Financial Disclosure in Separation and Divorce

Financial disclosure in separation and divorce is the process by which both parties provide a comprehensive and transparent account of their financial situations. This includes details about income, assets, liabilities, and expenses. The purpose of financial disclosure is to ensure that both parties understand the financial landscape, which is essential for fair and equitable property division and determination of support obligations.

Key Components of Financial Disclosure:

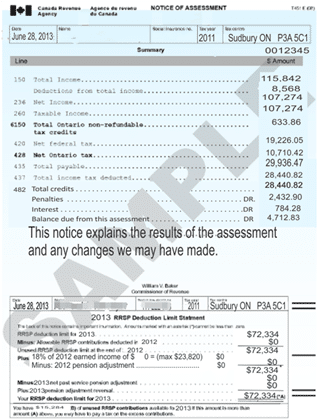

- Income Information:

- Pay stubs, tax returns, and other proof of income.

- Details of any bonuses, commissions, or other sources of income.

- Assets:

- Real estate holdings, including the marital home and any investment properties.

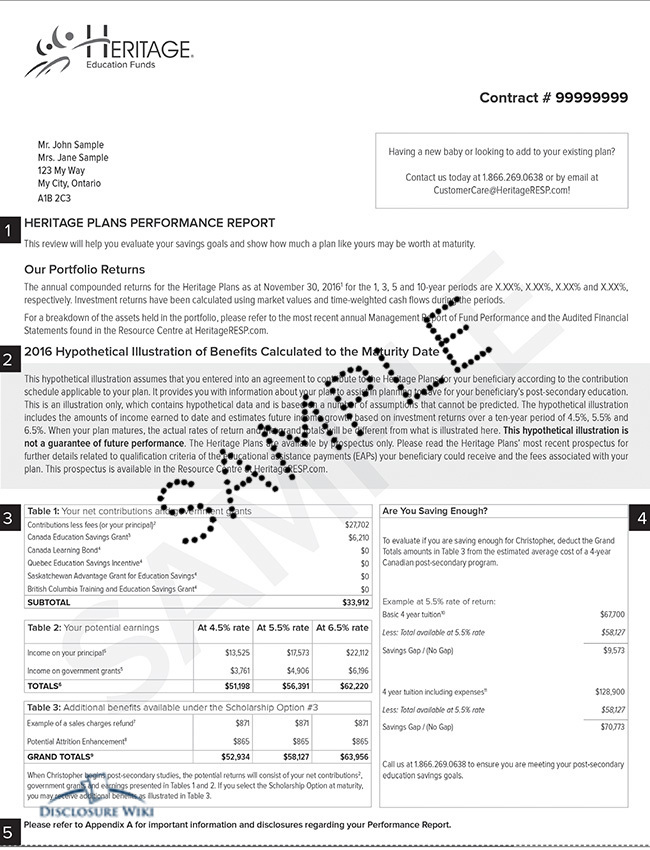

- Bank accounts, investment accounts, retirement accounts (e.g., RRSPs, pensions).

- Vehicles, personal property, and valuable collectibles.

- Liabilities:

- Mortgages, loans, and lines of credit.

- Credit card balances and other debts.

- Any other financial obligations.

- Expenses:

- Monthly household expenses, including utilities, groceries, and transportation.

- Child-related expenses, including education, childcare, and extracurricular activities.

- Insurance premiums, medical expenses, and other recurring costs.

Importance of Financial Disclosure:

- Equitable Division of Property:

- Ensures that all assets and liabilities are accounted for and fairly divided between the parties.

- Spousal and Child Support:

- Provides the necessary financial information to determine appropriate support payments.

- It helps establish the financial needs and capabilities of both parties.

- Transparency and Trust:

- Promotes honesty and openness, reducing the likelihood of disputes and mistrust.

- Facilitates smoother and more efficient negotiation and mediation processes.

- Legal Compliance:

- Complying with legal requirements for financial disclosure is mandatory in many jurisdictions.

- Please disclose accurately to avoid legal penalties or unfavourable judgments.

Process of Financial Disclosure:

- Collection of Documents:

- Both parties gather all relevant financial documents, which may involve accessing bank statements, loan agreements, and tax records.

- Completion of Financial Statements:

- Standardized forms are often used to detail financial information, ensuring consistency and completeness.

- Exchange of Information:

- The completed financial statements are exchanged between the parties, typically through their legal representatives or mediators.

- Verification:

- In some cases, financial information may be verified by accountants or financial experts to ensure accuracy.

- Ongoing Updates:

- Financial situations can change, so ongoing updates and additional disclosures may be necessary as the separation or divorce progresses.

By ensuring comprehensive financial disclosure, separating or divorcing couples can work towards a fair and amicable resolution, minimizing conflicts and facilitating a smoother transition into their post-separation lives.

DTSW Disclosure & Financial Statement Workshop

Disclosure & Financial Statement Assistance Tailored to Your Needs

Our Affordable. Efficient. Effective. Disclosure Workshop

Disclosure Workshop with a Certified Divorce Financial Analyst is a service excelling in one critical area: Family Law Financial Disclosure.

Pinpoints Issues

Disclosure Workshop pinpoints the legal issues you are addressing or challenging and strategically positions you ahead of these issues through meticulous financial disclosure.

Shortens Resolution Timeframe

Our workshop not only builds trust and credibility but also reduces costs, shortens the resolution timeframe, and strengthens your legal position—all through comprehensive financial disclosure.