What is the Ultimate Fate Of My TFSA In Separation – Divorce?

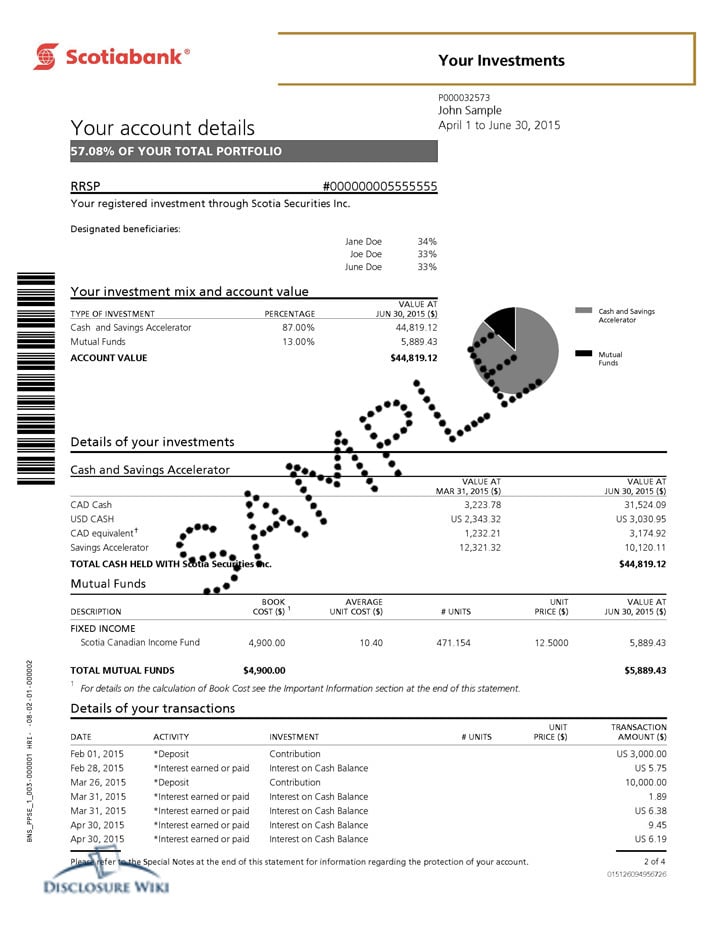

Making a TFSA financial disclosure

TFSA financial disclosure Documents Details

The statement is typically sent to subscribers on a quarterly basis, usually in March, June, September and December. If you have not received your statement for the period, you may need to conduct inquiries.

Emptying a TFSA before divorce is not recommended and may have serious legal consequences

Withdrawing funds from your Tax-Free Savings Account (TFSA) before divorce proceedings without proper consent or legal guidance is considered a serious matter in Canadian family law. Such actions can be interpreted as attempting to hide marital assets, which may result in:

- Court-ordered penalties and sanctions

- Negative impact on your divorce settlement

- Requirement to repay withdrawn funds

- Damage to your credibility during proceedings

Instead, consult with a qualified family law professional to understand your rights and obligations regarding TFSA assets during divorce. All financial accounts should be properly disclosed and divided according to provincial family law requirements.

Tax-free divorce settlements are possible through proper legal documentation and strategic asset transfers

Managing the tax implications of a divorce settlement requires careful planning and proper legal documentation. To minimize or avoid taxes, consider these key strategies:

- Obtain a formal separation agreement or court order that clearly outlines asset transfers

- Transfer TFSA funds directly between accounts without withdrawing to cash

- Ensure property transfers are completed within the tax-free rollover period

- Consider splitting registered accounts like RRSPs through direct transfers

- Maintain proper documentation of all transfers for the Canada Revenue Agency (CRA)

Working with qualified legal and financial professionals can help ensure all transfers are structured properly to maintain their tax-sheltered status and comply with Canadian tax laws.

TFSAs must be held individually, but spouses can contribute to each other’s accounts

Tax-Free Savings Accounts (TFSAs) are strictly individual accounts that cannot be jointly held. However, there are ways for couples to coordinate their TFSA strategies:

- A spouse or common-law partner can contribute to their partner’s TFSA without affecting their own contribution room

- All gains remain tax-free within the account regardless of who contributed

- Contributions made during marriage may be subject to division in case of divorce

- Each account holder maintains full control over their individual TFSA

TFSA assets can be split between spouses during divorce without tax penalties through direct transfers

During a marriage breakdown, Tax-Free Savings Account (TFSA) assets can be divided as part of the overall separation of marital property. The division process maintains the tax-free status of these investments when handled correctly.

- Assets can be transferred directly between spouses’ TFSAs without affecting contribution room

- The transfer must be ordered by a separation agreement or court decree

- Both growth and contributions during the marriage are typically considered shared assets

- The receiving spouse maintains the tax-free status of their portion

To ensure proper handling, these transfers should be coordinated through financial institutions with proper documentation from legal professionals. This helps maintain compliance with the Income Tax Act while protecting both parties’ interests.

TFSAs remain individual assets but their value during marriage may be divided during divorce

While Tax-Free Savings Accounts (TFSAs) are legally registered to individual holders, the funds accumulated during marriage are typically considered family property in Canadian divorce proceedings. The division of TFSA assets follows these key principles:

- Contributions made during marriage are generally subject to equal division

- Investment growth and earnings accumulated during the marriage period may be split

- Pre-marriage TFSA values usually remain with the original account holder

- Division can be settled through:

- Mutual agreement between spouses

- Formal separation agreement

- Court-ordered settlement

Obtaining a digital copy of this document:

Obtaining a digital copy of this document

- Many online sources allow you to download a digital copy to the device.

- Most up to date Web Browsers allow you the option of “Print to PDF”

- Scan your hard copy to a pdf.

Note: This can be done on a personal (home or work) scanner, or can be done at a retailer such as Staples Business Depot

Related Documents:

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.