender values

- Business interests and professional practices

Working with a Certified Divorce Financial Analyst (CDFA) is highly recommended to understand tax implications, pension division rules, and long-term financial impacts of different settlement options. This expertise helps ensure both parties can maintain financial stability post-divorce.

Grey divorce often leads to significant financial impacts on retirement plans, assets, and long-term security

A grey divorce (separation after age 50) typically creates more complex financial challenges than younger divorces due to accumulated wealth and proximity to retirement. Major financial considerations include:

- Division of retirement accounts, pensions, and investment portfolios

- Splitting of shared property, including the family home and vacation properties

- Potential long-term spousal support obligations, especially for marriages over 20 years

- Adjustments to estate planning, insurance policies, and beneficiary designations

- Tax implications from asset division and property transfers

Working with a certified divorce financial analyst (CDFA) can help navigate these complexities and develop a post-divorce financial strategy that protects your retirement security. Early financial planning is crucial to ensure both parties can maintain their standard of living after separation.

Grey divorce typically requires securing new individual health insurance coverage if previously under spouse’s plan

Health insurance arrangements often undergo significant changes following a grey divorce (divorce after age 50). If you were previously covered under your former spouse’s employment benefits or family plan, you’ll need to arrange new coverage promptly to avoid any gaps in protection.

Several options are typically available:

- Converting to an individual policy through your former spouse’s insurance provider

- Obtaining coverage through your own employer if you’re working

- Purchasing private health insurance on the open market

- Exploring government healthcare programs if eligible

It’s crucial to address health insurance during divorce negotiations, as coverage transitions must be carefully timed. A divorce mediator can help ensure this important aspect is properly addressed in your settlement agreement.

Mediation is an excellent option for couples navigating a grey divorce, offering a cooperative and cost-effective resolution

Mediation provides a supportive environment for mature couples ending their marriage, with a neutral third-party mediator guiding discussions about asset division, retirement accounts, and other important considerations. This approach is particularly beneficial for long-term marriages where couples have accumulated significant shared assets and memories.

- Helps preserve family relationships and social connections

- Allows for flexible scheduling and comfortable pacing

- Typically costs less than traditional litigation

- Provides privacy and confidentiality

- Enables couples to maintain control over important decisions

The process is especially suitable for grey divorce situations where both parties wish to maintain dignity and respect while working toward practical solutions for their retirement years.

Issues That Must Be Considered When Facing A Grey Divorce:

Preparing for a Grey Divorce: Financial Education

Understand that older individuals have limited time to rebuild their finances. Make strategic financial decisions to ensure long-term stability.

By following the following checklists, you can better navigate the complexities of a grey divorce and work towards a stable and secure financial future.

Grey Divorce Checklist: Considerations for Financial Stability

After your Separation Agreement is Final:

External Links:

- Spectrum Family Law: Unpacking the Rise of “Grey” Divorce in Canada – This article discusses the increasing trend of grey divorce in Canada and its financial and emotional implications. Chosen for its comprehensive coverage and relevance to Canadian readers.

- Spectrum Family Law: The Impact of Grey Divorce on Adult Children and Grandchildren – This piece explores how grey divorce affects not just the couple but also their adult children and grandchildren. Chosen for its focus on family dynamics.

- Kiplinger: The Consequences of Gray Divorce – Kiplinger provides insights into the financial challenges of grey divorce, including asset division and retirement planning. Chosen for its detailed financial advice.

- The Clark Law Firm: What Causes Gray Divorce? – This article examines the reasons behind the increasing rate of grey divorce and provides advice on moving forward. Chosen for its insightful analysis and practical advice.

- Divorce Magazine: 6 Reasons Why Women are More Likely to File for Divorce Than Men – Divorce Magazine discusses why women are more likely to initiate grey divorces and the implications of this trend. Chosen for its gender-focused perspective.

- Marriage.com: 6 Tips to Get Over a Divorce – Marriage.com offers practical tips for coping with the emotional aftermath of a grey divorce. Chosen for its focus on emotional well-being.

- Forbes: Financial Tips for Grey Divorce – Forbes provides financial advice tailored to individuals going through a grey divorce, covering key areas such as asset division and retirement planning. Chosen for its authoritative financial guidance.

- AARP: Dealing with Divorce After 50 – AARP discusses the specific challenges faced by individuals divorcing after 50 and offers practical solutions. Chosen for its trusted perspective on senior issues.

- Psychology Today: Emotional Impact of Grey Divorce – Psychology Today explores the emotional consequences of grey divorce and provides strategies for coping. Chosen for its focus on mental health and well-being.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.