Understanding the Value of Your Small Business in a Divorce Settlement

Divorce can be complex and emotionally charged, especially for small business owners who must consider business valuation in a divorce. Understanding how your business will be valued and divided during a divorce settlement is one of the most challenging aspects. This blog post will explore the critical factors that influence the valuation of a business during divorce and address common misconceptions that business owners often have.

What Defines a Small Business in the Context of Divorce?

The definition of a “small business” can vary widely. For some, it may mean a micro-business or a sole proprietorship that relies heavily on the owner’s direct involvement. For others, it could be a more substantial operation with several employees and significant revenue. Still, it is classified as a small business under legal definitions (typically with a turnover of less than $10 million annually).

Key Points to Understand:

- Micro-businesses are often not seen as separate entities from their owners, meaning their value might be closely tied to the owner’s input and cannot easily be transferred or sold.

- Larger small businesses, however, can have intrinsic value beyond the owner’s involvement, including customer relationships, brand reputation, intellectual property, and more.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

Common Misconceptions About Small Business Valuations in Divorce

Many small business owners underestimate the value of their business in a divorce context because they don’t need to understand how value is assessed fully. Here are some common misconceptions:

- “My business isn’t worth anything without me.”

- This is a frequent belief among micro-business owners or those deeply involved in daily operations. However, even if a business relies heavily on the owner’s skills and knowledge, it can still have value. The company might have a solid customer base, a valuable brand, or proprietary technology that adds to its worth.

- “If I sell my business, I must be completely out of the picture.”

- In many cases, business sale agreements involve the owner staying temporarily to help transition the business. This period can help maintain the business’s value and ensure a smoother transfer of ownership.

- “The business is worth only what it could be sold for today.”

- Valuations for divorce often consider the business’s future earning potential, not just its immediate sale value. This means that business asset evaluation in divorce could lead to a company being valued higher than what it might sell for in a quick sale.

How is a Small Business Valued in a Divorce?

Divorce business appraisal of a small business involves several steps and considerations. The following are the primary factors that come into play:

- Income-Based Approach: This method looks at the business’s earnings and projects future income to determine its value. It is beneficial for companies with a steady income stream.

- Market-Based Approach: This valuation compares the business to similar companies that have recently been sold. It is often used for more traditional businesses or those with tangible assets.

- Asset-Based Approach: In this approach, the value of the business is determined by its assets, including both physical and intangible assets like intellectual property or customer lists.

The Role of a Certified Divorce Financial Analyst (CDFA) in Business Valuations

A Certified Divorce Financial Analyst (CDFA) can be instrumental in helping business owners navigate the complexities of a divorce settlement. Here’s how a CDFA can assist:

- Providing a Clear Valuation: A CDFA can help ensure that all aspects of the business are considered in the valuation process, providing a more accurate and fair assessment.

- Understanding Financial Implications: They help you understand the long-term financial implications of various settlement options, helping to protect your financial future.

- Negotiating Fair Settlements: With their expertise, a CDFA can help negotiate a fair division of assets, including the business, ensuring that both parties are fairly compensated.

Why Business Owners Are Often Surprised by Valuation Outcomes

Many business owners receive a much higher valuation than expected, leading to shock and concern about the financial impact on their divorce settlement. This surprise often comes from needing to recognize the total value of intangible assets or the potential future earnings of the business.

Critical Reasons for Higher-than-Expected Valuations:

- Customer Base and Contracts: A solid client list or long-term contracts can significantly increase a business’s value.

- Goodwill: This intangible asset represents the business’s reputation and customer relationships, which can be highly valuable.

- Growth Potential: If a business has a strong growth trajectory, its value will reflect that potential, not just its current earnings.

Protecting Your Business During Divorce Proceedings

To protect your business during a divorce, it is essential to prepare in advance and understand the legal landscape:

- Pre- and Post-Nuptial Agreements: A pre-or post-nuptial agreement that outlines how the business will be handled in the event of a divorce can provide clear guidelines and reduce disputes.

- Keep Detailed Records: Maintain meticulous records of your business finances, including all income, expenses, and investments. This documentation will be crucial during valuation and settlement discussions.

- Seek Professional Guidance Early: Engaging a CDFA and a family lawyer with experience in business valuations can help you navigate the complexities and protect your interests.

Final Thoughts

Understanding the value of your small business in a divorce settlement is crucial for protecting your financial future. It’s not just about what the company is worth today but also about its potential to generate income and its intrinsic value in the marketplace. You can approach the process with greater confidence and clarity by dispelling common misconceptions and getting professional advice.

11 Key Takeaways

- Small Business Definition: A small business can range from a micro-business to a more substantial operation with a turnover of less than $10 million annually.

- Misconception of Worth: Many business owners need to pay more attention to their business’s value in a divorce due to misunderstandings about valuation.

- Different Valuation Methods: Businesses can be valued based on income, market comparisons, or assets.

- Importance of Intangible Assets: Customer bases, goodwill, and growth potential significantly contribute to a business’s value.

- Role of a CDFA: A Certified Divorce Financial Analyst can provide valuable insights and help negotiate fair settlements.

- Joint Owner Misconceptions: Owners often believe their business is worthless without them, which is rarely true.

- Higher-than-Expected Valuations: Many business valuations surprise owners due to the inclusion of intangible assets and potential earnings.

- Legal Considerations: Pre- and post-nuptial agreements can protect business interests during divorce.

- Record Keeping is Crucial: Detailed financial records are vital for accurate valuations and fair settlements.

- Professional Guidance is Key: Engaging experts early can help navigate the complexities of divorce involving a business.

- Fair Settlements Benefit Both Parties: Settling quickly and reasonably can prevent prolonged disputes and financial strain.

Table of Contents

- What Defines a Small Business in the Context of Divorce?

- Common Misconceptions About Small Business Valuations in Divorce

- How is a Small Business Valued in a Divorce?

- The Role of a Certified Divorce Financial Analyst (CDFA) in Business Valuations

- Why Business Owners Are Often Surprised by Valuation Outcomes

- Protecting Your Business During Divorce Proceedings

- Final Thoughts

- 11 Key Takeaways

- At DTSW

- At DTSW

- Get Acquainted Call

At DTSW

At DTSW

At DTSW, we understand that navigating the complexities of divorce, especially when it involves business valuation, can be overwhelming and emotionally draining. You’ve come to this webpage because you’re seeking clarity and guidance on a topic that feels incredibly personal and challenging. As a team of Family Mediators and Certified Divorce Financial Analysts, we know how important it is to handle these sensitive matters with care, empathy, and professionalism.

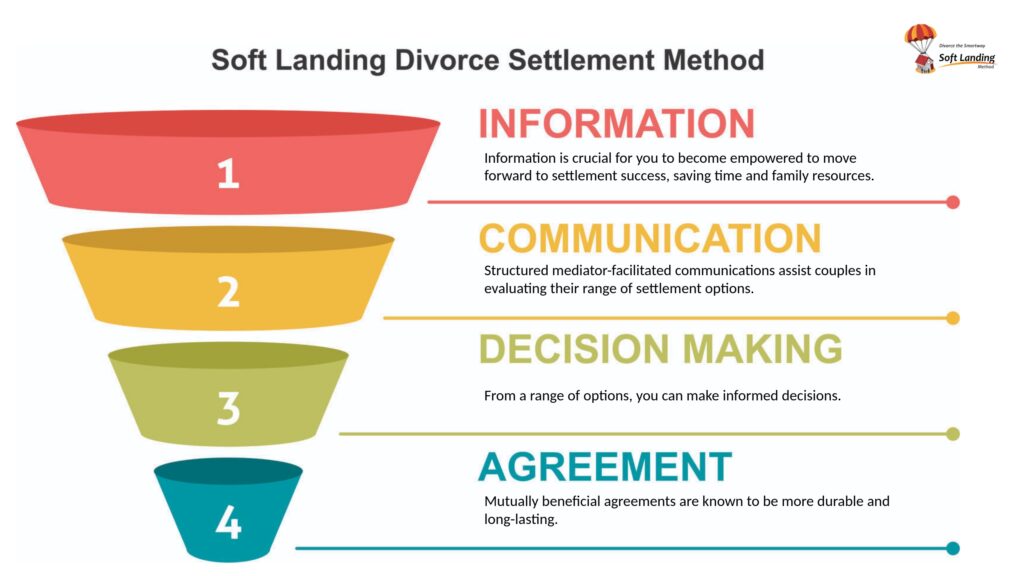

Our Soft Landing Divorce Settlement Method is designed to provide you with the support and expertise you need during this difficult time. We focus on creating a smooth transition that minimizes stress and helps both parties reach a fair and equitable resolution. By working with us, you’ll gain a clearer understanding of your financial situation and learn how to protect your interests as you move forward.

We encourage you to reach out and connect with us. Let’s explore how we can assist you in finding the best path forward. Schedule a Get Acquainted Call with our team today to learn more about how we can help you achieve a settlement that works for everyone involved. Click here to Schedule a Get Acquainted Call. We’re here to support you every step of the way.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.