Help with RRSP Division During Separation or Divorce

RRSP Division in Canadian Divorce

When going through separation or divorce in Canada, dividing retirement assets like Registered Retirement Savings Plans (RRSPs) can be one of the most complicated financial parts of your settlement. Divorce mediators and Certified Divorce Financial Analysts (CDFAs) are key in ensuring fair RRSP division and protecting your financial future.

RRSPs are big assets that need to be properly valued and divided during divorce. These tax-advantaged retirement accounts often hold a large chunk of a couple’s wealth and their division requires specialized knowledge of both financial principles and Canadian family law.

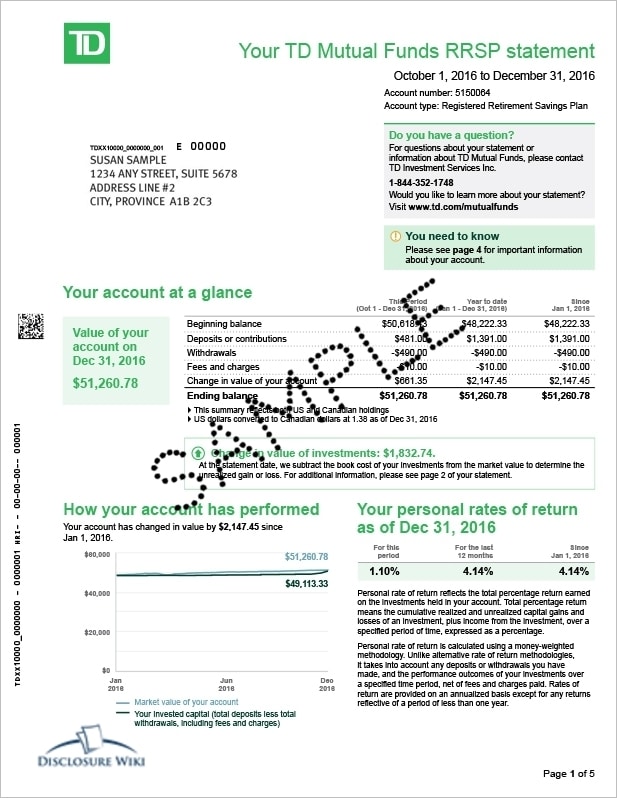

What is an RRSP Statement and Why It Matters in Your Divorce

An RRSP statement is a document that gives you the details of your retirement savings, including contributions, investment performance and account balance. During separation, these statements become crucial financial evidence that divorce mediators and CDFAs use to ensure fair asset division.

Divorce mediators and CDFAs will ask for RRSP statements from three specific time periods:

- Marriage/Cohabitation Date: Establishes the initial value of RRSPs brought into the relationship

- Separation Date: Determines the final value of RRSPs accumulated during the relationship

- Current Date: Provides the present value for negotiation and settlement purposes

These dates are critical to calculating net family property and fair division during mediation. Without RRSP statements from these periods, your divorce settlement may not reflect your financial entitlements properly.

Where to Get RRSP Statements for Your Divorce Mediation

Your divorce mediator or CDFA will request all RRSP documentation during the financial disclosure process. You can get these statements from:

- Online Banking: Most financial institutions have electronic access to current and historical RRSP statements

- Financial Institution: Request statements from the bank or institution holding your RRSP

- Financial Advisor: Your investment advisor can provide copies of your statements

- Accountant: Your tax professional may have records of your RRSP contributions and values

- Personal Records: Check your own files for previous statements, especially from around your marriage and separation dates

A CDFA can help you figure out which documents you need and guide you through getting historical statements that may be harder to find. This saves you time and ensures full financial disclosure.

Why Professional Guidance is Important for RRSP DivisionDivorce mediators and CDFAs offer specialized knowledge to help separating couples navigate RRSP division:

Tax Implications of RRSP Division During Separation

One of the biggest services CDFAs offer is tax planning during RRSP division. While RRSPs can be transferred between spouses tax-free during divorce (under certain conditions), improper handling can trigger big tax consequences.

A CDFA will:

- Calculate the after-tax value of your RRSP assets

- Structure RRSP transfers to minimize tax impacts

- Ensure proper documentation for tax-free rollovers

- Consider timing strategies to optimize your financial position

Equalization Calculations and Fair RRSP Division

Divorce mediators work with CDFAs to ensure RRSP division equals overall asset division:

- Proper Valuation: Determine the value of RRSPs at critical dates

- Growth Attribution: Account for growth of pre-marriage RRSPs during the relationship

- Integration with Other Assets: Balance RRSP division with other property settlement components

- Future Value Projections: Understand how today’s RRSP division affects retirement security

Special Considerations for Locked-In Retirement Accounts

Locked-In Retirement Accounts (LIRAs) and Locked-in Retirement Savings Plans (LRSPs) have unique challenges during divorce. These accounts, which hold transferred pension funds, have special rules restricting withdrawals.

A divorce mediator with CDFA expertise can:

- Navigate the provincial regulations governing LIRAs

- Develop strategies for dividing these restricted accounts

- Ensure proper documentation for pension administrators

- Explain the long-term implications of different division options

The Divorce Mediator’s Approach to RRSP Division

Divorce mediators facilitate constructive discussions about RRSP division, helping couples reach agreements without litigation. Their approach includes:

- Full Financial Disclosure: Ensure all RRSP assets are identified

- Education on Options: Explain various RRSP division approaches

- Neutral Evaluation: Provide unbiased assessment of fair division scenarios

- Documentation: Create agreements that can be implemented

- Professional Coordination: Work with lawyers to ensure legal compliance

How a CDFA Supports Your Financial Security During RRSP Division

A Certified Divorce Financial Analyst is with you throughout the RRSP division process:

- Financial Impact Analysis: Show you how different RRSP division scenarios affect long-term financial security2. Tax Planning: Structuring the settlement to minimize taxes

- Implementation Details: Ensuring RRSP transfers are done correctly

- Retirement Rebuilding: Strategies to rebuild retirement savings post-divorce

- Future Value Analysis: How today’s decisions affect tomorrow

Common RRSP Mistakes a Mediator Can Help You Avoid

Without professional guidance, separating couples often make costly errors when dividing RRSPs:

- Tax Ignorance: Not considering the after-tax value of RRSPs compared to other assets

- Incorrect Documentation: Missing the requirements for tax-free transfers between spouses

- Valuation Errors: Using wrong dates or methods for RRSP valuation

- Investment Blindspots: Not considering risk, liquidity and growth potential

- Timing Mistakes: Transferring at the wrong time

A CDFA can help you navigate these pitfalls and protect your interests while achieving a fair settlement.

The Mediation Process for RRSP Division

When working with a mediator on RRSP division, you can expect:

- Initial Disclosure: Gathering all RRSP statements and related documents

- Valuation: Working with a CDFA to determine values at critical dates

- Options: Creating scenarios for fair division of retirement assets

- Negotiation: Facilitated discussions about preferences and priorities

- Agreement: Recording the final division plan in your separation agreement

- Implementation: Instructions for transferring RRSPs properly

Why Document Gathering Matters for RRSP Division

Accurate RRSP statements are the foundation of fair property division during divorce. As your mediator will stress, document gathering is a time for precision, not guessing. There can be no mistakes, misunderstandings or secrets. This is the only way both spouses can be protected.

A CDFA can help you get the right documents, especially for complex situations involving:

- Multiple RRSP accounts

- Accounts at different institutions

- Historical statements from marriage date

- Valuation of investment holdingsOnce you have an agreement, before you sign anything, have your lawyer review your financial disclosure with you to make sure you know your numbers.

Working with experts who get both the emotional and financial aspects of divorce will help you feel more secure with RRSP division.

Making an RRSP financial disclosure

With records of your and your spouse’s financial position at the date of marriage and date of separation, it will help greatly with calculating the net-family property.

The statement is typically sent to subscribers on a quarterly basis, usually in March, June, September and December. If you have not received your statement for the period, you may need to conduct inquiries.

RRSPs are considered shared marital property and must be divided during divorce proceedings

During a divorce settlement in Canada, Registered Retirement Savings Plans (RRSPs) accumulated during the marriage are treated as family property and must be fairly divided between spouses. The division process can be handled in several ways:

- A tax-free direct transfer of RRSP funds between spouses using Form T2220

- Offsetting RRSP values against other marital assets during property division

- Maintaining separate RRSP accounts with adjusted contribution amounts

The exact division depends on provincial family law, the length of the marriage, and whether the couple reaches a mutual agreement or requires a court order. It’s important to consult with a financial advisor and family lawyer to ensure the most tax-efficient transfer of retirement savings.

RRSPs must be held individually, but spousal RRSPs allow contributions to benefit your partner

Registered Retirement Savings Plans (RRSPs) are strictly individual accounts under Canadian tax law. However, there are strategic options for couples planning retirement together. The most common approach is a spousal RRSP, which allows one spouse to contribute to their partner’s RRSP while receiving the tax deduction.

- Each person must maintain their own separate RRSP account

- Spousal RRSPs enable tax-efficient income splitting in retirement

- The contributing spouse claims the tax deduction

- The account holder spouse owns and controls the investments

A Spousal RRSP is legally owned by the receiving spouse, while the contributing spouse claims the tax deduction

The ownership structure of a Spousal RRSP is specifically designed to benefit both partners while following Canadian tax regulations. The spouse named as the annuitant (receiving spouse) maintains full legal ownership and control of the account, despite not making the contributions themselves.

- The contributing spouse receives the tax deduction for contributions made

- The receiving spouse has full control over investment decisions and withdrawals

- Withdrawals within 3 years of contribution are attributed back to the contributing spouse

- In case of marriage breakdown, the Spousal RRSP remains with the receiving spouse

A Spousal RRSP typically remains with the registered spouse after divorce, but assets may be divided through legal proceedings

When couples divorce in Canada, the Spousal RRSP account ownership stays with the spouse whose name is on the registration. However, these retirement savings are usually considered part of the overall matrimonial assets subject to division.

- The account holder maintains control of the RRSP investment decisions and administration

- The account value may be included in divorce settlement negotiations

- Courts can order the division or transfer of RRSP funds as part of the separation agreement

- Tax implications should be considered when dividing or transferring RRSP assets

RRSP spousal rollovers during divorce allow tax-free transfers as part of property division settlements

A tax-free RRSP transfer between divorcing spouses is permitted under Canadian tax law when it’s part of a formal property division agreement or court order. This process, known as a spousal RRSP rollover, helps couples equalize their assets during separation without triggering immediate tax consequences.

- Transfer must be made directly between RRSP accounts

- A written separation agreement or court order is required

- The transfer maintains tax-deferred status

- Both spouses must be Canadian residents

- Form T2220 must be completed for the transfer

The receiving spouse assumes full control and responsibility for the transferred RRSP funds, including future tax obligations when withdrawals are made. This arrangement provides a clean break while preserving the tax-sheltered status of retirement savings.

An RRSP is a government-registered investment account that offers tax benefits for retirement savings in Canada.

A Registered Retirement Savings Plan (RRSP) is a powerful financial tool designed to help Canadians build their retirement nest egg while providing immediate tax advantages. When you contribute to an RRSP, the money is tax-deductible from your current income, allowing you to reduce your taxable income for that year.

Key benefits of an RRSP include:

- Tax-deferred growth on investments until withdrawal

- Immediate tax deductions on contributions

- Investment flexibility with options for stocks, bonds, mutual funds, and GICs

- Contribution room of up to 18% of your previous year’s earned income

RRSP contributions cannot reduce child support payments in Canada

Child support payments in Canada are calculated based on your gross income before RRSP deductions. The Federal Child Support Guidelines specifically require that RRSP contributions be added back to income when determining support obligations.

- Child support is calculated using your income after taxes but before RRSP deductions

- Making RRSP contributions will not lower your child support payment obligations

- Courts consider RRSP contributions to be voluntary savings rather than mandatory deductions

- The only deductions that may affect child support are mandatory ones like CPP, EI and income tax

Yes, RRIF income splitting is permitted between spouses or common-law partners who are 65 or older

Under Canadian tax law, you can split up to 50% of your RRIF income with your qualifying spouse or common-law partner. This income-splitting strategy can help reduce your household’s overall tax burden by shifting income to the lower-income spouse.

To qualify for RRIF income splitting, you must meet these requirements:

- Both spouses/partners must be Canadian residents

- The RRIF holder must be at least 65 years old

- You must be married or in a common-law relationship

- Both partners must agree to the income split on their tax returns

This arrangement is handled through your annual tax filing using Form T1032 and does not require actually transferring funds between accounts.

Investment assets acquired during marriage are typically split 50/50 between divorcing spouses in Canada

During divorce proceedings, all matrimonial property, including investments, must be fairly divided according to provincial family law. This includes:

- Registered accounts like RRSPs, TFSAs, and pension plans

- Non-registered investments such as stocks, bonds, and mutual funds

- Business investments and ownership shares acquired during marriage

The division process typically involves valuing all investment assets at the date of separation, then splitting them through direct transfer or asset equalization payments. Some investments may require special handling, like tax-free transfers of registered accounts between spouses. Couples can negotiate their own settlement or have the court determine the division if an agreement cannot be reached.

A tax-free transfer of RRSP funds between spouses during marriage breakdown or divorce

A Spousal RRSP rollover allows for the transfer of Registered Retirement Savings Plan (RRSP) assets between separating spouses or common-law partners as part of a divorce settlement. This process helps equalize retirement savings while maintaining the tax-deferred status of the funds.

- Transfer must be done according to a written separation agreement or court order

- No immediate tax implications when done properly

- Funds move directly between RRSP accounts

- Both parties must be Canadian residents at the time of transfer

- The receiving spouse becomes responsible for future taxes on withdrawals

RRSP transfers between divorcing spouses can be done tax-free through a direct rollover process

When dividing retirement assets during a divorce, Canadian tax law allows for a tax-free transfer of RRSP funds between spouses or common-law partners. This process, known as a matrimonial property rollover, must meet specific requirements:

- The transfer must be pursuant to a court order or written separation agreement

- Funds must move directly between RRSP accounts through a financial institution

- Both parties must be Canadian residents at the time of transfer

- Form T2220 must be completed to document the transfer

This tax-efficient method ensures fair division of retirement savings while protecting both parties’ long-term financial interests. The receiving spouse assumes full responsibility for any future tax implications when funds are eventually withdrawn.

Related Documents:

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.