What is CCB in Marriage and Separation – Canada Child Benefit

The Canada Child Benefit is one of the tax-free payments families in Canada may be entitled to, depending on their income level, providing them crucial financial support. However, there are many things to think about when considering this benefit, including how separation and divorce may affect payments.

Here, we explain what the Canada Child Benefit is, who qualifies for the payment and how it works after divorce. In addition, our professional mediator explains how Divorce the Smartway helps couples make the most of the Canada Child Benefit, both during marriage and after divorce.

Get Acquainted Call

Do you want a Soft Landing?

Have a few questions?

Learn More:

Schedule a 15-Minute Complimentary Call

What is the CCB aka Canada Child Benefit?

The Canada Child Benefit (CCB) was introduced in 2016 by the Canadian federal government and is administered by the Canada Revenue Agency (CRA). It is a tax-exempt benefit program that sees qualifying families with children receive a monthly payment from the government to assist with the financial cost of raising children.

The CCB is a consolidation of three previous child benefits programs – the Universal Child Care Benefit, the Canada Child Tax Benefit, and the national Child Benefit Supplement – into one non-taxable benefit. The CRA pays the CCB in addition to a child disability benefit of up to $2,886 per child with a qualifying disability. The CCB can be received in addition to other provincial and territorial benefit programs.

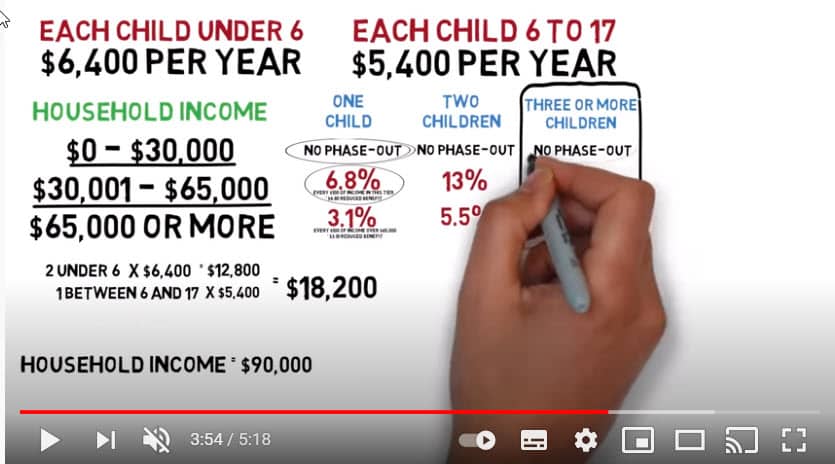

Under the benefit program, qualifying families may receive a payment up to $6,765 per year ($563.75 per month) for children under 6 years of age. In addition, they may receive up to $5,708 per year ($475.66 per month) for children between 6 and 17 years of age.

However, how much families may receive under the CCB program depends on their adjusted family net income (AFNI). Families (including single parent families) with an AFNI of $31,711 or less are eligible to receive the full benefits for each eligible child. This means if you have two children under 6 and one above 6 but under 17 years of age, you will receive the full $6,765 for both children under 6, and the full $5,708 for the child above 6 but less than 17.

The applicable benefits get scaled down the higher your AFNI. Families with an AFNI over $31,711 but below $68,708 will receive a reduced amount based on a percentage of their income above $31,711. Similarly, families with an AFNI above $68,708 will receive a reduced amount based on a fixed reduction of $2,590 and a percentage of their income over $68,708. You can learn more about how this calculation works below.

Qualifying families may receive a payment of up to $6,765 per year under the CCB for children under 6 years of age.

In addition, they may receive up to $5,708 per year for children between 6 and 17 years of age.

One of the primary problems is the CRA’s treatment of situations of shared custody, there is a strong possibility that each family would receive less overall.

How much you can get for CCB depends on several factors.

In certain situations, the CRA may conduct a child tax benefit audit.

You will be required to split CCB with the other parent if you have shared custody.

Who qualifies for CCB?

The CCB is usually applied for by just one parent, even though how much you get is determined based on household income. However, before a parent can apply for or collect CCB, they must meet the following requirements. The parent:

- Must live with a child or children under 18 years of age;

- Must be primarily responsible for the care and upbringing of the child;

- Must be a resident of Canada for tax purposes;

- Must have filed their most recently-due income tax returns. For instance, you must have filed your 2019 tax returns to be qualify for benefits payments in 2020;

- Either the parent or their spouse or common law partner must be a:

- Canadian citizen;

- Permanent resident;

- Protected person;

- Temporary resident and has lived in Canada for 18 months prior and has a valid permit for the 19th month;

- Indigenous person who is “Indian” as defined by the Indian Act

How do you tell if you are primarily responsible for your child or children? According to the CRA, a parent is primarily responsible for a child if they are responsible for the care and upbringing of the child. This includes being the one that does tasks such as supervising the child’s daily activities and needs, making arrangements for child care, and seeing to the child’s medical needs. A parent claiming CCB will need to attach documentation that shows they are truly the one that is primarily responsible for the child.

However, when the child lives with both a female and a male parent, the CRA “assumes” the female parent is primarily responsible for the child. As a result, they will expect the female parent to apply for CCB. The CRA admits this assumption will not operate all the time though. So, if the male parent is actually primarily responsible for the child, he may apply. But he must also attach a signed letter from the female parent, stating the he is primarily responsible for the child.

Who claims child on taxes after separation?

Since only one parent can apply for CCB, it means only one parent can claim the child on taxes both during marriage and after separation. While spouses may agree on how they want to treat the children for tax purposes during marriage, this decision becomes more complicated after separation.

Which parent claims the child on taxes after separation depends on whether you have shared physical custody or one parent has sole physical custody. Shared physical custody is when the child spends some time living in each parent’s house during the year. The amount of time the child spends in each household may be more or less equal or the child could only spend a small part of the year in one parent’s household (such as Christmas or summer holidays). Sole physical custody is when the child spends all their time with one parent, in one household.

For CCB purposes, it is possible for one parent to claim the child on taxes if they have sole physical custody. But in cases of shared custody, the rule is that both spouses may have to split CCB payments for as long as shared custody continues. But the question whether you have shared or sole physical custody will be determined based on the discretion of the CRA.

Determining if your custody arrangement amounts to shared custody in the opinion of the CRA can be confusing though. This is why many spouses address these issues in a comprehensive separation agreement that specifies which of the parents will claim the child for tax purposes.

Shared Custody and the CRA

You will be required to split CCB with the other parent if you have shared custody. The CRA has its own rules for determining how CCB payments will be split in shared custody situations.

Where the child shares their time “more or less equally” between both parents, they are considered to have shared custody. Here, the parents must inform CRA of the custody arrangement. When it learns of the arrangement, CRA will calculate what each parent would have received, based on their separate AFNI. Then it will pay each parent exactly 50% of what they would have received if they had sole physical custody.

If the child spends their time mostly with one parent, the CRA considers that parent to have sole physical custody. Only that parent can apply for CCB and they will be entitled to the full amount of CCB, based on their AFNI. This means it doesn’t matter that the child spends 30% of their time with the other parent. Only the parent with majority custody can apply for and receive CCB.

But there’s a third scenario. If the child spends most of their time with their mom, for instance, but for a limited period (say, the summer holidays), they spend all their time with their father, the father can apply for CCB for that period. At the end of the period, the mother can begin applying for CCB again. But the CRA must be informed when this arrangement is to commence and when it ends.

How much will I get for CCB as a separated parent?

How much you can get for CCB depends on several factors. These include the following:

- The number of children in your sole physical custody;

- The age of the children (those below 6 years of age, and those above 6 but below 17;

- Your AFNI as reported in your tax return for the previous year; and

- Your marital status. This may affect your AFNI for the year, either making it lower or higher, and this can in turn affect how much you get as CCB.

Generally, parents with an AFNI of $31,711 or less will get the full amount of CCB for each eligible child. This means they get $6,765 for all children under 6, and the full $5,708 for all children above 6 but less than 17.

Parents with an AFNI above $31,711 up to $68,708 will have their CCB payments reduced based on a percentage of their income greater than $31,711 and the number of children they have. This works as follows:

- For 1 child, the CCB is reduced by 7% of income above $31,711

- For 2 children, CCB is reduced by 13.5%

- For 3 children, CCB is reduced by 19%

- For 4 or more children, CCB is reduced by 23%

Similarly, parents with an AFNI above $68,708 will have their payment reduced by $2,590 + a percentage of their income above $68,708 and the number of children in their care. Here’s how it works:

- For 1 child, the CCB is reduced by $2,590 + 3.2% of income above $68,708

- For 2 children, CCB is reduced by $2,590 + 5.7%

- For 3 children, CCB is reduced by $2,590 + 8%

- For 4 or more children, CCB is reduced by $2,590 + 9.5%

Getting this calculation right can be tricky. To ensure your calculation is swift and accurate, use our interactive child tax benefit calculator for separated couples. You can access it here.

Child tax benefit problems

Despite the recorded impact of the CCB (it is estimated to have contributed in a decline of child poverty from 11 to 9%), the program still has its problems. One of the primary problems is the CRA’s treatment of situations of shared custody. By paying each parent only 50% of what they would have been entitled to if they had full custody, there is a strong possibility that each family would receive less overall than if only one parent had applied.

In addition, the CRA’s insistence that a CCB recipient who becomes married or enters a common law relationship must inform them can be detrimental. In this situation, the CRA adds the new partner’s income to that of the receiving parent in computing their AFNI. But there is no guarantee that the new partner intends to take responsibility for the child’s care. Therefore, this may result in an unjustified reduction of child benefit a parent would (and should) have been otherwise entitled to.

There are several other problems that organizations such as the Office of the Taxpayers’ Ombudsman have pointed out. The CCB does not provide clear information on what documentation is acceptable in establishing that a parent is the primary caregiver. This often leads to situations where people who need these benefits most get denied because of unclear information.

Also, the fact that women are presumed to be the primary caregiver may provide an incentive not to work. Since the higher your income, the less you receive in benefits, more people may choose not to participate in the labor force. This also operates as a disincentive to marriage, since marriage often leads to higher AFNIs.

Child tax benefit audit

In certain situations, the CRA may conduct a child tax benefit audit to determine if a parent is receiving the amount of CCB they should be receiving. An audit may be triggered in certain specific situations, such as when both parents apply for CCB at the same time or if both claim the child for tax purposes, at the same time. In such an instance, the CRA will conduct an audit to determine who should be entitled to CCB.

Also, where there has been a change in living arrangements or the receiving parent has remarried or entered a common law relationship, an audit may be triggered where the parent fails to inform the CRA. In these circumstances, if the CRA finds that the parent failed to inform them quickly enough and their CCB payments should be lowered, the parent may have to return the excess amounts they received over that period.

Final Thoughts

Navigating the financial landscape of raising children in Canada can be complex, but tools like the child benefit calculator can help families plan and understand their potential benefits. The Canada Child Benefit (CCB) is a tax-free monthly benefit aimed at assisting families with the cost of raising children. The amount of the child support benefit is determined by factors such as family net income, the number of eligible children, and their ages.

The Canada Revenue Agency (CRA) is responsible for administering these benefits, and the calculation of the benefit is based on the income tax return information provided by families. It’s important to note that the benefit is adjusted annually in July based on the family’s net income from the previous tax year. This means that changes in your family’s income, such as from a new job or a change in your marital status, can affect the amount of your benefit.

For families with an eligible child aged under 18 years, the child benefit can provide a significant boost to their monthly income. In addition to the CCB, there are other benefits such as the child disability benefit (CDB) for families with a child with a severe and prolonged impairment in physical or mental functions. The registered disability savings plan (RDSP) is another financial planning tool for eligible individuals.

The child care benefit, also known as the Universal Child Care Benefit (UCCB), is another government benefit that provides a tax-free monthly payment to help families with the cost of child care. However, it’s crucial to consult with a financial planner or use a benefit calculator to estimate the total benefit amount accurately.

In conclusion, the Canada Child Benefit, along with other government benefits, can provide significant financial support for families raising children in Canada. It’s important to stay informed about these benefits and to keep your information updated with the Canada Revenue Agency. Remember, every bit of financial planning and information can make a significant difference in the quality of life and opportunities for your children.

The Canada Child Benefit (CCB) is a tax-free monthly payment that helps Canadian families with child-raising costs

The Canada Child Benefit (CCB) is a cornerstone of Canada’s family benefit system, providing financial support to eligible families across the country. This tax-free monthly payment helps offset the costs of raising children under 18 years of age.

Key features of the CCB include:

- Tax-free payments delivered monthly to eligible recipients

- Payment amounts based on family income and number of children

- Support for children under 18 years of age

- Automatic adjustment each July based on the previous year’s tax return

At DTSW

We understand that navigating the complexities of financial matters during a separation can be overwhelming. The Canada Child Benefit is just one aspect of this intricate puzzle, and we know how crucial it is to get it right for the sake of your children’s future.

At Divorce the Smart Way, our team of Family Mediators and Certified Divorce Financial Analysts are committed to helping you through this challenging time. We’ve developed the Soft Landing Divorce Settlement Method to ensure a smooth transition towards a secure future. Our approach is designed to sidestep the excessive conflicts, confusion, and costs often associated with legal proceedings.

We believe that every family deserves a ‘soft landing’ in the face of life-altering changes. Our method is clear, straightforward, and tailored to your unique circumstances. We’re here to guide you through every step of the process, ensuring that you understand all the financial implications of your decisions.

Remember, you’re not alone on this journey. We’re here to provide the support, guidance, and expertise you need to navigate this transition with confidence and peace of mind.

Ready to take the next step? Schedule a Get Acquainted Call with us today. Let’s explore how we can help you divorce the smart way.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.