Understanding RESPs in a Divorce or Separation

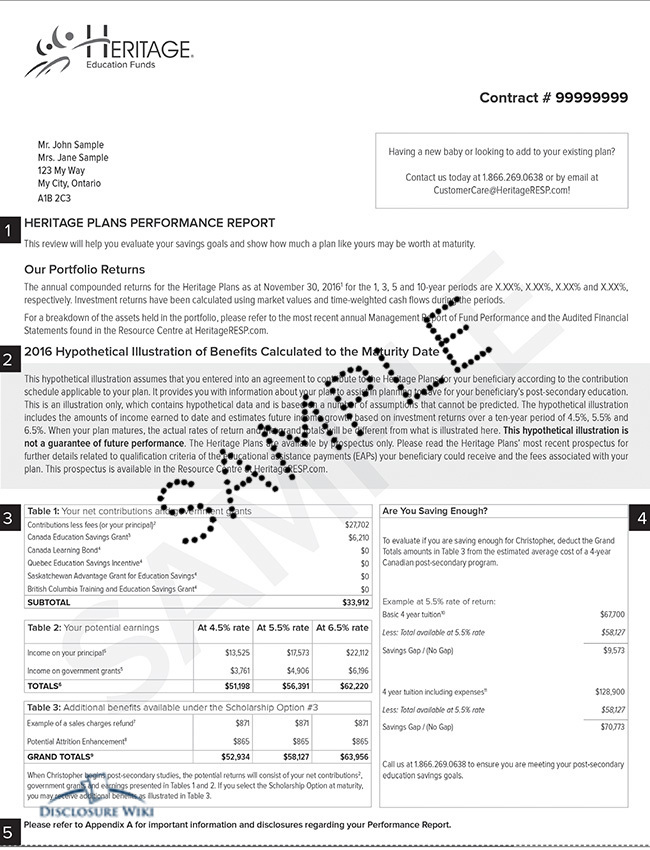

What is an RESP Statement?

A Registered Education Savings Plan (RESP) Statement is a document that shows your investment holdings, contributions and transactions for your child’s education savings. During a separation or divorce, these statements become critical financial documents that need attention.

The main purpose of an RESP Statement is to give you a clear picture of the education savings you’ve built for your children. During divorce proceedings, these statements play a crucial role in establishing both parents’ financial contributions and managing the education savings element effectively.

RESPs have big implications during divorce as they are funds specifically designated for your children’s future education. A Certified Divorce Financial Analyst (CDFA) can help you understand how to deal with these assets in your settlement.

What’s in an RESP Statement:

- Account Balance: The total value of contributions, grants and earnings

- Transaction History: Records of deposits, grants and withdrawals

- Grant Information: Details about government grants like the Canada Education Savings Grant (CESG)

- Contributor Information: Who contributed and how much

Who Can Help Me with My RESP During Separation?

When dealing with RESPs in a divorce or separation, specialized professionals can be super helpful:

- Certified Divorce Financial Analysts (CDFAs): These financial professionals specialize in divorce-related financial matters. They can review your RESP statements, explain the tax implications of different division strategies and help create a fair plan for managing education savings post-divorce.

- Divorce Mediators: While not financial experts per se, mediators can facilitate productive conversations about RESPs between separating parents, helping you reach mutually acceptable arrangements.

- Family Lawyers: They ensure any RESP agreements comply with Canadian family law and are documented in your separation agreement.

A CDFA is particularly useful for complex RESP situations as they understand both the investment side and the unique considerations that come up during separation.

What Are the Common RESP Settlement Options?

When separating, couples have several options for RESPs:

- Joint Contributions: Some parents agree to freeze the existing RESP and continue joint contributions according to a set schedule.

- Freeze and Create New Plans: A popular approach is to freeze contributions to the existing plan (preserving what’s already been invested) and each parent opens new, individually-sponsored RESPs for future contributions.3. Proportional Division: The existing RESP can be divided proportionally based on each parent’s historical contributions.

- Education Fund Agreement: Parents can create a separate written agreement about how the RESP will be managed, who will make withdrawal decisions and how funds will be distributed.

Your CDFA can help you determine which approach makes the most sense for your situation while keeping your children’s education protected.

How Are RESPs Valued for Financial Disclosure?

For financial disclosure during separation, your RESP statements must show:

- Current Value: The most recent statement showing the total account value

- Date of Separation Value: The statement closest to your separation date

- Contribution History: Statements showing who contributed what amounts

- Grant Amounts: Documentation of government grants received

A CDFA will help you value the RESP, considering:

- The tax implications of early withdrawals

- The potential repayment of government grants if the RESP isn’t used for education

- The true accessible value of the RESP (considering penalties and taxes)

This valuation is required for fair asset division and will be included in your Financial Statement forms required by Canadian family courts.

What Legal Considerations Apply to RESPs in Canadian Divorces?

In Canada, RESPs have specific legal considerations during divorce:

- RESPs are generally considered family property subject to division in most provinces

- Government grants may need to be repaid if the RESP is collapsed during divorce

- The subscriber (usually a parent) controls the RESP, not the beneficiary child

- Changes to subscriber arrangements may require financial institution approval

Your CDFA can work with your lawyer to navigate these legal considerations while developing a plan that protects your children’s education funds.

How Does a CDFA Help with RESP Decision-Making?

A Certified Divorce Financial Analyst can help with RESPs by:

- Analyzing Tax Implications: Explaining how different RESP decisions affect your tax situation post-divorce

- Projecting Education Costs: Creating forecasts of future education expenses to ensure adequate saving

- Developing Contribution Schedules: Creating fair, manageable contribution plans for both parents

- Integrating with Overall Settlement: Ensuring RESP decisions align with other financial aspects of your separation, including child support and property division

- Creating Documentation: Helping prepare the financial records needed for your separation agreementUnlike general financial advisors, CDFAs know how RESPs interact with other divorce-specific financial matters like support payments and asset division.

What Happens to Government Grants in the RESP After Separation?

Government contributions like the Canada Education Savings Grant (CESG) require special attention during divorce:

- Grants remain attached to the beneficiary child, not the parent contributors

- If an RESP is collapsed, government grants typically must be repaid

- New individual RESPs may have different grant eligibility based on post-divorce household incomes

- Maximum grant limits apply per beneficiary, regardless of how many RESPs exist

A CDFA can help you structure your post-divorce RESP strategy to maximize available government grants while both parents can contribute to their children’s education.

How Do I Ensure Fair RESP Management After Separation?

To manage RESPs fairly after separation:

- Document Everything: Include RESP provisions in your separation agreement, outlining contribution expectations, withdrawal processes and decision-making authority

- Create Accountability Mechanisms: Require regular statements to be shared between parents

- Set Clear Milestones: Define what happens at key points, such as when children start post-secondary education

- Plan for Contingencies: Address what happens if a child doesn’t pursue higher education or if one parent can’t maintain contributions

Your CDFA can help you draft these provisions to ensure they’re financially sound and implementable.

What Should I Ask My CDFA About Our RESP?

When working with a CDFA on RESP matters, ask:

- “How will freezing our current RESP and starting individual plans affect government grants?”

- “What’s the most tax-efficient way to structure our RESP arrangements?”

- “How do we handle RESP decisions when our child starts university?”

- “What financial documentation do we need to properly value the RESP?”

- “How do we ensure equal contributions based on our different incomes?”

- “What happens if one of us can’t maintain the agreed-upon contributions?”

These questions will help your CDFA give you customized advice on RESP management post-separation for your situation.

The statement is typically sent to subscribers on a quarterly basis, usually in March, June, September and December. If you have not received your statement for the period, you may need to conduct inquiries.

The subscriber(s) who opened the RESP typically maintain control, but this can be addressed in your separation agreement.

Under Canadian law, the subscriber who opened the RESP maintains legal control of the account after separation. If you have a joint RESP with both parents as subscribers, you’ll need to decide how to handle this in your separation agreement.

You have three main options: continue as joint subscribers with clear decision-making protocols, transfer subscriber rights to one parent with oversight provisions, or divide the RESP into separate accounts.

A Certified Divorce Financial Analyst (CDFA) can help structure an arrangement that protects your children’s educational funds while respecting both parents’ contributions

While legally possible, withdrawing RESP funds during separation is rarely advisable as it reduces your child’s education fund and may trigger penalties.

Although you may technically be able to withdraw your contributions, doing so can trigger repayment of government grants like the Canada Education Savings Grant (CESG) and create tax consequences. A better approach is to include the value of your RESP contributions in your overall asset division calculations.

Your separation agreement can include provisions to protect your financial interest in the RESP without actual withdrawal. Remember that courts generally view RESPs as being held in trust for the child’s education, as established in recent legal precedents.

Post-divorce RESP contribution arrangements should be based on each parent’s financial capacity and formally documented in your separation agreement.

When structuring ongoing RESP contributions after divorce, consider approaches that reflect each parent’s financial capacity. Common methods include: contributions proportional to income (similar to child support calculations), equal fixed amounts on a regular schedule, incorporating contributions into child support payments, or having one parent handle RESP contributions while the other covers different child-related expenses of similar value.

Your separation agreement should clearly document this plan to ensure consistency, and a CDFA can help develop a sustainable approach that maximizes government grants while working within both households’ financial realities

If your ex stops contributing to the RESP, review your separation agreement for enforcement options or consider adjusting your approach to education savings.

When your ex-spouse stops making agreed-upon RESP contributions, first check your separation agreement to determine if contributions are a binding obligation or simply a general intention. If they’re binding, you may be able to enforce this through legal channels or return to mediation. Alternatively, you might need to adjust your approach by increasing your own contributions or exploring other education savings options. To prevent this situation, have your separation agreement include contingency plans, compensation mechanisms, and reporting requirements for RESP contributions.

The decision between maintaining one RESP or creating separate accounts depends on your specific situation and ability to cooperate after divorce.

Maintaining a single RESP offers advantages like simpler administration, maximized compound growth, coordinated investment decisions, and clear grant eligibility tracking. Creating separate RESPs provides each parent with independent control, allows different investment approaches, accommodates varying contribution capacities, and simplifies administration when communication is difficult.

Many financial experts recommend a hybrid approach: freeze contributions to the existing RESP (preserving established investments) while each parent opens new, individually-sponsored RESPs for future contributions. Under the Income Tax Act, there’s no requirement to divide RESP assets upon relationship breakdown, so former spouses can remain joint subscribers after separation if they choose.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.