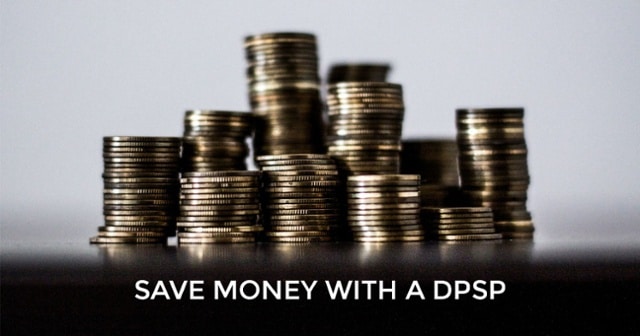

The Deferred Profit Saving Plan (DPSP) factor in divorce

What is DPSP in Canada

Making a DPSP financial disclosure

DPSP financial disclosure Documents Details

It’s important to note that this document is a private one, and your partner is not authorized to claim it as a joint document. With that said, you’ll be required to present this statement on some dates such as Inclusive of Date of Marriage / Cohabitation and Inclusive of Date of Separation. Consult with your legal representation to get more information on how the statement would be presented on these dates.

Obtaining a digital copy of this document:

To get access to your Deferred Profit Saving Plan, you’ll need to request it from your files with your employer or their HR department. You can also locate your DPSP through your Employer Portal, Accountant or Tax Preparation Professional. As stated earlier, your Deferred Profit Saving Plan is funded and managed by your employer. It’s an allotment of a part of the company’s profit made available to you upon leaving the organization or retiring. Your company may also decide to provide your Deferred Profit Saving Plan (DPSP) statement quarterly or annually.

However, you should note that this arrangement is made voluntarily by your employer as there are no Canadian laws that mandate this apportioning. So it’s very likely that the distribution would only be made when the corporation is making a considerable profit, which allows for a more flexible approach to your DPSP for the company. Unfortunately, the Family Law Act lacks consistency regarding handling DPSP as a kind of pension or benefit. There hasn’t been deliberate clarification on whether these pension-like benefits are considered individual or family assets -to conclude if they should be divided in a separation or divorce. We advise that you spare no expense in receiving legal advice, especially on matters regarding the separation of incomes and pensions.

It’s recommended that you get your up-to-date financial statement to inform yourself of all your transactions and investment holdings within that reporting span. Most financial institutions that receive deposits will send your monthly statement via mail. After submitting a request, you’ll receive a document from your financial institution that entails all your private account information such as account balance, interest earned and transaction details. These reports are usually sent in on the same day every month, so you should feel free to contact your financial institution if you don’t receive them when expected.

If you’re leaving your matrimonial home in the processing of a legal separation, then you’ll have to tender an indication of that change to key authorities to prevent complications. In the event of an address change, you must inform your financial institution of this development. You wouldn’t want a situation where your ex-partner receives your financial statements, especially when your divorce or separation is not finalized. Nonetheless, your statement’s privacy should always be a priority regardless of the stage of the divorce proceedings.

For ease, you can decide to receive your financial statement in the form of an E-statement depending on whether your financial institution provides that nature of online services. Instead of receiving a hard-copy file through the mail, the same document would be sent to your bank account’s official email address. You can also stipulate a private email address where your financial institution’s statement or a link to view it online would be received. The E-statement will contain the same information as the hard copy document sent via mail by your financial institution after receiving a confirmed request from you.

Some select financial institutions provide online access services for their customers with Deferred Profit Savings Plans that are guaranteed and funded by employers. This online access provides a detailed view of all statements on the account -past and ongoing. You can check whether your financial institution offers this option by visiting its official website. If they do, log in with your uniquely secured password and username that you will provide upon your registration. You can then navigate the ‘View Statements’ section on the website, and you’ll come across your detailed transaction history. You can either save the file to your device storage as a .pdf file or print it to view it as hard-copy.

It’s important to note that this document is a private one, and your partner is not authorized to claim it as a joint document. With that said, you’ll be required to present this statement on some dates such as Inclusive of Date of Marriage / Cohabitation and Inclusive of Date of Separation. Consult with your legal representation to get more information on how the statement would be presented on these dates.

Related Documents:

Ken Maynard CDFA, Acc.FM

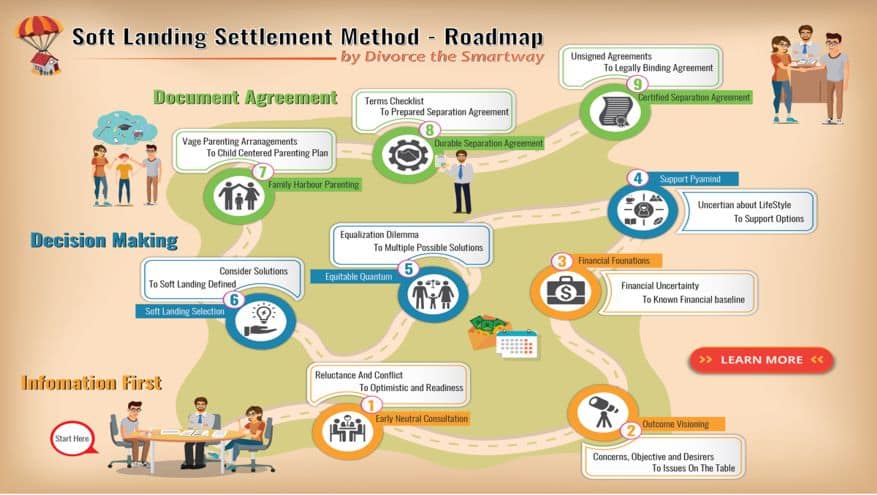

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call