Navigating through the complexities of divorce can be challenging, but Divorce the Smartway guides you every step of the way. Our comprehensive resource on Ontario divorce information and disclosure provides essential insights into various aspects of separation and divorce.

From understanding the significance of dates in separation and divorce to exploring the fate of your TFSA when couples separate, we cover it all.

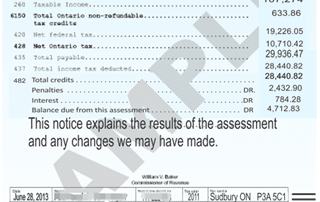

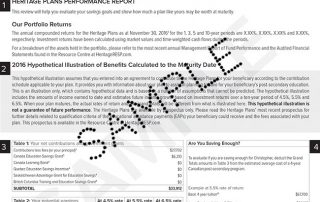

We delve into the intricacies of Home Buyers’ Plan Repayment in divorce, the role of RRSP, and options for your Kids’ RESP during a divorce: our expert, Ken Maynard CDFA, Acc.FM also discusses the role of a Deferred Profit Saving Plan (DPSP) in a separation or divorce, how your savings accounts are factored in separation and divorce, LIRA factors in separation and divorce, and the importance of a Notice of Assessment financial disclosure.

Lastly, we shed light on what happens to life insurance during divorce and separation. Join us on this journey to make your divorce process brighter and smoother, ensuring you’re well-informed every step of the way