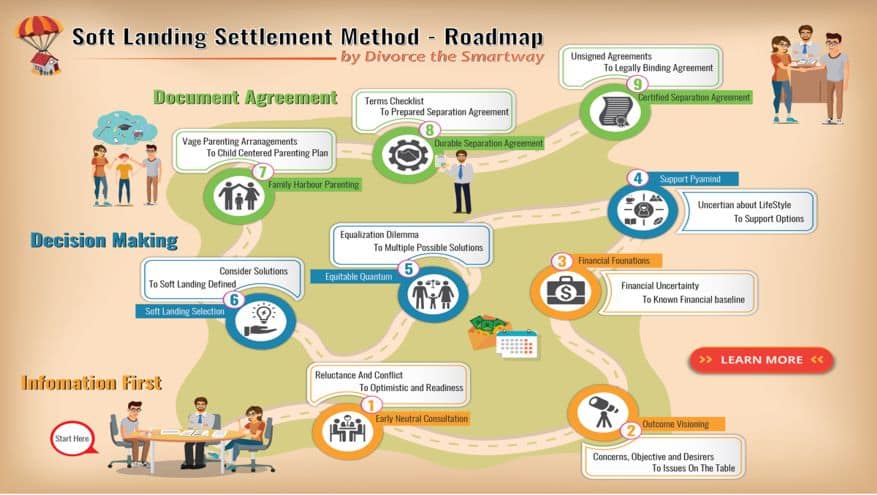

Divorce Equalization Payment Calculation – Case Study

What is an equalization payment in a divorce?

Equalization Payment: This is an amount paid from one spouse to another to equalize the net worth of the two individuals. The equalization payment is equal to one-half of the difference in net worth between the husband and wife.

| Bruce Smith (Husband) | Amount |

|---|---|

| Assets | |

| Value of Real Estate (matrimonial home value at $1,800,000) | $900,000 |

| Household (Cars, Boat Furniture, etc.) | $55,000 |

| Financial Accounts (RESP, Savings, RRSP etc.) | $350,000 |

| Business | $135,000 |

| Subtotal of Assets | $1,440,000 |

| Liabilities | |

| Mortgage | $275,000 |

| Ford Motor Credit Car Loan | $9,000 |

| RBC Visa Credit Card (50% of Joint card with a $22,600 balance) | $11,300 |

| Tax Allowance on RRSP | $45,000 |

| Business Tax Adjustments | $34,000 |

| Real Estate Disposition Cost | $52,545 |

| Subtotal of Liabilities | $426,845 |

| Date of Marriage Deduction | |

| RRSP | $12,000 |

| Line of Credit | ($4,000) |

| Subtotal of Date of Marriage Deduction | $8,000 |

| Excluded Property | |

| Kids RESP | $123,400 |

| Inheritance | $50,000 |

| Subtotal of Excluded Property | $173,400 |

| Net Family Property Summary | |

| Total Assets | $1,440,000 |

| Less Total Liabilities | $426,845 |

| Less Total Marriage Deduction | $8,000 |

| Less Total Excluded Property | $173,400 |

| Net Family Property | $831,755 |

| Mary Smith | Amount |

|---|---|

| Assets | |

| Value of Real Estate (50% of matrimonial home value at $1,800,000) | $900,000 |

| Household (Cars, Furniture, etc.) | $35,000 |

| Financial Accounts (Teachers’ Pension, Savings, etc.) | $650,000 |

| Time Share | $5,000 |

| Subtotal of Assets | $1,590,000 |

| Liabilities | |

| Mortgage | $275,000 |

| Honda Finance Canada Car Loan | $15,000 |

| RBC Visa Credit Card (50% of Joint card with a $22,600 balance) | $11,200 |

| Tax Allowance on and Pension | $114,000 |

| Real Estate Disposition Cost | $52,545 |

| Subtotal of Liabilities | $467,845 |

| Date of Marriage Deduction | |

| RRSP | $18,000 |

| MasterCARD Credit Card | ($4,000) |

| Subtotal of Date of Marriage Deduction | $14,000 |

| Excluded Property | |

| Inheritance | $23,400 |

| Gift | $30,000 |

| Subtotal of Excluded Property | $53,400 |

| Net Family Property Summary | |

| Total Assets | $1,590,000 |

| Less Total Liabilities | $467,845 |

| Less Total Marriage Deduction | $14,000 |

| Less Total Excluded Property | $53,400 |

| Net Family Property | $1,054,755 |

| Equalization Calculation | NET FAMILY PROPERTY | ||

|---|---|---|---|

| Bruce | Mary | ||

| $831,755 | $1,054,755 | ||

| Mary | $223,000 | ||

| Financial Imbalance | has a greater NFP then | ||

| Bruce | |||

| Mary | $111,500 | ||

| Equalization Amount | To equalize she needs

Pay / Transfer to |

||

| Bruce | |||

| Soft Landing Settlement Example | |||

|---|---|---|---|

| Matrimonial Home Value (appraised market value) | $1,800,000 | ||

| Obligations: | |||

| Disposition Cost (RE Commission + Legal + HST) | $105,090 | ||

| Mortgage (Bruce will assume) | $550,000 | ||

| Subtotal of Obligations: | deductions from home equity | – | $655,090 |

| Subtotal: Equity | = | $1,144,910 | |

| Share of Net Equity: | Value due to Mary (50%) | 1/2 | $572,455 |

| Offsetting Values: | |||

| Equalization due from Mary to Bruce (see above) | $111,500 | ||

|

Bruce Transfer RRSP to Mary (Tax-Free Rollover) |

$190,000 | ||

| Bruce pays Mary cash | $270,955 | ||

| Subtotal of Payments | Value of payments to Mary | $572,455 | |

| Total Balance due to Mary | $0 | ||

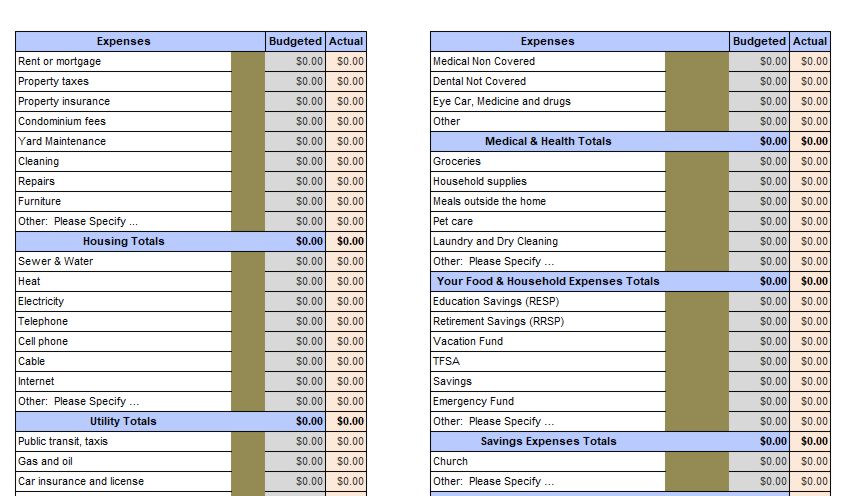

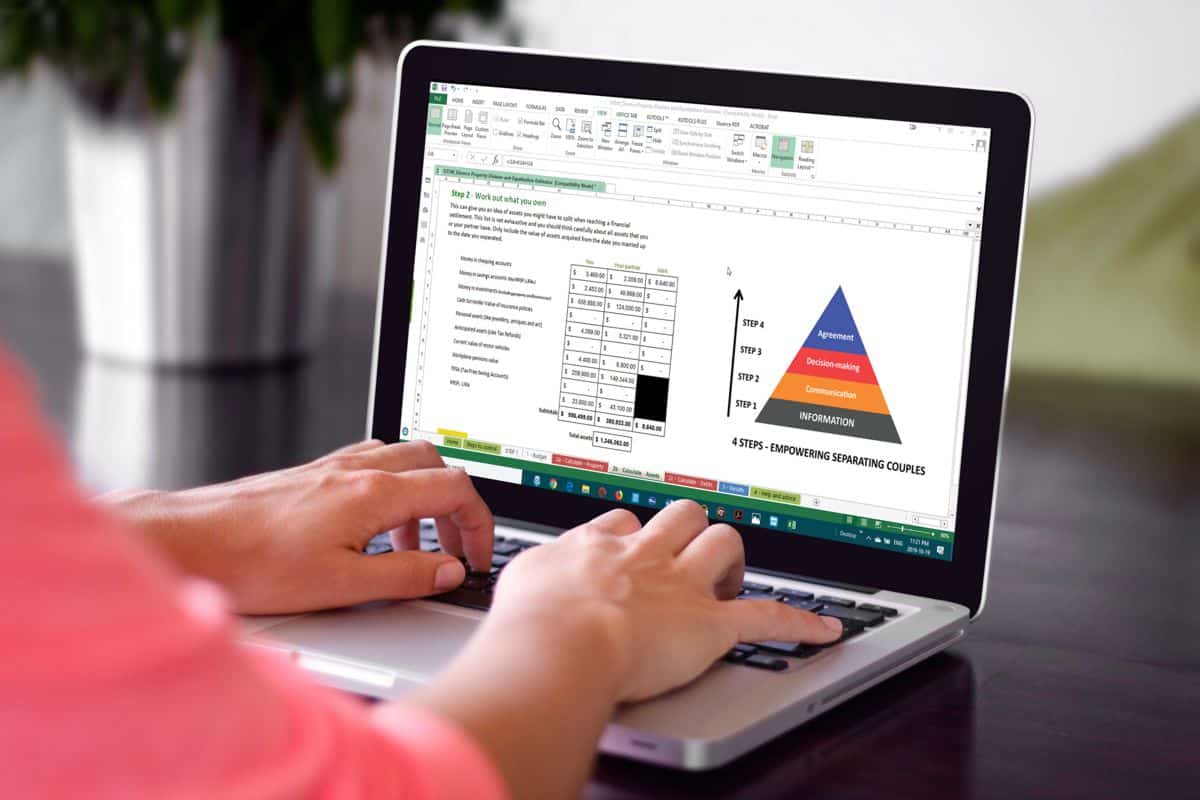

Divorce Equalization Payment Calculator – Download

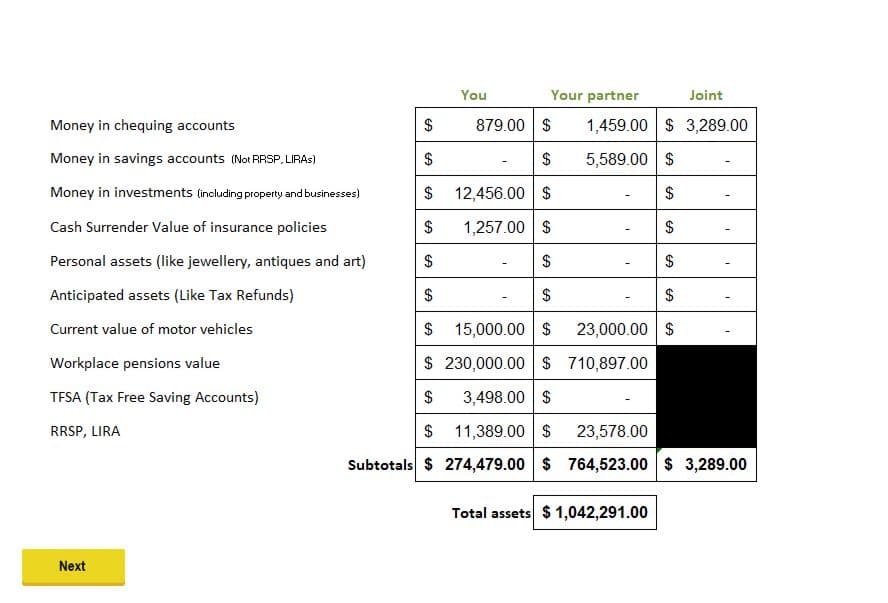

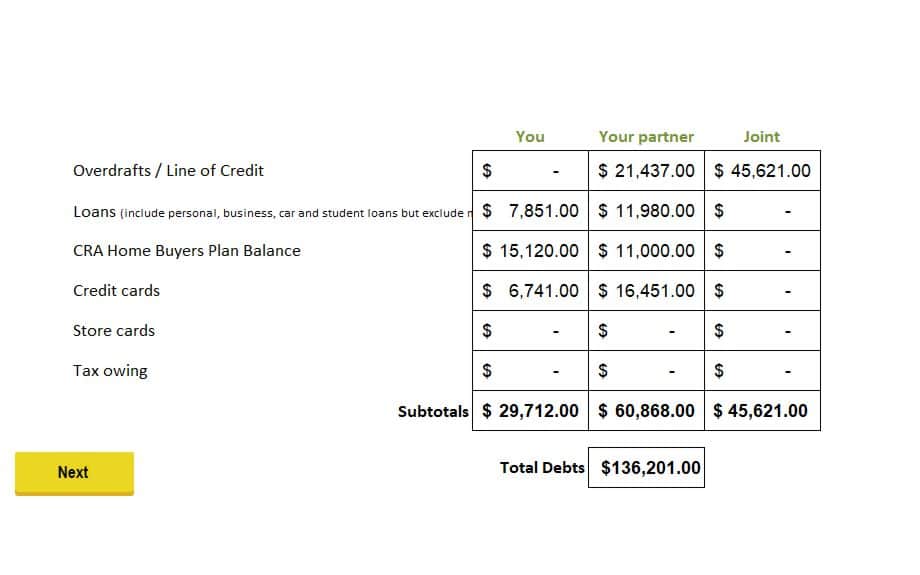

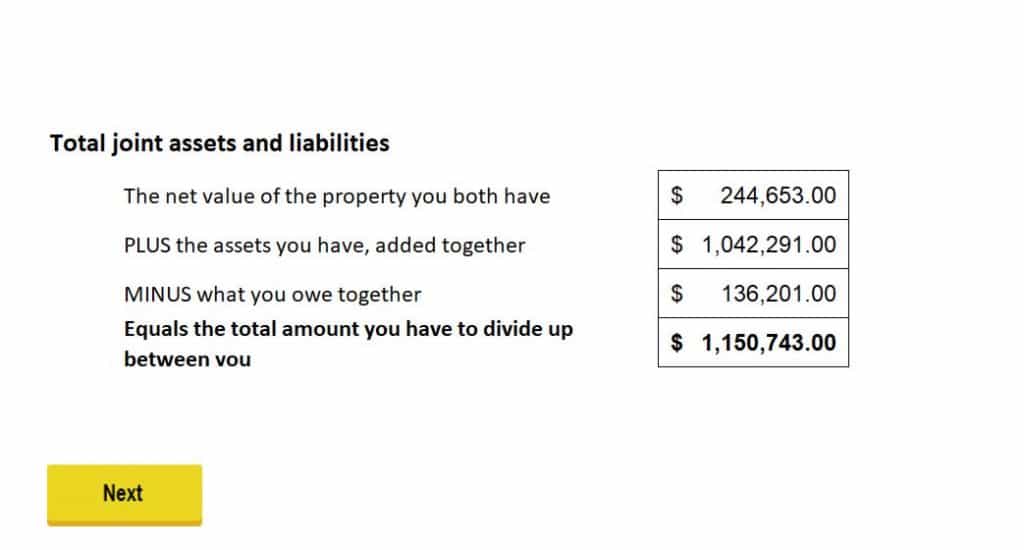

Division of assets in divorce calculator

Equalization Estimator Spreadsheet Screenshots

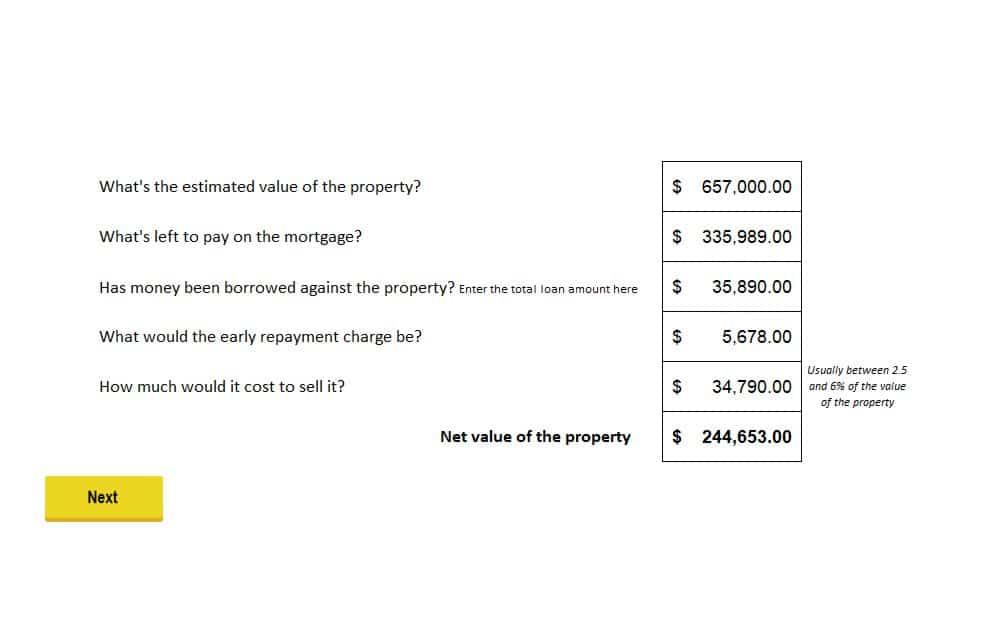

Matrimonial Home Buyout Calculator

Enter Your Home Information to calculate a buyout.

Ken Maynard CDFA, Acc.FM

I assist intelligent and successful couples in crafting rapid, custom separation agreements that pave the way for a smooth transition towards a secure future. This efficient process is achieved in about four meetings, effectively sidestepping the excessive conflicts, confusion, and costs commonly linked to legal proceedings. Clients have the flexibility to collaborate with me either via video conference or in-person through a DTSW associate at any of our six Greater Toronto mediation centers, located in Aurora, Barrie, North York, Vaughan, Mississauga, and Scarborough.

Have a few questions - Tap here to Schedule a Get Acquainted Call