Post-Divorce Budgeting: Your 9-Step Guide to Financial Stability

Create a detailed budget and track expenses carefully to adjust to post-divorce finances

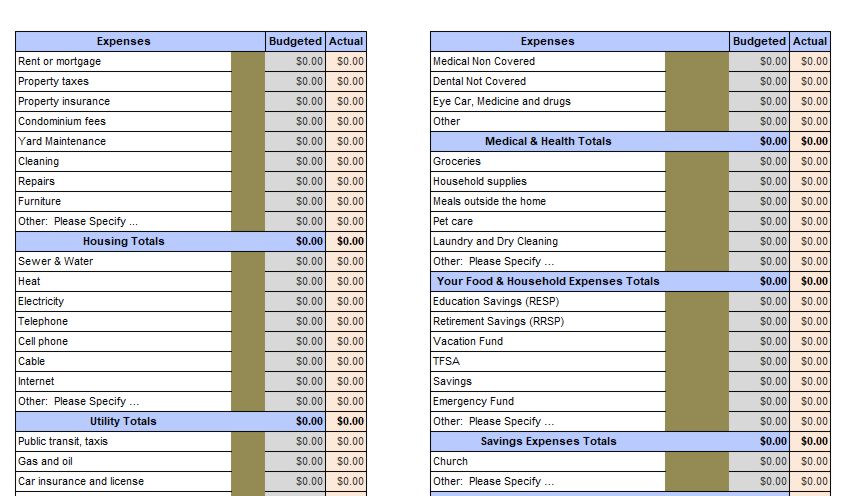

Managing expenses after divorce requires a strategic approach to your new financial reality. Start by conducting a thorough assessment of your current financial situation and developing a structured budget plan.

- Track essential expenses first:

- Housing costs and utilities

- Food and groceries

- Transportation expenses

- Healthcare and insurance

- Review and adjust discretionary spending:

- Entertainment and dining out

- Subscriptions and memberships

- Non-essential shopping

- Implement money-saving strategies:

- Set up automatic bill payments

- Build an emergency fund

- Look for opportunities to reduce fixed costs

Consider using budgeting apps or spreadsheets to monitor your spending patterns and make necessary adjustments as you adapt to your new financial circumstances.

Divorce does not directly impact credit scores, but financial obligations from joint accounts can affect your rating

While a divorce decree itself won’t appear on your credit report, the financial aftermath can significantly influence your credit score. The main risks come from:

- Shared credit cards and joint accounts where both parties remain legally responsible for payments

- Joint mortgages or loans that need to be refinanced or transferred

- Missed payments on accounts that remain linked to both parties

- Changes in household income affecting ability to maintain payment schedules

To protect your credit score during divorce, prioritize separating joint accounts, maintain timely payments on all obligations, and monitor your credit report regularly for any unexpected changes. Consider working with your financial institution to establish independent credit accounts in your name only.

Establish clear financial priorities focused on stability, savings, and long-term security after divorce

Following a divorce, rebuilding your financial foundation requires careful planning and strategic goal-setting. Focus on creating both immediate stability and long-term financial security through structured objectives.

- Create an emergency fund covering 3-6 months of essential expenses

- Review and adjust your monthly budget to reflect your new financial situation

- Develop a plan to manage or eliminate debt, particularly joint obligations

- Reassess your retirement planning strategy and contribution levels

- Update insurance coverage and beneficiary designations

- Build a credit history in your own name if needed

Consider working with a financial advisor to create a personalized roadmap that aligns with your new circumstances and future aspirations.

Conduct a comprehensive review of income, expenses, assets, and debts to understand your post-divorce financial position

Assessing your financial situation after divorce requires a systematic evaluation of your complete financial picture. A thorough financial assessment helps create a stable foundation for your new life chapter.

Start by organizing your finances into these key categories:

- Income Sources: Salary, investments, support payments, rental income, and other revenue streams

- Monthly Expenses: Housing costs, utilities, insurance, groceries, transportation, and discretionary spending

- Assets: Property, vehicles, investments, retirement accounts, and valuable possessions

- Liabilities: Mortgage, credit cards, loans, and other outstanding debts

Once organized, create a realistic monthly budget that reflects your new financial reality. Consider consulting a financial advisor to help develop strategies for long-term financial stability and growth.

Build an emergency fund by saving 3-6 months of expenses through consistent monthly deposits

Creating a financial safety net after divorce is crucial for your long-term stability. Start by establishing a dedicated savings account specifically for emergencies and develop a systematic saving strategy.

- Calculate your essential monthly expenses, including housing, utilities, food, and insurance

- Set up automatic monthly transfers from your chequing to savings account

- Start with small, manageable amounts like 5-10% of your income

- Look for opportunities to reduce spending and redirect funds to savings

- Consider keeping your emergency fund in a high-interest savings account for better growth

Remember that building an emergency fund takes time, but even small regular contributions will help create the financial buffer you need for unexpected expenses and peace of mind.

A post-divorce budget is a detailed financial plan that helps you manage money and maintain stability after separation.

Creating a comprehensive post-divorce budget is essential for financial independence and long-term security. This financial roadmap helps you understand and manage your new financial reality as a single person.

A well-structured post-divorce budget should include:

- Income tracking from all sources, including employment, investments, and support payments

- Monthly fixed expenses such as housing, utilities, and insurance

- Variable costs including groceries, transportation, and entertainment

- Emergency savings to handle unexpected expenses

- Long-term financial goals like retirement planning and debt management

Regular budget reviews and adjustments ensure you maintain financial stability while building a secure future. This practical tool helps you make informed decisions about spending, saving, and investing in your post-divorce life.

Should you require our advice and assistance, please do not hesitate to contact Ken S. Maynard at Divorce the Smartway. To Schedule, a Complimentary “Get Acquainted Call” with Ken. TAP HERE

External Links:

- Budgeting Tips for Life After Divorce – This article from SoFi offers practical budgeting tips and strategies for those adjusting to a single income after divorce, including how to handle changes in income and necessary expense adjustments.

- 10 Essential Tips To Budget Money After A Divorce – Frozen Pennies provides essential tips to manage and reduce debt post-divorce, focusing on practical steps to create and maintain a budget.

- Tips for Budgeting After Divorce – Fidelity offers advice on building an emergency fund and prioritizing essential expenses, helping to reduce financial stress after divorce.

- Post-Divorce Budgeting – Finance Strategists explains the importance of creating a post-divorce budget and provides a comprehensive guide to assessing financial situations and setting realistic goals.

- 7 Steps on Budgeting After a Divorce – Elevation Wealth Partners outlines practical steps to establish a post-divorce budget, including assembling a support team and using budgeting software.

- 7 Steps to Building a Budget After Divorce – The Law Offices of Josephia Rouse offers a detailed approach to creating a marital balance sheet and recording essential expenses to build a healthy post-divorce budget.

- Personal Budgeting for Divorced Women – Woman’s Divorce provides a comprehensive budgeting guide tailored for women, highlighting the importance of controlling expenses and understanding income sources.

- Creating a Budget After Divorce – Protective Life discusses the importance of living below your means and generating extra income to manage a post-divorce budget effectively.

- New Year, New Way to Budget After Divorce: 5 Steps – Divorce Magazine provides a step-by-step guide to mastering post-divorce budgeting, including tips on cutting expenses and setting financial goals.

- Tips for Budgeting After Divorce – Another excellent resource from Fidelity, this article emphasizes the need for realistic budgeting and provides tips for effective financial management after divorce.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in navigating the Divorce Industrial Complex by crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.